USD, JPY flows: JPY gains as yields edge lower, verbal intervention returns

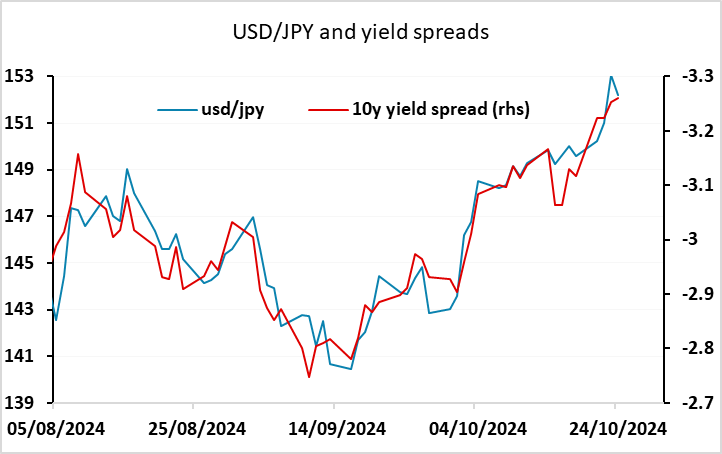

USD/JPY slightly lower but limited downside without yield spread or equity moves

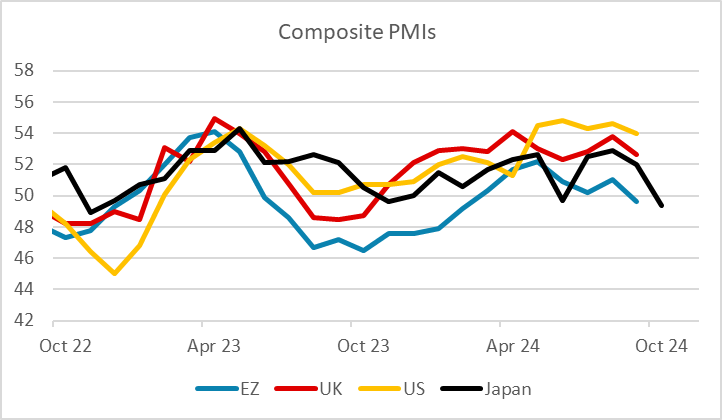

The USD is a little weaker overnight, mainly against the JPY, as US yields edge a little lower and Japanese officials engage in some verbal intervention. As we have seen in the past though, verbal intervention typically has little impact. USD/JPY has broadly moved with yield spreads in the last couple of months, even though it started from levels that look too high relative to long term correlations, and is only likely to move significantly lower if yield spreads decline or US risk premia rise. On the negative side for the JPY, the Japanese services PMI fell sharply overnight, suggesting the wage increases we have seen are not translating to higher consumption, which may discourage any monetary tightening from the BoJ. However, this is one month’s data which may well be erratic. The focus now will be on the European data this morning. Similar weakness there could be expected to have a big negative effect on the EUR.