FX Daily Strategy: Europe, July 8th

RBA surprisingly on hold

AUD may need hawkish comments to hold above 0.65

JPY weakness continues as equities remain firm

SEK gains on Monday look overdone

RBA surprisingly on hold

AUD may need hawkish comments to hold above 0.65

JPY weakness continues as equities remain firm

SEK gains on Monday look overdone

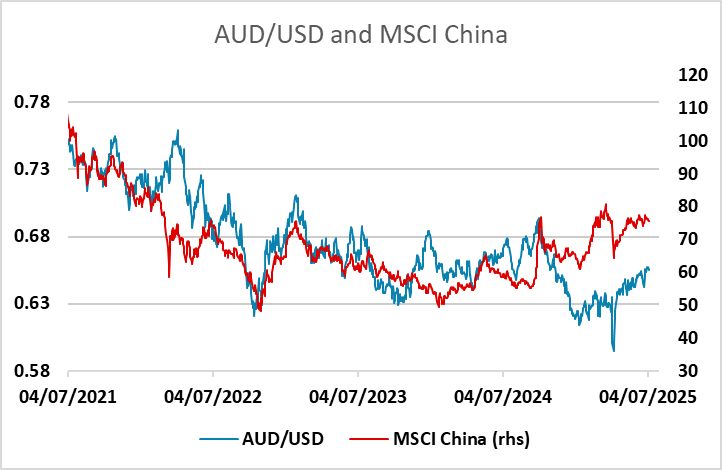

Tuesday sees the RBA monetary policy decision, with a 25bp rate cut essentially fully priced in. For much of this year, the AUD has been edging up back towards the levels suggested by the long term correlation with yield spreads as the USD has generally fallen back. However, spreads have moved steadily back on favour of the USD for much of this year, as markets have started to anticipate RBA easing, and the case for AUD gains on a yield spread driven move is less compelling than it was. Also, while the AUD still shows some correlation with local equity markets, the correlation of AUD/USD with the S&P has largely disappeared since the announcement of the tariffs in April.

To most surprise, the RBA did not cut and suggest it could wait for more confirmation after the previous 50bps cut. It is hardly surprising as there is likely only three cuts left for the RBA till terminal rate with little urgency from current inflationary dynamic and we continue to expect only two 25bps cut in 2025. Market participants are waiting for more clarification from RBA's governor Bullock, which so far is giving vague hope of another cut after antoher quarterly CPI.

Since a rate cut is essentially fully priced in, the impact of the RBA meeting will likely depend on what impression they give of the likely path of rates from here on. The market is currently pricing two further rate cuts this year (on top of today’s expected cut), which to us seems on the aggressive side, so the risk might be towards somewhat higher rate expectations and a higher AUD. But with the general USD tone a little improved on Monday, a more hawkish than expected RBA looks necessary to maintain AUD/USD above 0.65.

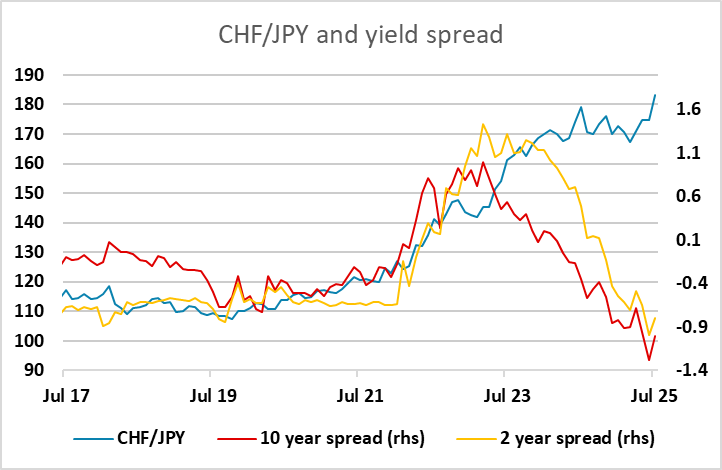

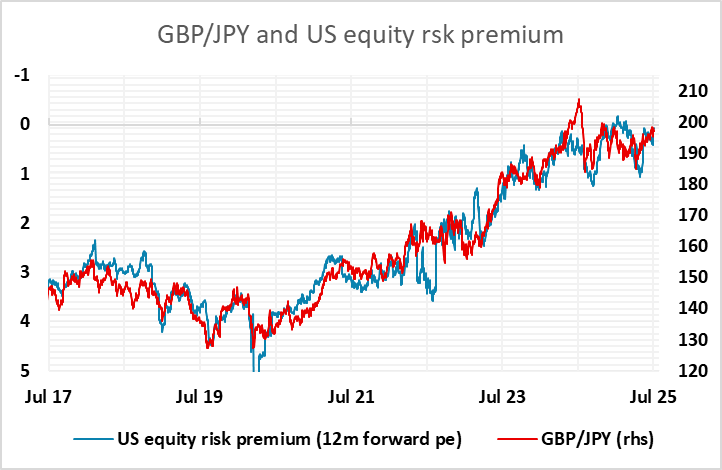

Otherwise the calendar is fairly bare. The most notable move on Monday was further weakness in the JPY, which hit another new all time low versus the CHF and another new one year low against the EUR. As long as we continue to see broad optimism in equity markets JPY weakness may well continue, even though we regard current risk premia as too low given the risks relating to tariffs and the evidence of slowdown in the US we already have.

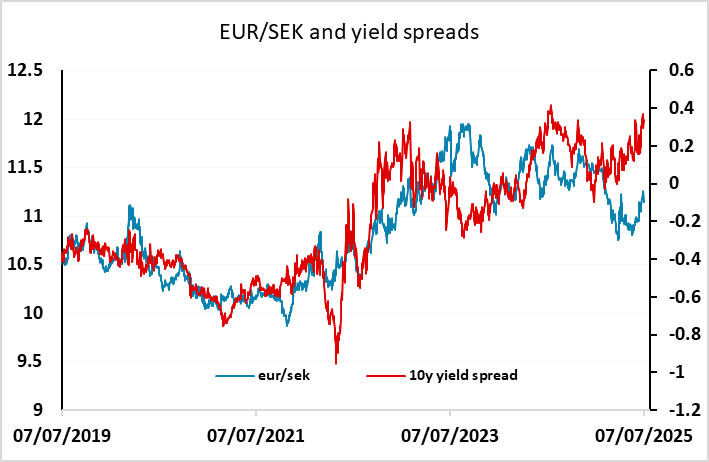

SEK strength on Monday also looks somewhat overdone. While the CPI data was much stronger than expected, real sector data has shown a slowdown in the last few data points, and we suspect the June CPI rise may prove erratic. The Riksbank still look likely to ease further this year, albeit probably not at the August meeting. The SEK is already trading on the strong side relative to yield spread movements, and if the USD start to perform better USD/SEK may see the biggest retracement as it has seen the biggest rise as the USD has fallen against Europe.