EUR, GBP flows: EUR slips as PMIs dip

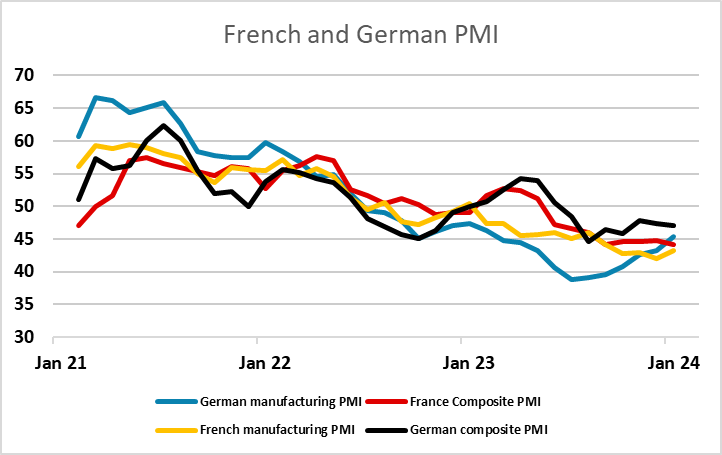

French and German composite PMIs dip as services weaken despite manufacturing bounce. EUR decline modest with limited downside scope for yields.

Weaker than expected French PMIs, followed by weaker than expected German PMIs should weigh on EUR/USD. The only positive was the modest recovery (from very low levels) in the manufacturing PMIs, but the composite PMIs in both France and Germany showed another decline against market expectations of a modest recovery.

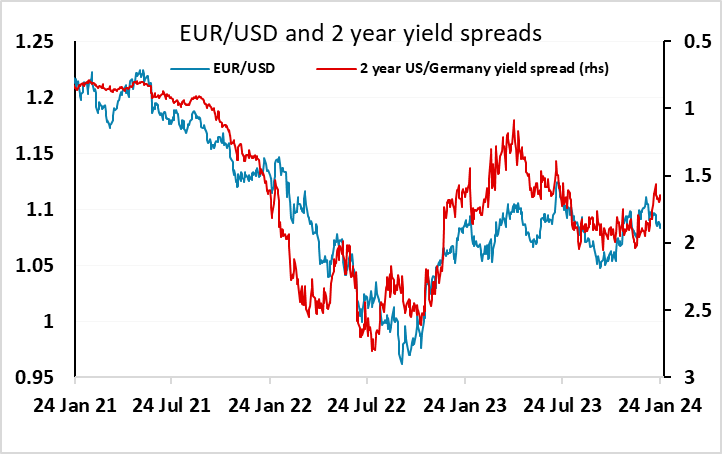

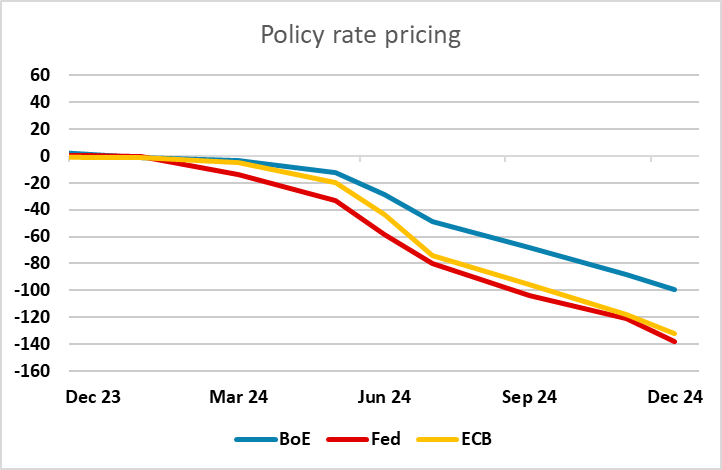

Initially, EUR/USD has edged a little lower, but EUR/JPY has slipped further, with USD/JPY also lower as yields decline. EUR/JPY continues to look vulnerable here, but there is limited scope for further declines in EUR rate expectations, with an April cut still 80% priced in, despite the ECB signalling that no cut is likely until the summer. GBP may also be vulnerable, as it is hard to believe that the UK PMIs will retain their recent strength with the Eurozone weakening, even if there is a similar bounce in UK manufacturing PMI.