EUR/USD, USD/JPY flows: Market Expects Slower 2026 USD Decline

Traders views for 2026 are biased towards further USD losses, but at a smaller scale than 2025.

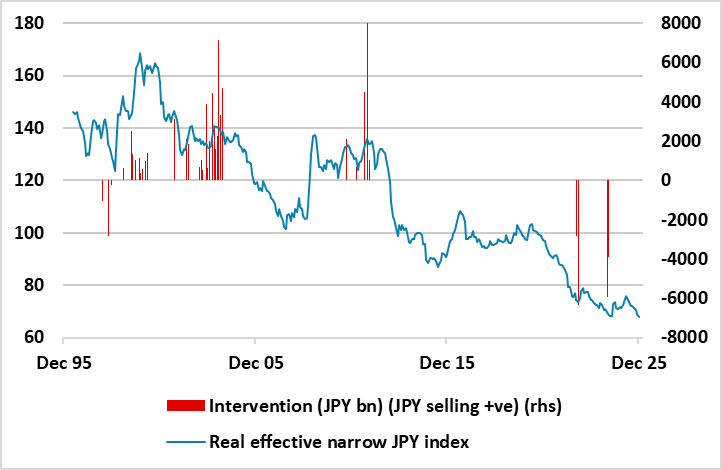

The USD is not so overvalued as the start of 2025 and the Fed is expected to pause in H1 2026. Though the Supreme court ruling on reciprocal tariffs is expected to increase FX volatility it may not provide lasting direction. EUR is expected to remain good, helped by FX hedging of the huge U.S. equity positions by European funds. Views on the JPY are split between ongoing weakness versus catch-up on other USD majors – BOJ FX intervention will be a swing factor.

We are most bullish on the JPY, as we see catch-up. BOJ intervention in the past has also changed sentiment and we are close to levels that previously triggered intervention. We see a move to 140 on USD/JPY by end 2026. We also love the AUD, which has lagged other majors and the RBA is the toughest of the G10 central banks. We see 0.72 by end 2026. Finally, we feel that the NOK is out of line with fundamentals and rate differentials and looks for EUR/NOK to 11.00 by end 2026. Our 2026 DMFX Outlook is here.