EUR, JPY flows: EUR supported by German data, JPY soft

Solid German production and orders data support more positive EUR tone post-ECB. JPY undermined by weak real wages and consumption.

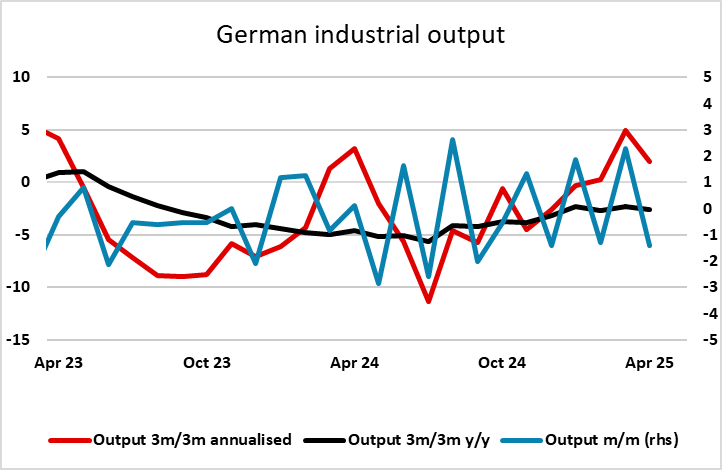

A fairly quiet start in Europe with EUR/USD shaving slipped back down after the rally post-ECB on Thursday. The German production data for April gas come in a little below consensus, but the underlying trend still looks to be solidly positive, and the orders data yesterday also showed an improving trend. This supports the more positive view of the European economy that was being put forward by Lagarde yesterday, and should help EUR/USD to hold levels above 1.14 ahead of the US employment report later.

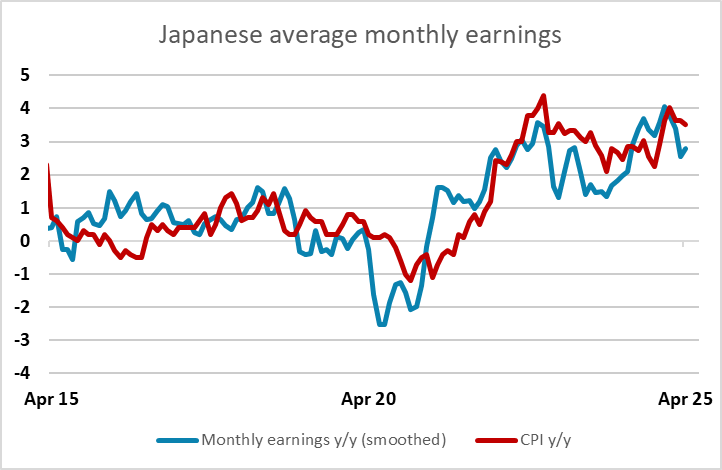

The JPY has underperformed in the last 24 hours, in part due to the reasonably risk positive market tone, in part to the softer than expected wage data yesterday and the weak household spending numbers this morning. The comments from BoJ governor Ueda earlier this week highlighting the still negative real wage growth in Japan limiting the scope for tightening look to have been influenced by prior knowledge of these numbers. The JPY in any case usually requires a weaker global risk tone to gain significant ground, but the softer recent data will make it harder for it to hold its own in risk positive conditions.