FX Daily Strategy: N America, January 4th

December German and French inflation bounces much as expected

EUR/USD benfits from upward revision to PMI

GBP holding strength as UK PMIs outperform

JPY weakness looks overdone medium term

December German and French inflation bounces much as expected

EUR/USD benfits from upward revision to PMI

GBP holding strength as UK PMIs outperform

JPY weakness looks overdone medium term

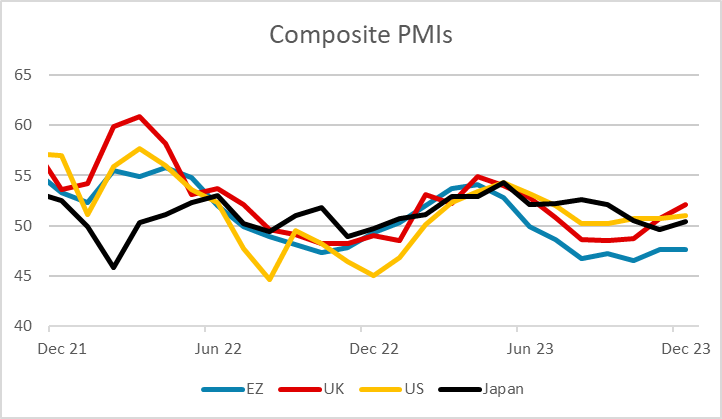

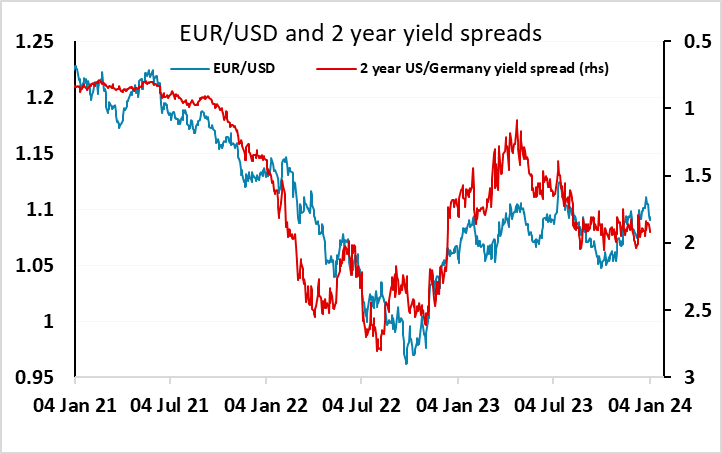

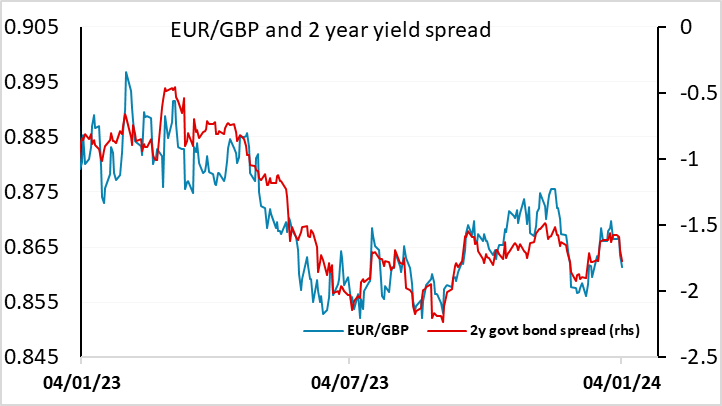

Upward revisions in services PMIs have helped the EUR and particularly GBP to strengthen through the morning, with the UK composite PMI revised up to its highest since July. The EUR PMI has shown a more modest rise, and remains well below the 50 level, but the upward revision has been enough to push EUR yields and the EUR higher, with the French and German preliminary CPI data only marginally on the weak side of expectations.

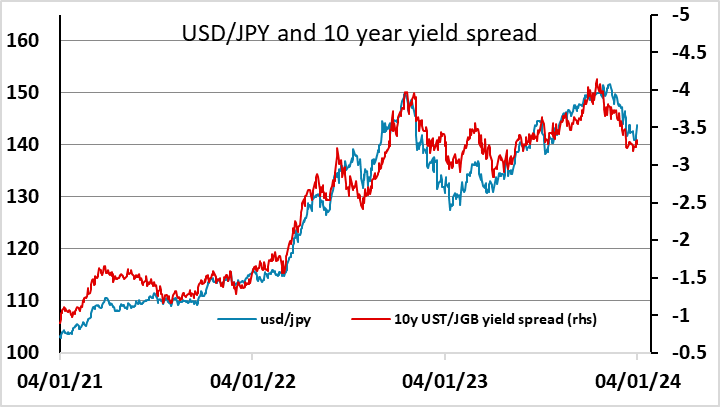

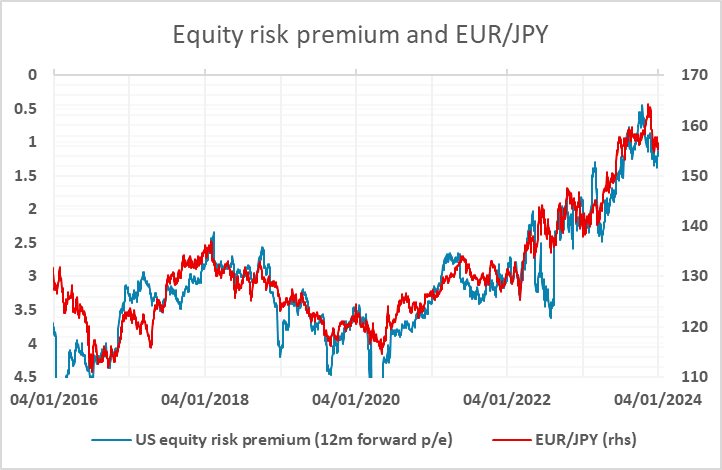

JPY weakness continues to be a theme, with USD/JPY as well as the JPY crosses looking high relative to yield spreads. The modest recovery in equities this morning also doesn’t really support JPY weakness, given the decline in equities earlier in the week, but the correlation with equity risk premia does still suggest that EUR/JPY is close to fair here. Nevertheless, we see the current JPY weakness as a JPY buying opportunity from a medium term perspective.

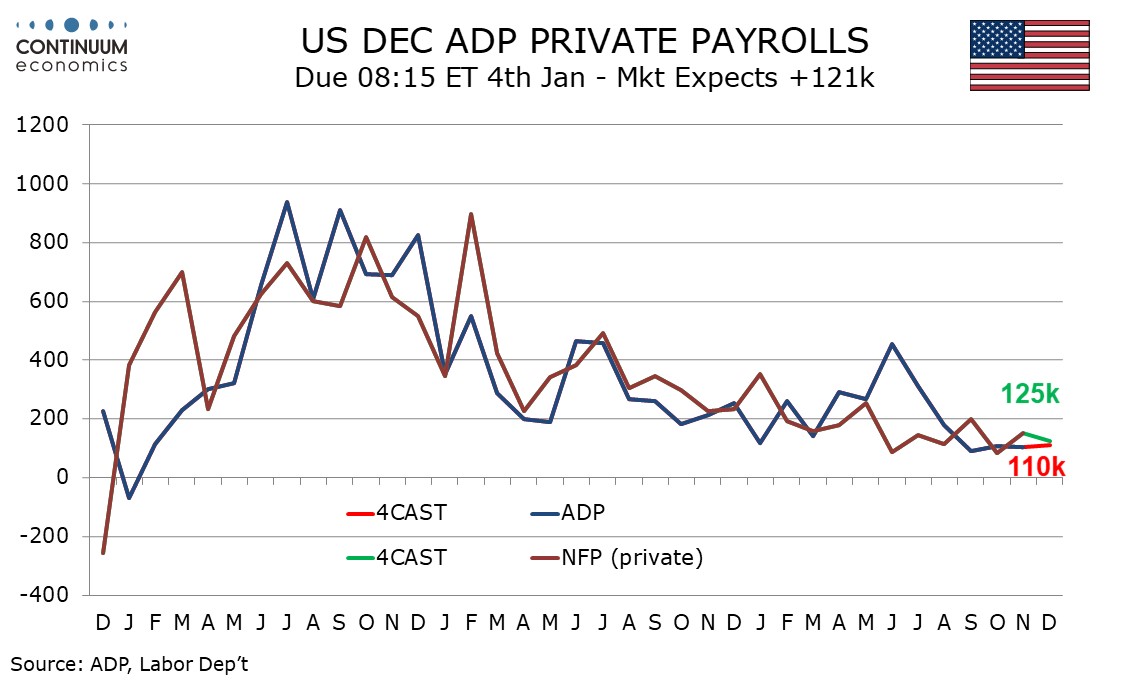

We expect a 110k increase in December’s ADP estimate for private sector employment growth, similar to if marginally stronger than the gains seen in the last three months, each of which was close to 100k. The trend in ADP data has slowed a little more than has that for the non-farm payroll, and we expect the ADP data to again modestly underperform. We are looking for private sector non-farm payrolls to rise by 125k with a 175k payroll increase overall. The market has a low level of trust in the ADP data, so we wouldn’t expect a big reaction. Our forecasts is marginally below market consensus, but not sufficiently to trigger any USD move.

UK PMIs were particularly strong but the money data was mixed with M4 falling again in November despite larger than expected gains in lending to individuals and mortgage approvals. UK front end yields consequently only kept pace with the modest rise in EUR yields, and with less easng priced into the UK, the downside for EUR/GBP now looks a little restricted.

JPY weakness was once again a feature on Wednesday, but we feel JPY weakness is getting a little extended on the crosses in particular. Even against the USD, the latest move looks a little overdone relative to yield spreads. Part of the reason for JPY weakness may be that a lot of houses are seeing JPY strength as a theme for the year, and we are consequently seeing an early squeeze of these positions. But this may be creating good entry levels for medium term JPY bulls who see Japanese yields rising through the year while yields elsewhere are likely to edge lower.