FX Daily Strategy: N America, February 19th

RBNZ cut 50bps, still scope for AUD/NZD gains

UK CPI may tick higher, but possibly less than expected

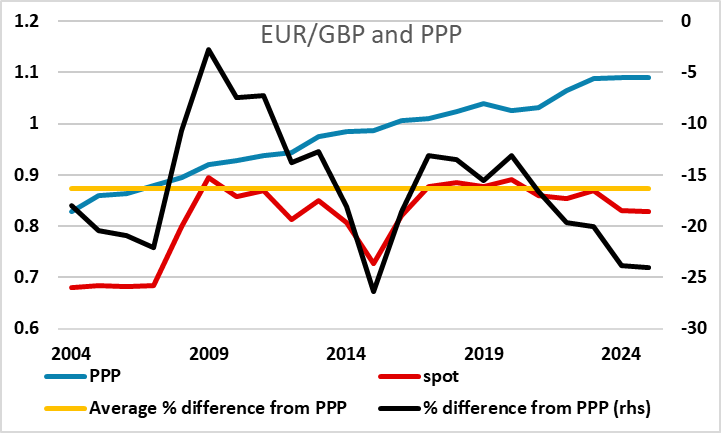

EUR/GBP still looks stretched near 0.83

USD may rally a little on FOMC minutes with the CAD maybe the most vulnerable

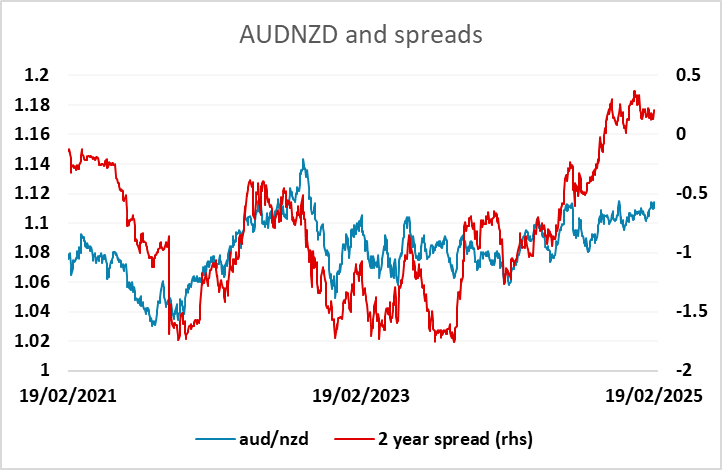

RBNZ cut 50bps, still scope for AUD/NZD gains

UK CPI may tick higher, but possibly less than expected

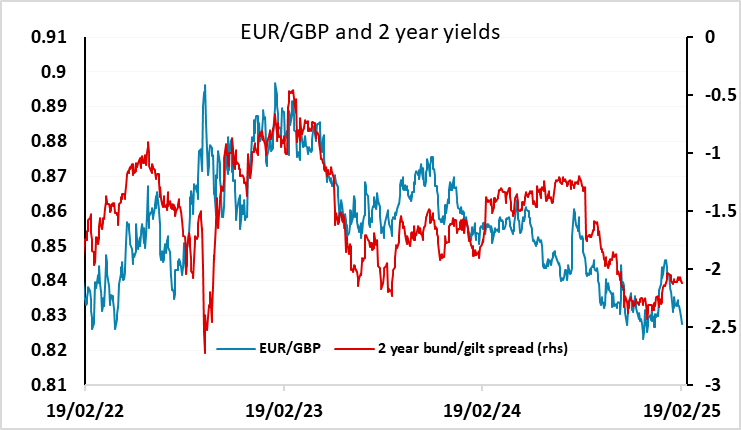

EUR/GBP still looks stretched near 0.83

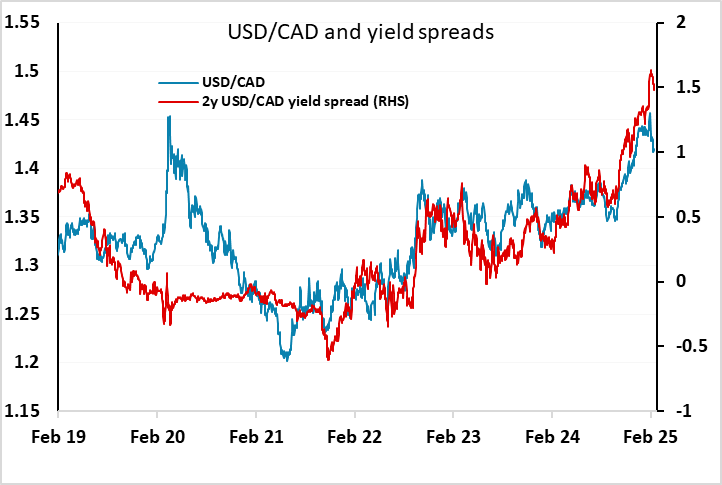

USD may rally a little on FOMC minutes with the CAD maybe the most vulnerable

Following the RBA meeting on Tuesday we had the RBNZ on Wednesday, who were expected to outdo the RBA by cutting rates 50bps to the RBA’s 25. This was fully priced into the market with a further 50bps seen by mid-year. This more aggressive easing stance from the RBNZ has led to some weakening of the NZD against the AUD over recent months, and the high of 1.1180 from November is within reach. Given the unusual situation of front end AUD yields being above NZD yields there is certainly a case for further AUD/NZD gains, especially since the RBNZ are expected to continue to ease more aggressively in the coming months. The RBNZ cut by 50bps as expected and guided there are more cuts to come. It seems to suggest the RBNZ is taking the opportunity of lower inflation to ease and stimulate the soft NZ economy. The slightly higher than expected Q4 CPI does not seem to bother them. AUD/NZD tested the highs of the year reaching 1.1175 after the decision but the NZD rallied from there and AUD/NZD dropped back to 1.11. From here there is still scope for AUD/NZD gains and a break of the highs after this correction.

In Europe the main focus was the UK CPI data for January. This was on the strong side of expectations, with broad based gains taking the y/y rate up to 3.0% y/y against a market consensus of 2.8%. There was strength in food and energy prices, but clothing and education also saw gains on a y/y basis, with the tax on private schooling hitting the education index. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.7% in the 12 months to January 2025, up from 3.2% in December 2024; the CPI goods annual rate rose from 0.7% to 1.0%, while the CPI services annual rate rose from 4.4% to 5.0%. The data is significantly above expectations and will make it hard for the BoE to ease policy. UK front end yields are modestly higher in response.

GBP has initially strengthened on the news, with EUR/GBP dropping 10 pips to 0.8275. While the data is likely to mean higher short term UK yields, EUR/GBP already looks a little low relative to yield spreads, and from a longer term value perspective GBP is expensive here against the EUR, trading some 24% below PPP, the most since before the Brexit vote in 2015. While the strength is to some extent justified by relatively high UK yields, it is unlikely that spreads over the EUR will remain this high for long, with little case for UK real yields being above those in the Eurozone. So even if UK rate cuts are slow, progress sub-0.83 is likely to be tough.

The only US data of note is housing starts, which are likely to fall due to bad weather in January. There may be more interest in the FOMC minutes, which are sure to indicate that there is no hurry to ease further from here. With 1 ½ rate cuts now priced in by the end of the year, the risk may be that the minutes help to cut this back to just one cut, helping the USD to recover slightly after recent losses. Scope for USD gains looks to be greatest against the CAD, where yield spreads suggest the recent rally is a little overdone despite the higher than expected inflation numbers on Tuesday.