FX Daily Strategy: APAC, April 25th

Scope for USD recovery to extend on solid durable orders data

German IFO stronger than expected

USD recovery still only likely to be short term

CHF can weaken further against the NOK

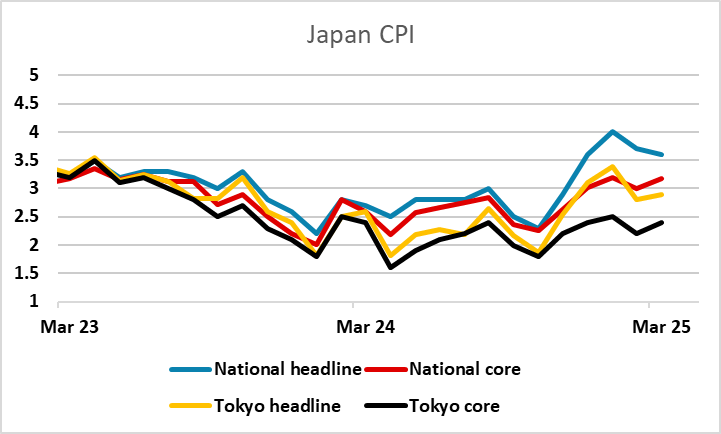

JPY might struggle despite rise in Tokyo CPI

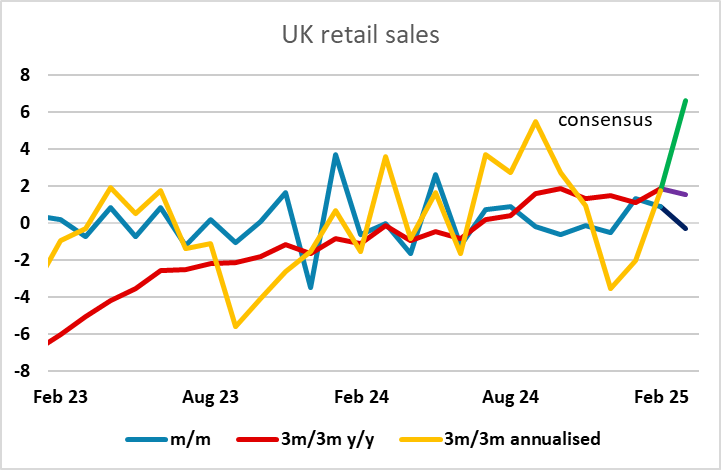

GBP has scope to recover modestly

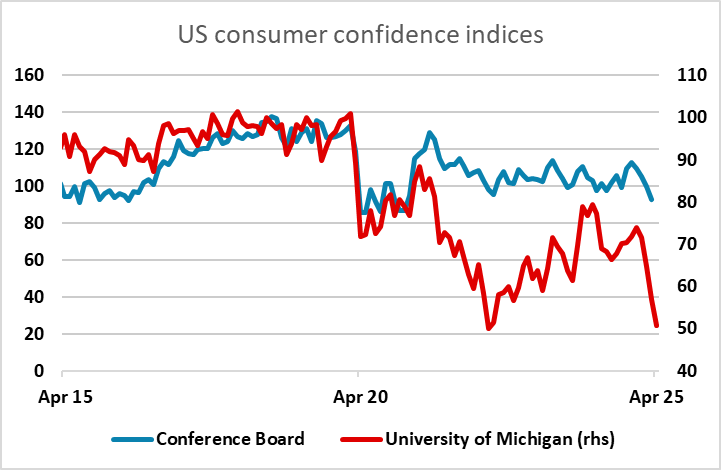

USD may struggle if University of Michigan confidence weakens again

Friday starts with Tokyo CPI. There is less focus on data as the markets await the impact of the tariffs, but the Japanese CPI data is nevertheless crucial for BoJ policy going forward. The consensus is for a fairly sharp rise in the Tokyo core CPI data to 3.2% y/y. This would suggest an even higher rate for the national CPI, which has been running well above the Tokyo level in recent months, and would maintain some pressure on the BoJ to tighten, even though they feel little urgency to act until there is more clarity on the tariff situation.

As it stands, the market isn’t fully pricing a BoJ hike this year, and even with a rise in the CPI data, this isn’t likely to change. However, if the world economy is hit hard enough by tariffs to prevent a BoJ hike, the likelihood is that it would favour the JPY due to weakness in risk appetite. Conversely, if the shock is absorbed and growth remains solid, there is more reason to expect tighter policy from the BoJ than from anyone else. So we still expect the JPY to perform well in most scenarios in the medium term. But in the short run, the markets have quietened down awaiting developments on trade deals, and lower volatility will tend to favour the higher yielders. With the CFTC data also showing record speculative long JPY positioning, there is certainly a risk of some unwinding of positions in calmer markets, so we may yet have some more near term USD/JPY upside towards 144.

There is also UK retail sales data, which is expected to show a modest decline of 03% on the month. However, after a strong January and February, this would translate into a very strong Q1, showing a rise of 1.5%. This has been the main driver of the relatively strong UK GDP growth in the quarter, but appears to be coming out of savings rather than out of rising earnings, as employment and wage growth have both been falling. Such data is therefore not necessarily supportive for GBP, with the latest survey data suggesting weakness to come. But if we see the higher yielders benefiting from declining volatility, there is scope for GBP to recover some of the losses against the EUR seen since the tariff concerns emerged.

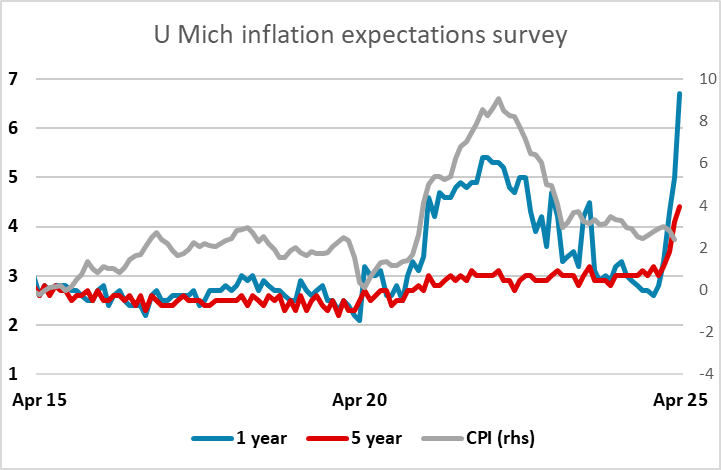

Late in the session we have the University of Michigan confidence data. The last few months have seen some very weak results on confidence and a sharp rise in inflation expectations. These are not fully matched in the conference board confidence survey, so must be taken with a little pinch of salt. But further weakness might well see the USD suffering into the end of the week.