FX Daily Strategy: APAC, Oct 3

Swiss CPI neutral but EUR/CHF basing

EUR/CHF basing near 0.93

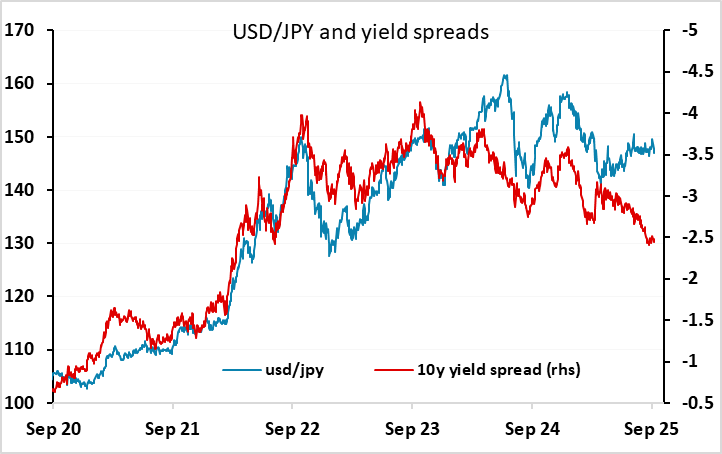

JPY has scope for further gains

GBP recovery unlikely to last

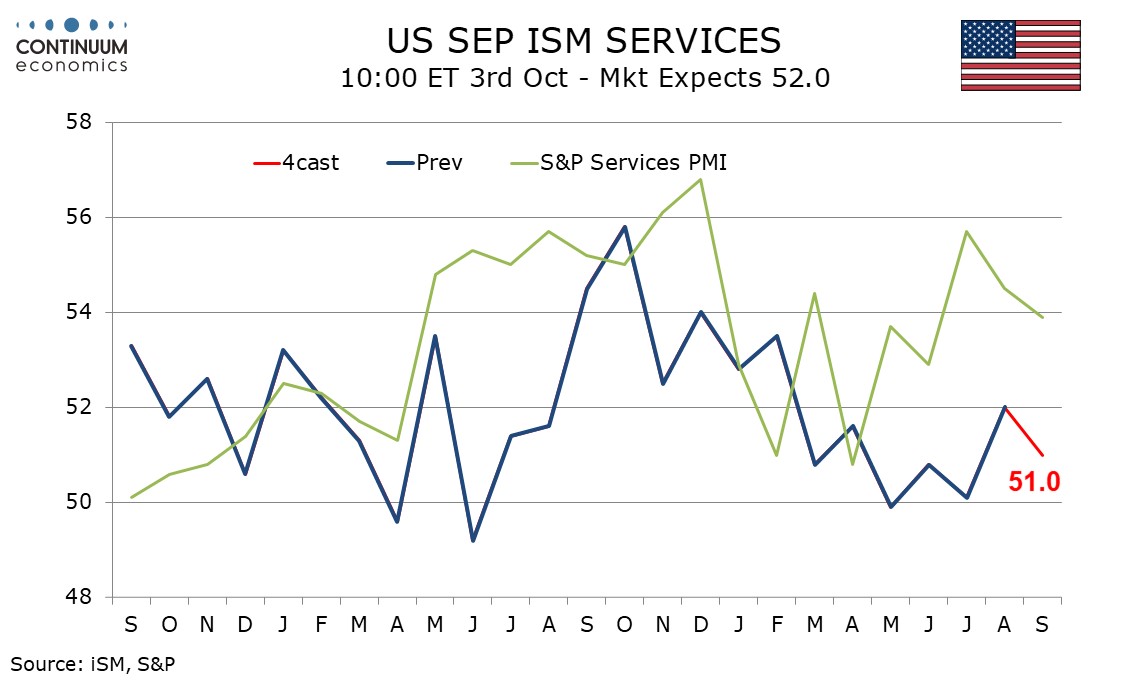

ISM services could weight on USD/JPY

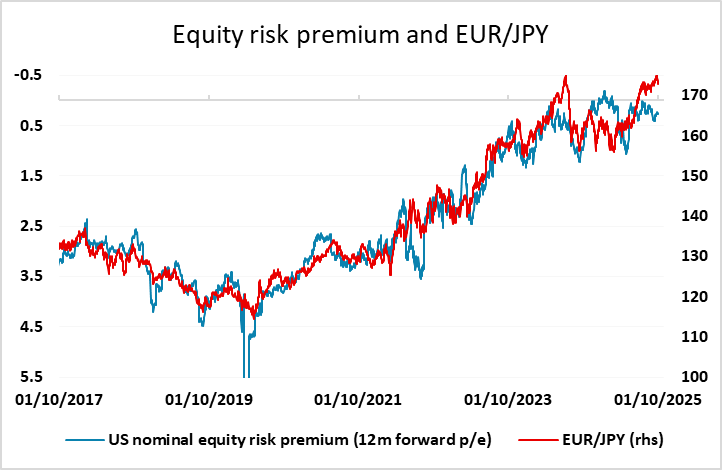

EUR/JPY remains vulnerable to any equity correction

Ueda could provide some guidance on BoJ October rate hike chances

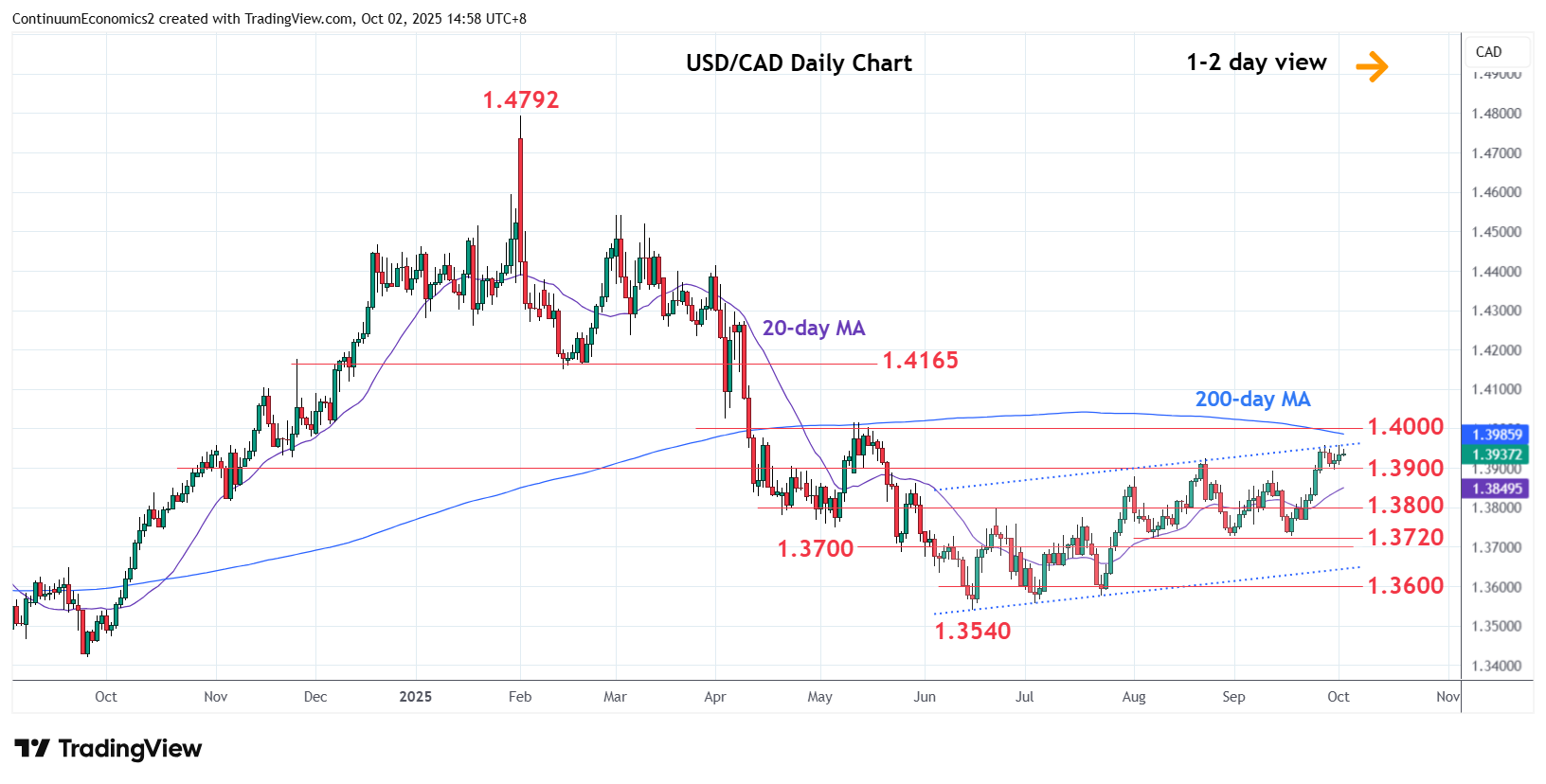

USD/CAD approaching 1.40 but gains beyond here likely to be difficult

In an official data desert, the ISM services survey takes on greater significance than usual. There is little correlation between the ISM services survey and the S&P non-manufacturing PMI, and the ISM services index is treated with greater respect as a contemporaneous indicator of demand. We expect slippage in September’s ISM services index to 51.0 from 52.0, still above the levels seen in May, June and July, but implying a subdued pace of economic growth. August’s improvement from July’s near neutral 50.1 was assisted by more supportive seasonal adjustments. September’s seasonal adjustments look tougher, particularly for new orders, which we see slipping to 54.0 from 56.0, and business activity which we see slipping to 53.5 from 55.0.

Our forecast is somewhat weaker than the market consensus of a small decline to 51.8, and following on from the weaker than expected ADP employment data, suggests the USD could extend the weaker tone seen so far this week, primarily against the JPY. However, USD/JPY has so far not managed a sustained break below the 146.00/50 area since breaking above there in early July, and after a week of JPY strength it may take a significantly weaker ISM index to trigger a break if equity markets retain the positive tone seen so far this week. Having said this, the equity market gains seen this week look hard to justify, so may also be due a correction. This could be expected to benefit the JPY, though possibly more on the crosses than against the USD. EUR/USD failed to sustain early gains on Thursday, and EUR/JPY continues to look expensive relative to the correlation with risk premia, and any equity weakness would add to the case for a EUR/JPY decline below 170.

Other than the ISM data there isn’t much else on the calendar, although a speech from BoJ governor Ueda may be of interest, with comments on Thursday from deputy governor Uchida suggesting there is a strong chance of an October BoJ tightening. A hike is still only around 35% priced for the October 30 meeting, and some suggest it might be dependent on the result of the LDP leadership election at the weekend. However, none of the candidates is expected to institute a tighter fiscal policy, so it seems unlikely to be a barrier to BoJ tightening.

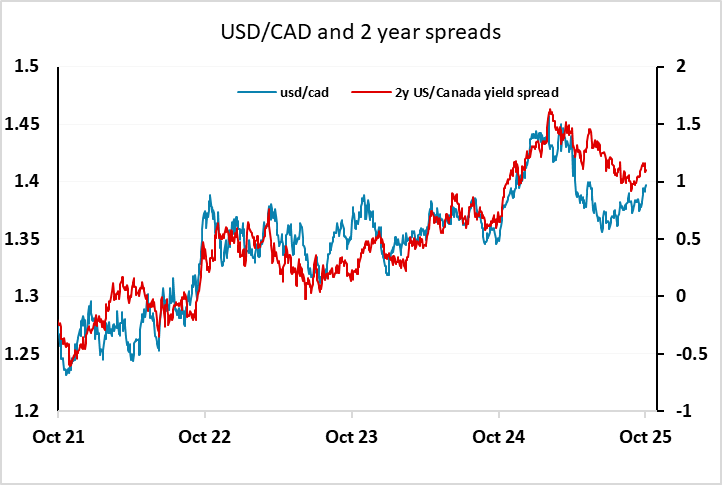

Although equity markets have been strong, risk sentiment in the FX market has been generally more negative, with the CAD seeing the most significant weakness. USD/CAD hit its highest level since May on Thursday, and has now nearly converged with its historic yield spread relationship. There may still be scope for a move above 1.40, but gains above here are likely to prove difficult.