FX Daily Strategy: Asia, January 17th

Chinese data may set the tone on Friday

Scope for the riskier currencies to rally as Chinese GDP posts a strong quarter

GBP vulnerable to evidence of retail sales weakness

US housing data could be a USD negative

Chinese data may set the tone on Friday

Scope for the riskier currencies to rally as Chinese GDP posts a strong quarter

GBP vulnerable to evidence of retail sales weakness

US housing data could be a USD negative

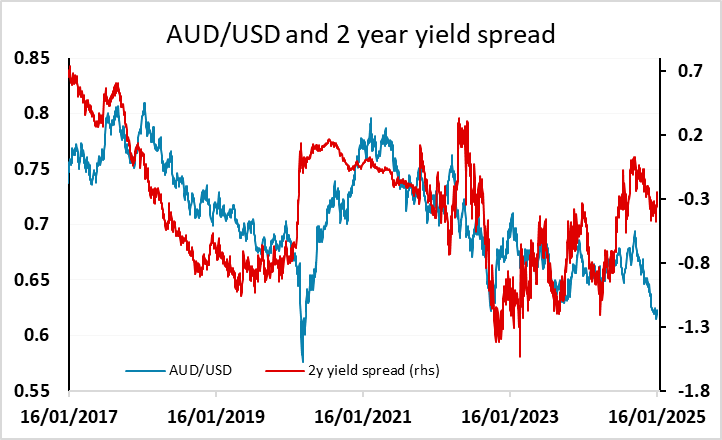

Friday’s tone may be set by the big Chinese data dump of GDP, retail sales and industrial production in the Asian session. The 1.6% q/q rise in Q4 GDP that is the forecast consensus represents and improvement from Q3, and may be enough to consolidate the better risk tone seen on Wednesday as US yields fell. If so, we may see some better performance from the riskier currencies, with the AUD continuing to look like the stand-out value, and this will be even more the case if the Chinese data are encouraging. Of course, weaker data would have the opposite effect, but the fact that the quarterly rate is expected to improve suggests there is a little more upside than downside risk for the riskier currencies.

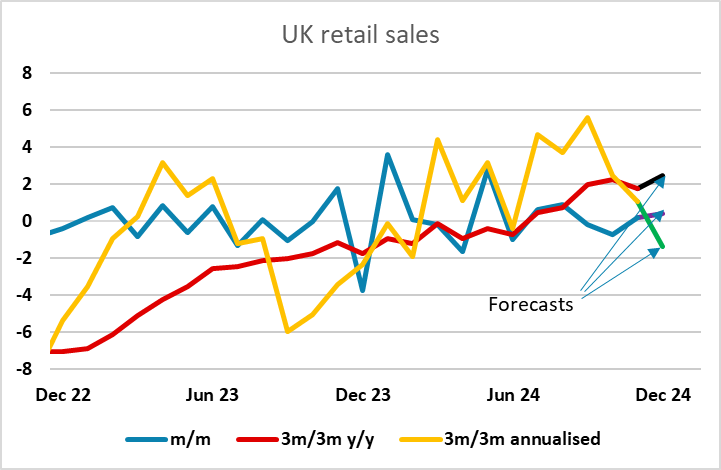

Elsewhere, the UK retail sales data will be of some interest, with the weak GDP data on Thursday having led to a resumption of some downward pressure on the pound. While the y/y trend has been improving, much of this relates to base effects, and recent months have shown some deterioration in the underlying trend. A consensus rise of 0.4% m/m would support the view that demand is softening an d growth is flattening off, suggesting some further GBP downside risks. We still see scope to 0.85 and beyond with the BoE meeting on February 6 looking increasingly likely to deliver both a 25bp rate hike and an indication that the market is pricing tool little easing for the rest of the year.

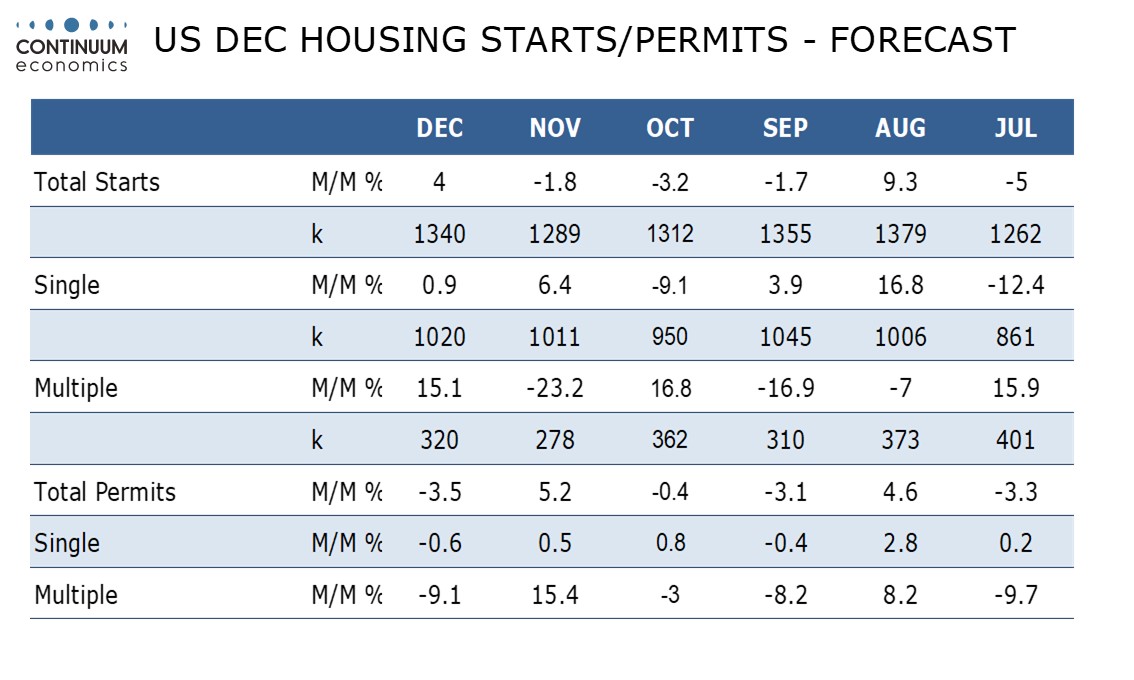

In the US, housing starts and building permits are the main data. We expect December housing starts to rise by 4.0% to 1.34m while permits fall by 3.5% to 1.44m. The starts rise will be following three straight declines while the permits fall will be correcting a 5.2% November increase. The underlying picture looks fairly flat. Looking forward the picture looks set to weaken in response to fading expectations of Fed easing and higher UST yields. Bad weather is likely to be an additional negative in January. This sector looks like one of the potential weaknesses in the economy, so the USD risks are to the downside with another decline potentially ringing alarm bells.

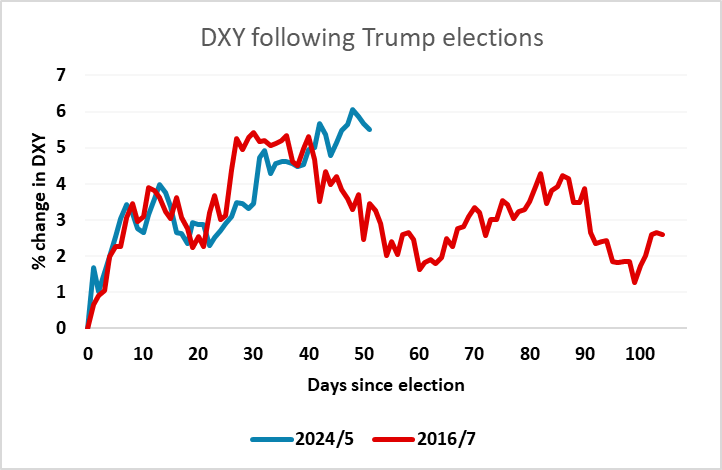

Big picture the market focus is moving to next week’s main event of the Trump inauguration. The inauguration itself is of less market interest than the executive orders that are likely to follow over the rest of the week. Most of this will be about immigration, but the market will be sensitive to anything on tariffs. In practice, the USD might not benefit from significant increases in tariffs – certainly that was the case in 2017/8. But in the initial stages any announcement of higher tariffs could be expected to benefit the USD against the target country.