USD flows: USD softer after GDP, trade

US Q1 GDP revised down as expected but bigger April trade deficit may reduce expectations for Q2. Modestly USD negative

US GDP came in in line with expectations in terms of the headline growth number, which was revised down to 1.3% q/q annualised. Weekly jobless claims were also in line with expectations. However, the market is reacting as if the data is weaker than expected, perhaps because of the downward revision to consumer spending to 2.0% annualised, although this was generally anticipated. More probably the reaction relates to the rise in the trade deficit, which reached USD99.4bn in April, and suggests we will see more GDP weakness in Q2.

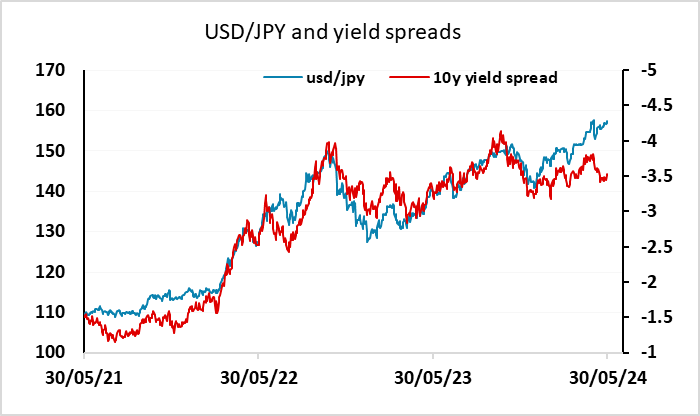

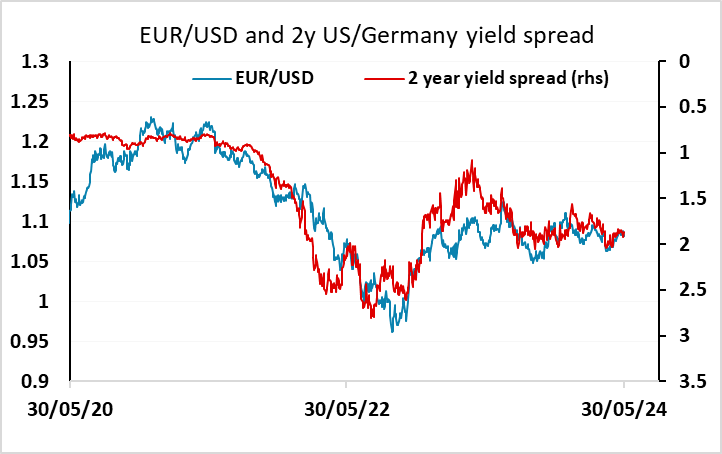

The trade data is a double whammy for the USD, although the direct impact of trade on FX is generally ignored nowadays. Also of note was the decline in corporate profits in Q1. In spite of this, equities are higher due to the decline in yields. The profits data isn’t watched too closely, but expected growth in corporate earnings is quite strong, and if it doesn’t materialise could undermine the equity market. As it is, the data only looks mildly USD bearish, but there should be scope for EUR/USD to return to the mid-1.08s while there remains more substantial potential downside for USD/JPY, especially if equities fail to benefit from lower yields.