FX Daily Strategy: Europe, Sep 2nd

Trump Tariff Fiasco Continues

U.S. ISM Manufacturing Back to neutral with firmer prices

Would Determine the next leg in DXY

While the USD/JPY Consolidation Continues

The Trump tariff fiasco continues as another Federal court challenges his authority to impose such tariffs. It is guaranteed that Trump's administration will appeal. However, with most trade deal being reached, its actual impact maybe limited. However, the ebbs and flows will dominate market sentiment. Market focus should remain on the Fed September cut as we do not expect a swift result from the legal challenges.

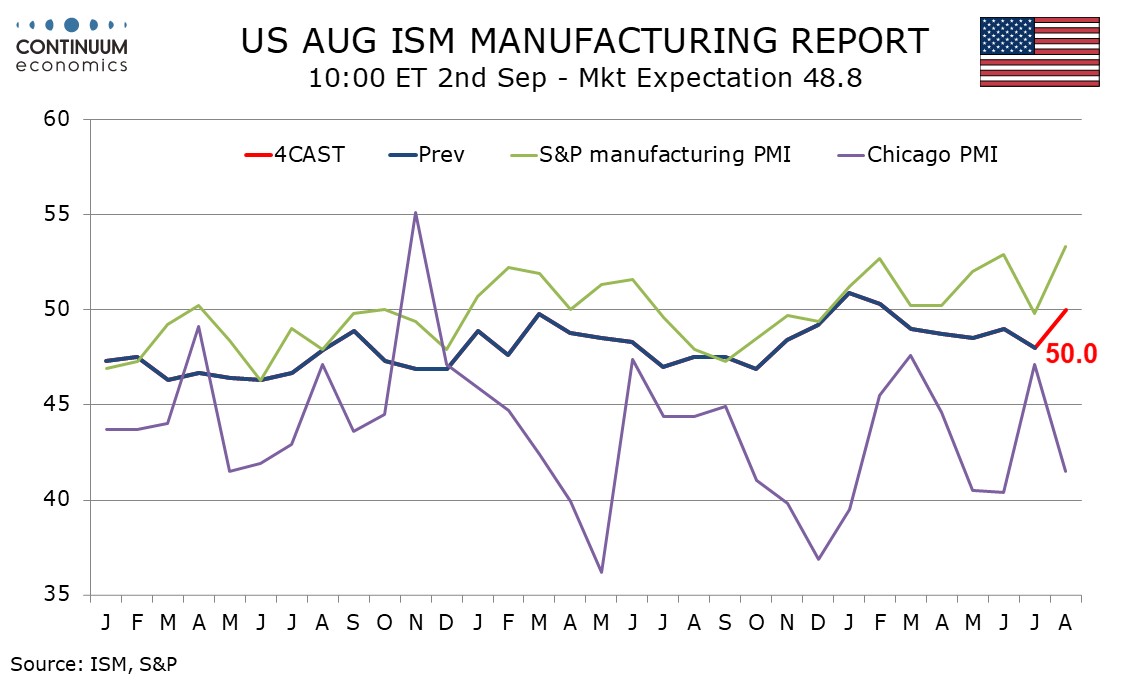

We expect August’s ISM manufacturing index to rise to a neutral 50.0 more than fully reversing a dip to 48.0 in July from 49.0 in June. This would be the strongest reading since January and February edged above neutral for the first time since October 2022. July’s dip had a mixed breakdown with improvements in new orders and production but slippage in inventories, deliveries and employment. We expect the improvement in new orders and production to continue and the other three components to recover from their July dips.

August’s S and P manufacturing PMI at 53.8 rebounded from a weaker July reading to reach its highest level since May 2022 at 53.3. Regional Fed manufacturing surveys are mixed relative to July but mostly improved from June and averaging near neutral. However the Chicago PMI saw a fresh dip to a weak level.

Despite in a downtrend, the greenback has been consolidating lately but could see volatiltiy if Trump's tariff is being legally challenged and restrained. However, its impact maybe minimal for market focus remain on FOMC and market participants are unlikely to position themselves before the meeting to avoid getting wrong footed.

On the chart, the anticipated break below 98.00 has bounced from 97.75~, with prices currently balanced just shy of 98.00. Daily readings are under pressure, highlighting room for fresh tests lower towards congestion support at 97.50. But mixed weekly charts should limit any immediate break in renewed consolidation above further congestion around 97.00. Meanwhile, a close back above congestion resistance at 98.00 would help to stabilise price action and prompt fresh consolidation beneath further congestion around 98.50.

The USD/JPY has been in consolidation for the past weeks for the uncertainty in U.S.-Japan trade deal and lack of commitment from the BoJ keep JPY bids on bay. Looking forward, lack of commitment from the BoJ have led to market participants unenthusiastic for any JPY bids. We doubt the BoJ will be able to keep their hands in their pocket any longer after core-core inflation steadily above 3%. They would water it down with moderating headline CPI but the underlying momentum should persuade their to hike soon. The main obstacle remain in the uncertainty of U.S.-Japan trade as negotiator is still in tight negotiation for details and may not provide any clarity in the coming month.

On the chart, there is little change, as prices holds a narrow range above support at the 146.55, congestion and March low. However, negative daily and weekly studies suggest eventual break here and the 146.00 level to extend the broader losses from the 150.92, August high. Lower will open up room for deeper pullback to support at the 145.00 level and trendline from the April low. Meanwhile, resistance at the 148.00 congestion is expected to cap and sustain rejection from the 148.65/149.00 resistance.