NOK, JPY flows: NOK firmer after CPI, JPY weaker on hopes of end to US shutdown

NOK rallies as CPI comes out strong in October. JPY weaker as risk rallies on hopes of end to US government shutdown

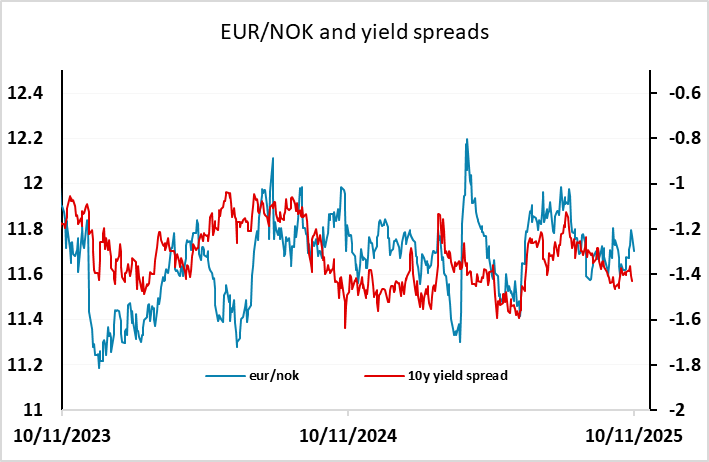

Norway October CPI has come in much stronger than expected this morning at 3.3% y/y headline and 3.4% core, pushing EUR/NOK 3 figures lower in early trade. Markets were pricing two 25bp rate cuts from Norges Bank by the end of 2026, but no cut is fully priced in before August next year. This data will make further rate cuts even less likely, and argue for some NOK gains. However, persistent NOK weakness in recent years combined with a vulnerability to risk negative news continues to frighten off NOK buyers, and it will be hard for EUR/NOK to break below the 11.55-11.60 area that has been the bottom of the range since June. But there are likely to be EUR/NOK sellers on any rally above 11.75, and the equity market rally overnight should be NOK supportive.

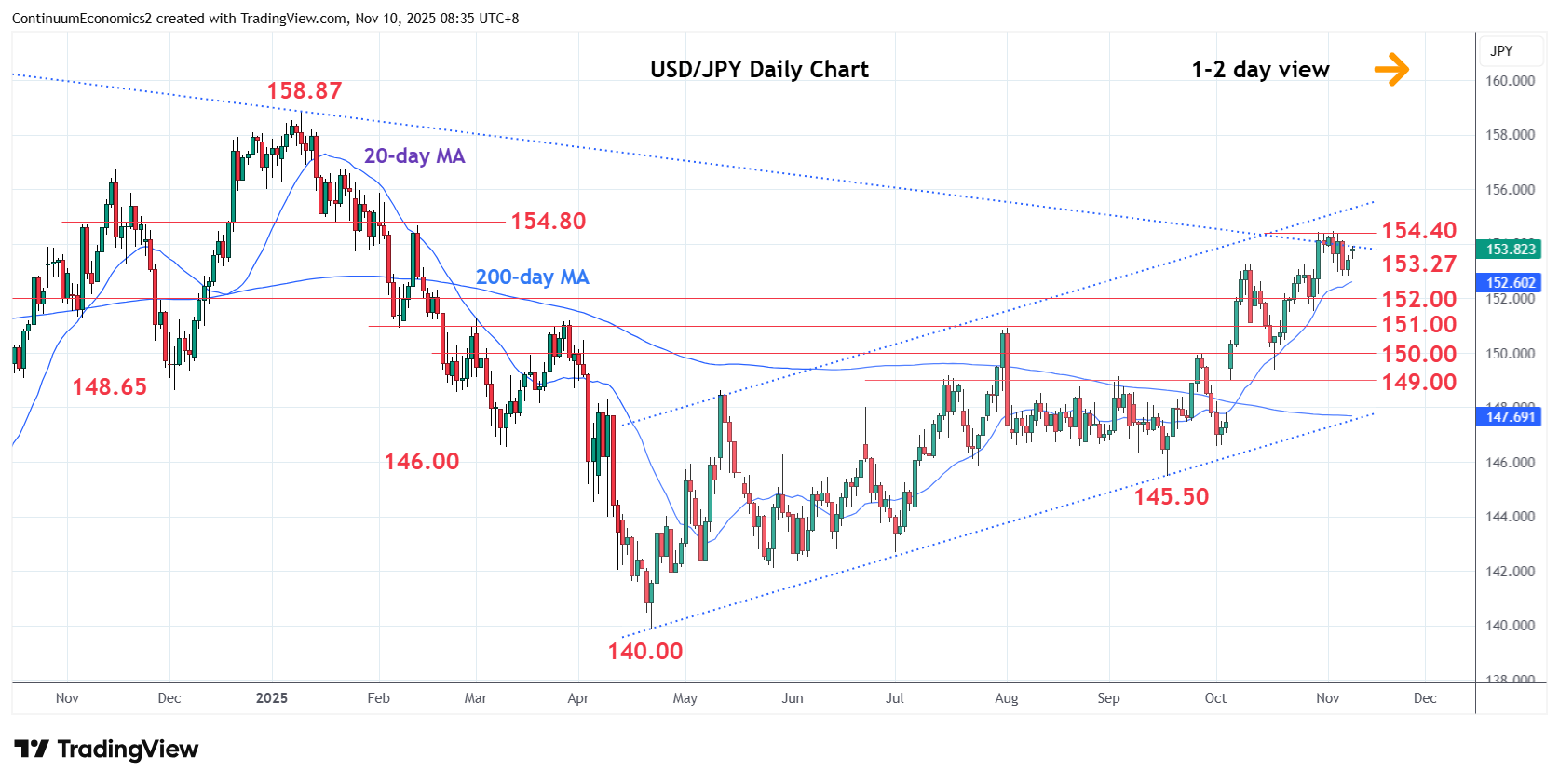

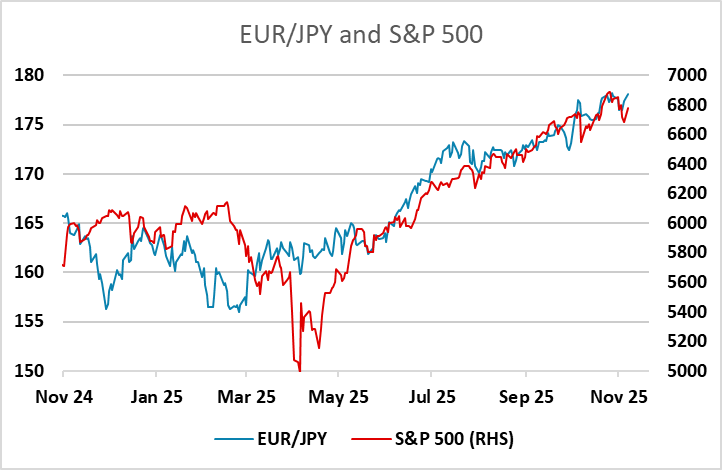

Elsewhere, the JPY has weakened overnight helped by a more risk positive tone due to reports that the US is coming closer to ending the government shutdown, with the AUD outperforming. The JPY also suffered a little from comments from Takuji Aida, and economic adviser to PM Takaichi, who said it would be risky for the BoJ to rise rates in December. Indications from Takaichi of a relaxation of fiscal policy rules and BoJ minutes that suggested a December hike will be difficult due to the lack of wage inflation also contributed to JPY weakness. Both USD/JPY and EUR/JPY are approaching big technical levels at 154.40 and 178.10 respectively.