USD flows: USD softer as polls suggest no Trump advantage

Latest polls suggests the presidential race is too close to call suggesting USD strength on the expectation of a Trump in is overdone

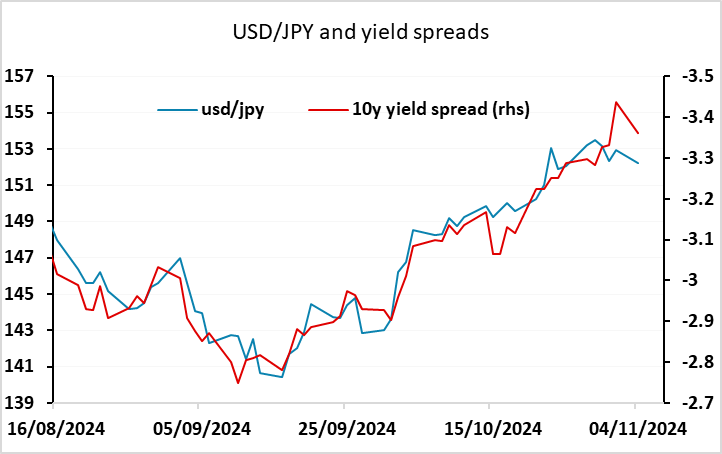

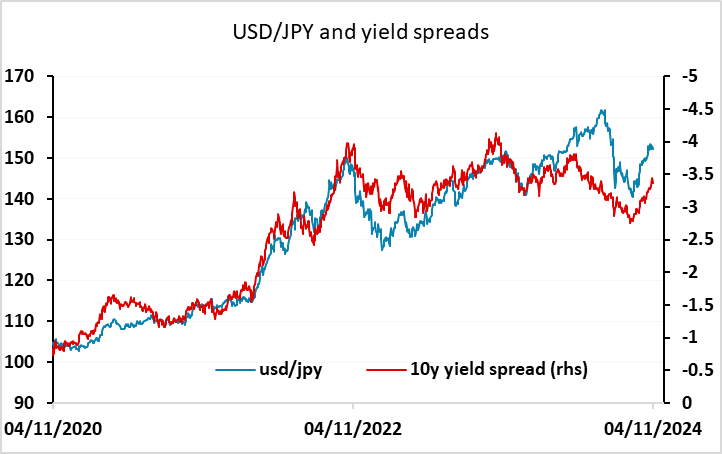

A quiet calendar on Monday as usual, with the markets now mostly focused on tomorrow’s US election. While betting odds still favour Trump they have moved slightly in favour of Harris over the weekend after a poll showing her ahead in Iowa – a state that was previously seen as solidly Republican and not as one of the swing states. The USD has edged lower in Asia, partly for that reason. Even so, US 10 year yields remain quiet elevated having spiked higher on Friday, and short term correlations still suggest USD/JPY is well supported, although the longer term correlations remain in the JPY’s favour.

A Trump win is expected to sustain USD strength, all the more so if it is accompanied by a Republican clean sweep of Congress. Unless the Republicans control the House, Trump will have difficult enacting all the tax cuts he wants, so that fiscal policy is likely to be less easy. However, tariffs are likely to rise on a Trump win and while that may be negative for the US economy in the longer run, in the short run it will be seen as raising inflation and reducing the scope of Fed easing. We would assess the market as close to fully pricing a Trump win but not pricing in Republican win in the House. The polls suggests the presidential race is too close to call, so we slightly favour the USD downside from here, and there may be a more USD negative reaction when the US opens after the weekend polls.