FX Daily Strategy: N America, February 1st

Downside risks for GBP on the BoE

SEK vulnerable against the NOK

USD still stretched against the JPY

Downside risks for GBP on the BoE

SEK vulnerable against the NOK

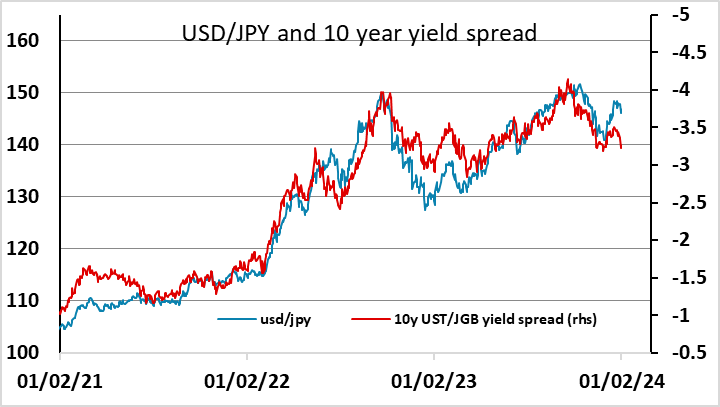

USD still stretched against the JPY

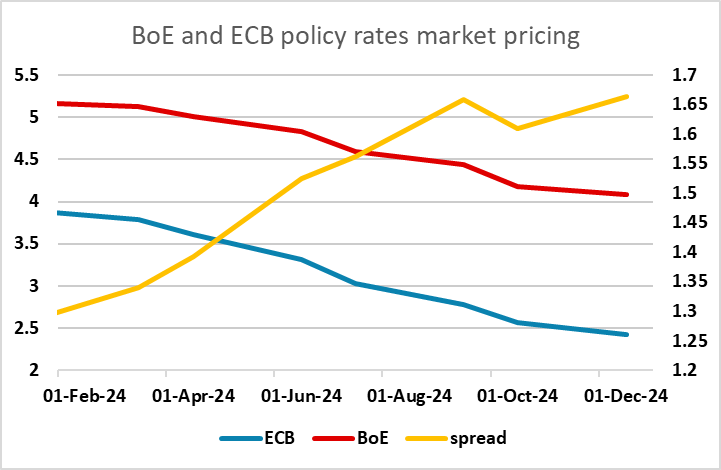

Thursday features monetary policy meetings at the Bank of England and the Riksbank. Neither is expected to change policy, but as with other DM central banks the interest is less on what is done, but more on what is said, especially given the manner in which market interest rates have fallen. Notably, and despite the softer interest rate assumption, the updated Bank of England Monetary Policy Report may see the inflation outlook even softer, possibly embracing our view of the headline rate falling below target by mid-year. If so, it will become a lot harder for the three hawks on the MPC to continue voting for a rate hike. The market median expectation is for two out of the three hawks to continue voting for a hike. But even though the Bank distrusts its own forecasts, the softer inflation and wage data since the last meeting ought to be enough to turn to committee towards easing. We would not rule out one vote (Dhingra) for an ease, while it may be that only one or none of the hawks vote for a hike.

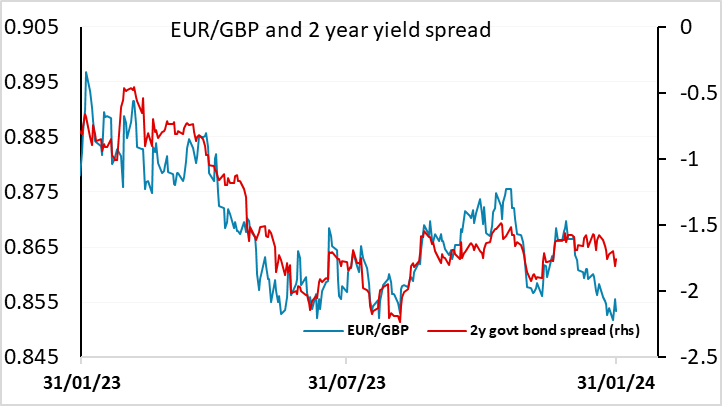

For GBP, this suggests some downside risks. Not only is the market pricing in a more hawkish policy stance for the BoE than for the Fed or the ECB, EUR/GBP is already below the levels that would be expected from the current yield spreads based on recent history. A more dovish BoE stance shold consequently lead to some general GBP losses.

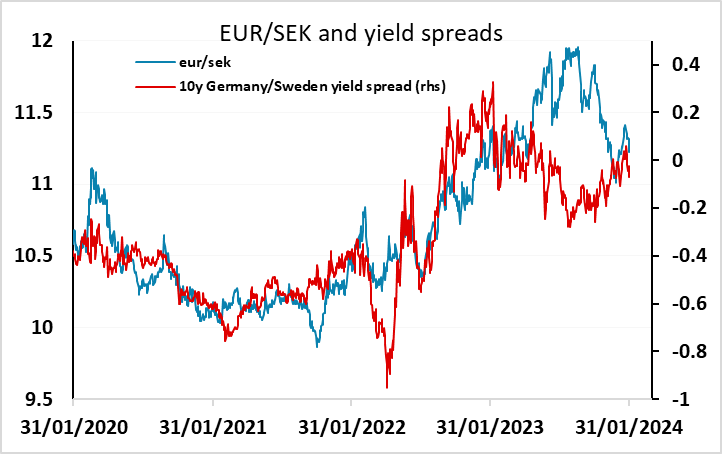

EUR/SEK is trading firmer after the Riksbank meeting. There are slightly mixed messages, with the Riksbank still indicating that tight policy is required in the near term. But the key statement is “the policy rate can therefore probably be cut sooner than was indicated in the November forecast.” This triggered around a 4 figure rise in EUR/SEK, with Swedish front end yields falling a few bps while Eurozone yields have edged a touch firmer. They also said the possibility of the policy rate being cut in the first half of the year cannot be ruled out, but this is already priced into the market, with a 30bp decline in rates priced in by the May meeting.

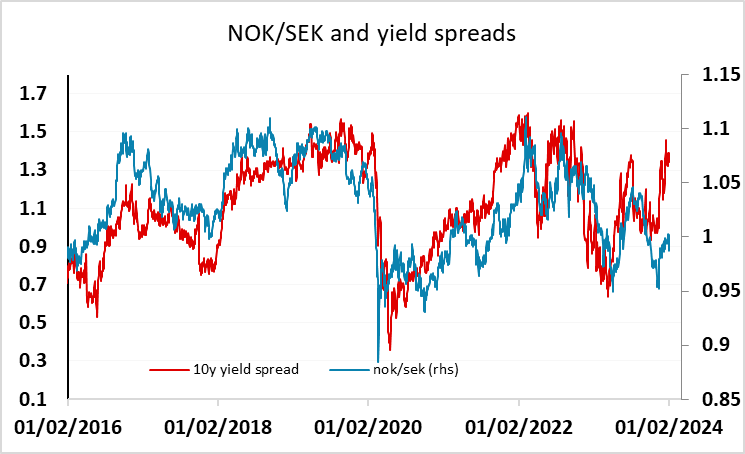

We don’t see major implications for EUR/SEK, as Riksbank policy looks likely to closely mirror the ECB and EUR/SEK is already close to fair based on the recent correlation in yield spreads, having corrected the SEK weakness seen through much of the second half of 2023. The Riksbank noted this, with no repeat of the currency being unjustifiably weak as they said in November. However, the SEK still looks strong relative to the NOK, based on the historically very robust correlation with 10 year yield spreads. This suggests there is scope for NOK/SEK gains, but they may have to come via EUR/NOK rather than EUR/SEK.

Otherwise, there is the usual Thursday set of claims data in the US, and the ISM manufacturing survey. But given the Wednesday Fed statement and the upcoming employment report, these are unlikely to have a lot of impact, with the market digesting the Fed and preparing for payrolls. We continue to see downside risks for the USD against the JPY, due to the big narrowing we have seen in yield spreads, but less scope for movement against the riskier currencies.