FX Daily Strategy: Europe, November 28th

EUR data likely to have minimal impact

Risk positive tone may fade, reducing USD and JPY weakness

AUD retains upside scope

GBP post-Budget strength looks flimsily based

JPY may suffer short term but turn near

EUR strength unlikely to extend

CAD may see gain on GDP

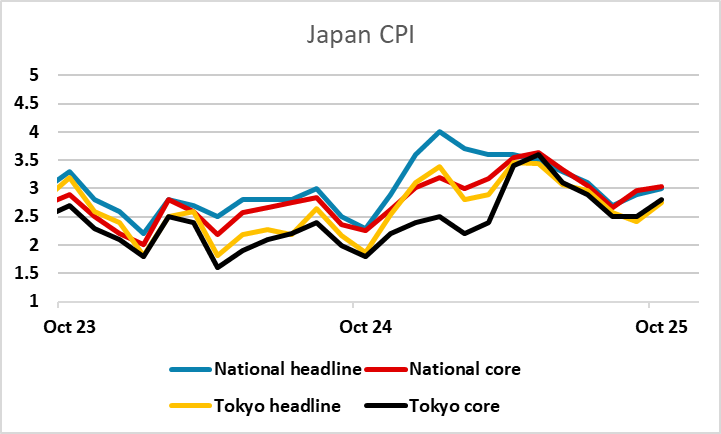

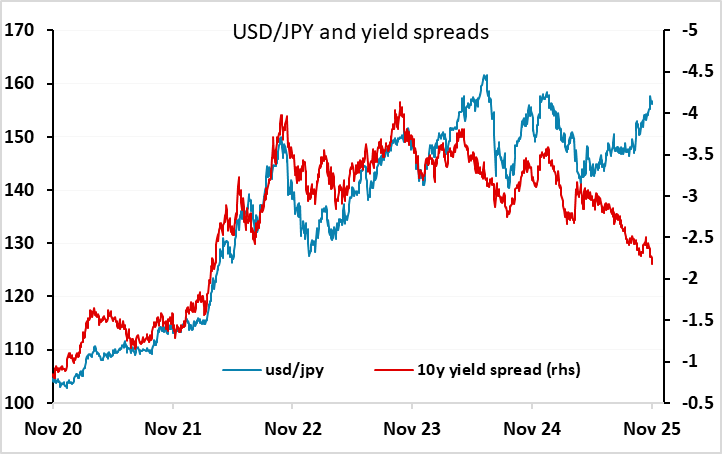

Friday kicks off with Tokyo November CPI data – effectively preliminary CPI for Japan – which has more significance than usual given the speculation about a possible BoJ rate hike in December. Market consensus is for a small drop in the y/y rate to 2.7%. This would be unlikely to prevent calls for a December rate hike intensifying. The JPY has remains soft on the crosses this week as equities have recovered, despite increased expectations of BoJ tightening, but continues to looks dramatically undervalued across the board.

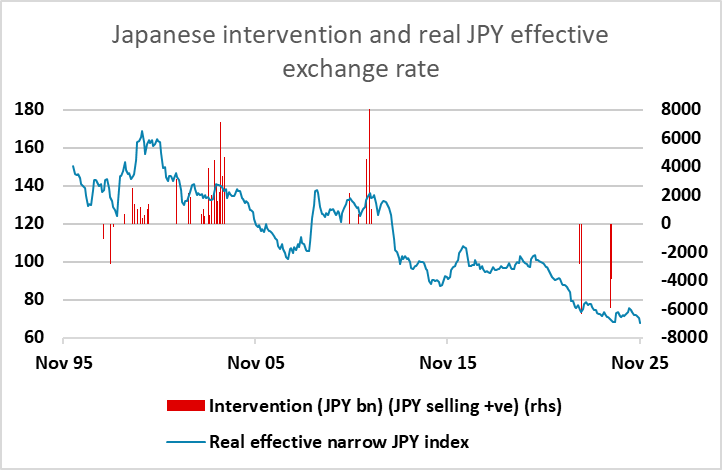

With the S&P approaching the all time highs above 6900, it should be harder for equities to make gains from here. But any break higher could be expected to trigger further JPY losses. These in turn might well trigger BoJ intervention, as any significant JPY decline from here would put the real effective JPY at new all time lows. The new administration has been clear about the willingness to intervene if moves are too rapid or too far removed from fundamentals, and history shows BoJ intervention typically markets the tops and bottoms for the JPY on a long run basis. So while we may see some short term renewed JPY weakness, we see little scope for JPY losses longer run and would beware a JPY bear trap.

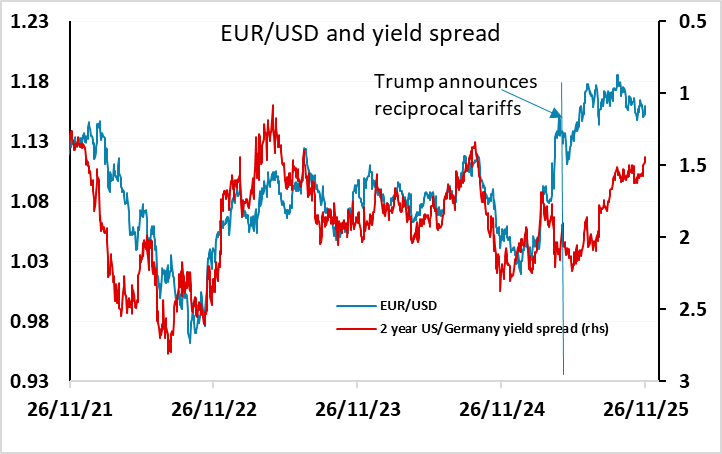

Friday also sees preliminary CPI data from France, Spain and Germany, but the ECB remains firmly in no change mode so it would take a lot for this data to have any significant impact. We also have revisions to Q3 GDP data for Sweden, France Italy and Switzerland, but revisions are typically minor so shouldn’t have a substantial impact. The EUR has remained from through the week, but strength looks to be related more to being the USD’s antipole than any intrinsic attraction. The EUR has significantly outperformed yield spreads since April’s announcements of US reciprocal tariffs, in contrast to the underperformance of spreads from the JPY and AUD. The risk is that the market falls out of love with the EUR with better value available elsewhere. A 1.14-1.18 range is looking hard to break medium term.

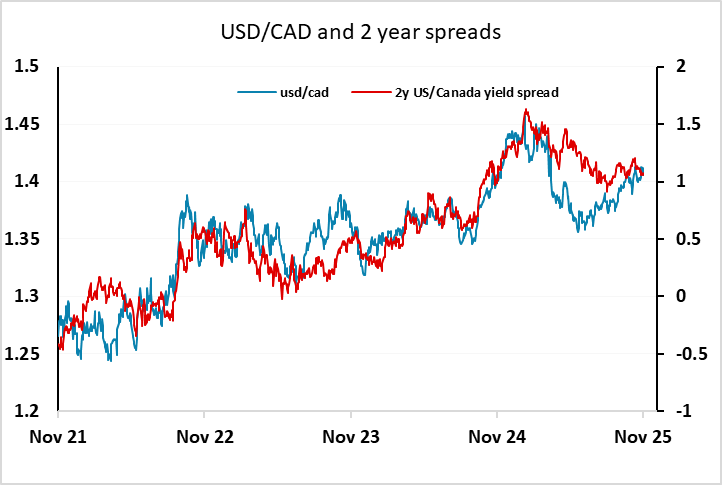

Canadian GDP is the only significant data from North America. The US is technically open but activity is typically light after the Thanksgiving holiday. We expect Q3 Canadian GDP to increase by 0.6% annualized, marginally stronger than a 0.5% estimate made by the Bank of Canada with October’s Monetary Policy report, with September GDP to increase by 0.2% on the month, slightly stronger than a preliminary estimate of 0.1% made with August’s data. This should give the CAD some support with potential for USD/CAD to dip back below 1.40.