FX Daily Strategy: Europe, April 9th

Imposition of reciprocal tariffs could trigger renewed equity market dip

JPY still good value, even if risk appetite stabilises

European currencies vulnerable on renewed risk decline

RBNZ unlikely to produce a surprise, but NZD could fall back vs the AUD

Imposition of reciprocal tariffs could trigger renewed equity market dip

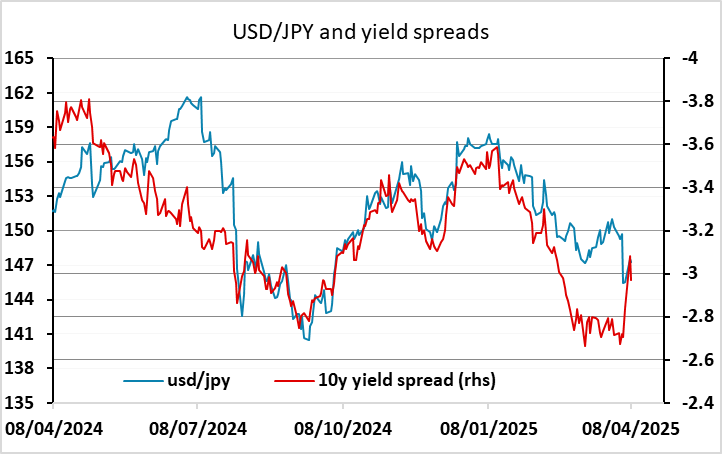

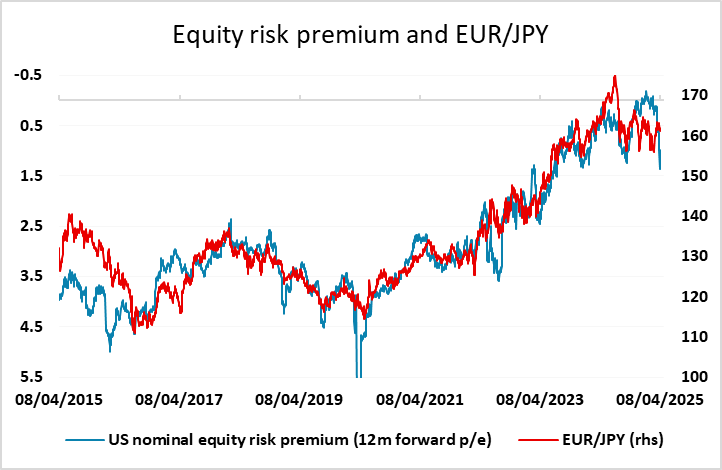

JPY still good value, even if risk appetite stabilises

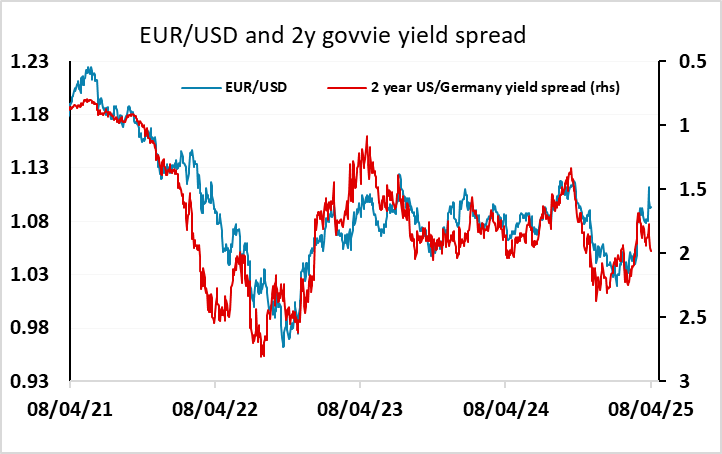

European currencies vulnerable on renewed risk decline

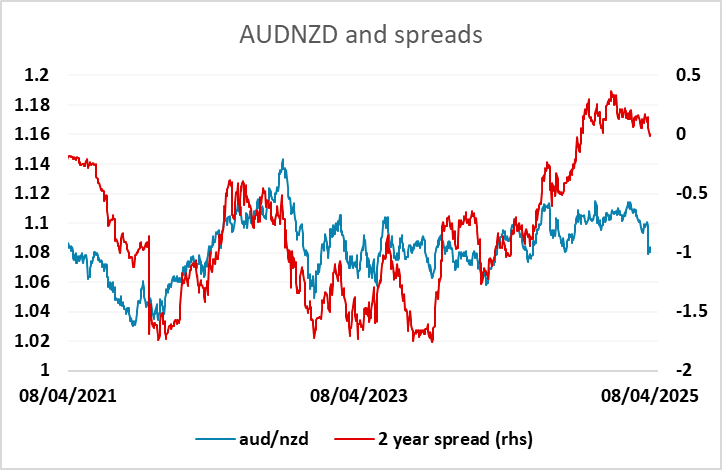

RBNZ unlikely to produce a surprise, but NZD could fall back vs the AUD

There isn’t a great deal on Wednesday’s calendar, but the main story is that the higher rates of “reciprocal” tariffs come into effect at midnight (US Eastern time) tonight. While there has been speculation that there will be a delay, everything out of the White House suggests that there will be no backing down at this stage. Rather, there are threats of further increases on China if they don’t remove their retaliatory tariffs. There are still hopes that tariffs can be negotiated away, but this seems likely to be on a case by case basis, so it’s hard to see how multiple deals can be reached quickly. If, as seems likely, there is no backing down at this stage, equity markets could see a renewed dip after the recovery on Tuesday.

As yields and equities edged back up on Tuesday, the USD generally moved lower against the riskier currencies. While the JPY and the CHF also performed well, this was more a catch-up on the declines in equities and yields in the previous days than a reaction to Tuesday’s moves. The JPY in particular still looks good value relative to equity risk premia. If we do see a renewed decline in risk sentiment in reaction to the imposition of tariffs, the JPY and CHF continue to look likely to be the main beneficiaries.

Even if markets remain sanguine about tariffs coming into effect, perhaps in the belief that there will be a reduction in the future, the JPY still looks good value at current levels. But if we see a stabilisation in risk sentiment it would also favour the riskier currencies against the USD. The AUD and NOK still look to represent the best value among the riskier currencies, and probably have scope for recovery on the crosses even if we see renewed weakness in risk appetite. However, a dip in risk sentiment could see the USD make renewed gains against the European currencies.

Before the tariffs come in there is the RBNZ monetary policy meeting to consider. They were already expected to cut rates 25bps before the current turmoil, and while there is a slight risk of a larger cut now priced in, we concur with the market consensus of a 25bp cut. This is unlikely to have much impact, and the statement will also be of limited interest given the current uncertainties. However, the NZD has significantly outperformed the AUD through this turmoil, helped by the NZ export basket being seen as less sensitive to global demand than the Australian, and by the AUD being generally more sensitive to shifts in global risk appetite. There may be scope for the recent decline to be reversed.