FX Daily Strategy: APAC, November 7th

CAD risks to the downside on Canadian employment

JPY benefiting from weakness in risk sentiment

GBP still vulnerable to increased rate cut expectations

Michigan sentiment might dip in response to weaker job market

CAD risks to the downside on Canadian employment

JPY benefiting from weakness in risk sentiment

GBP still vulnerable to increased rate cut expectations

Michigan sentiment might dip in response to weaker job market

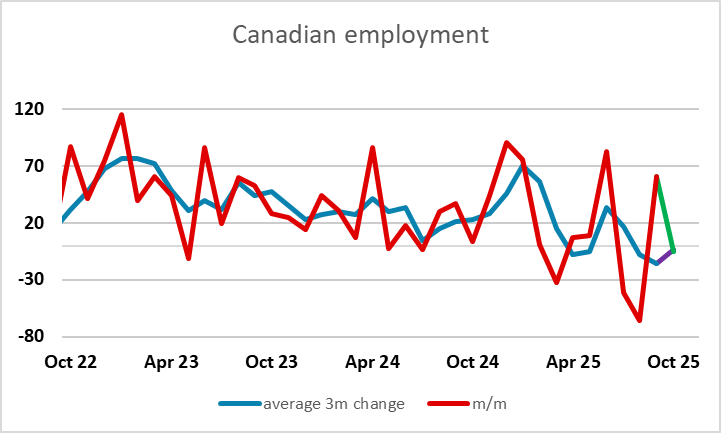

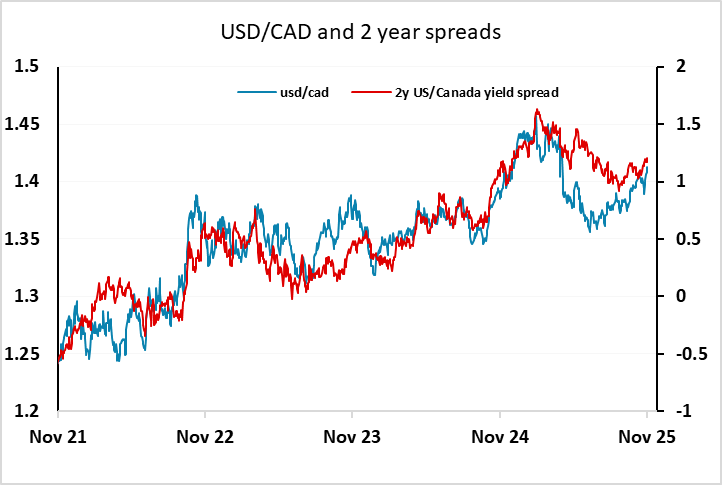

While the government shutdown still means there is no US employment report on Friday, there is a Canadian employment report. The market consensus is for a 5k decline in October following a 60k rise in September, which would imply a marginal improvement in the trend. The CAD will clearly be focused on this data, as USD/CAD has moved up substantially over the last week, largely because of reduced expectations of Fed easing and higher US yields. The USD/CAD rise is broadly consistent with the rise in the yield spread that we have seen, but there is scope for some increase in expectations of BoC easing if we see weakness in the Canadian numbers which could increase the pressure on the CAD. Strength in the Canadian numbers could help trigger a CAD recovery, but there is little chance of the market pricing in much less easing given there are no more cuts fully priced

The CAD was also suffering on Thursday from weakening risk sentiment, which appears to have been driven mostly by a surge in US job losses reported by Challenger in October, as well as some softish employment data from the Revelio labs October employment survey. For now, this is triggering risk related moves, so the riskier currencies are suffering and the JPY is gaining, but if it leads to increased expectations of Fed easing, the USD may also start to suffer. For now, JPY strength looks likely to continue, with JPY crosses now likely to focus on the gaps opened up on the election of PM Takaichi. There is scope for these to be closed, which would imply EUR/JPY down to as low as 173.

Other than trade data from France and Germany, there isn’t a great deal of significance on the European calendar, but GBP could come under renewed pressure if the market starts to reassess the scope for BoE rate cuts. These looks all the more likely in a risk negative market, which will also typically have an independently negative impact on GBP. In any case, a rate cut at Thursday’s meeting was only avoided by one vote, and a December cut now looks to us as being extremely likely, given what is likely to be a significant fiscal tightening being announced at the November 26 budget. As it stands, this is only priced as around a 60% chance, but this looks a major underestimate. Indeed, a larger 50bp cut is even possible if the Budget is particularly tight. EUR/GBP should have scope to test back to the 0.8830 highs seen earlier this week, but GBP/JPY may be the most vulnerable.

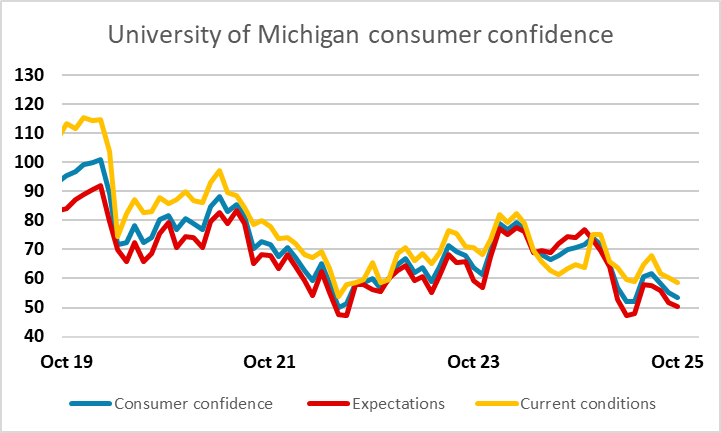

If the US job market really did deteriorate significantly in October we may see it reflected in weakening consumer confidence in the University of Michigan survey. The picture was already quite weak in recent months, but further evidence of weakness, taking confidence levels below the 2022 lows cold be expected to further undermine risk sentiment and trigger more JPY strength.