FX Daily Strategy: N America, December 4th

US claims data likely to be benign

Challenger layoff data should also see a dip after October spike

Risk positive tone to favour the AUD

Limited SEK upside coming into November CPI

US claims data likely to be benign

Challenger layoff data should also see a dip after October spike

Risk positive tone to favour the AUD

Limited SEK upside coming into November CPI

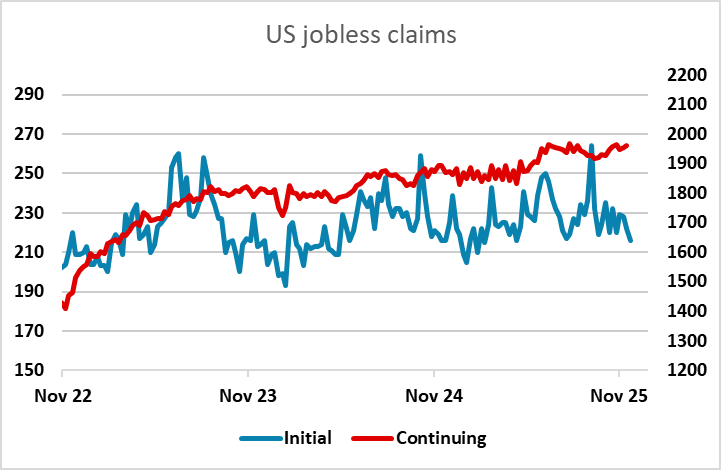

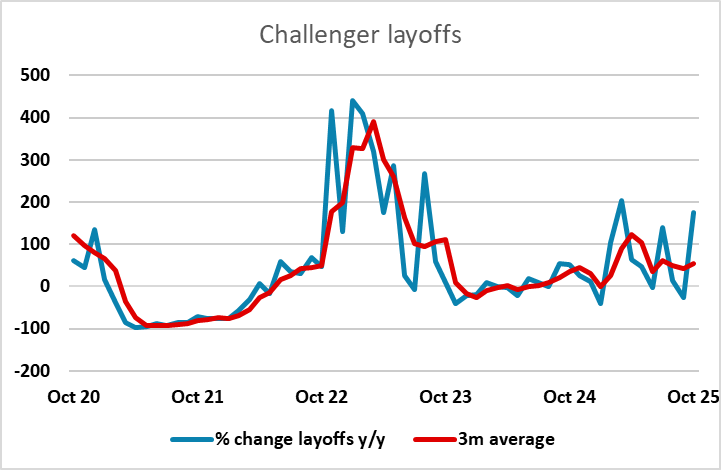

US jobless claims data on Thursday follows on from the somewhat weaker than expected November ADP data on Wednesday as the next measure of US labour market health, while there is also the Challenger layoffs data which follows on from a sharp rise in October that caused something of a stir. The claims data have so far seen initial claims holding at low levels but continuing claims near recent highs, which suggest that the October Challenger data was an anomaly and we should see a dip in November. The 3 month average of the Challenger data is quite stable despite October’s rise.

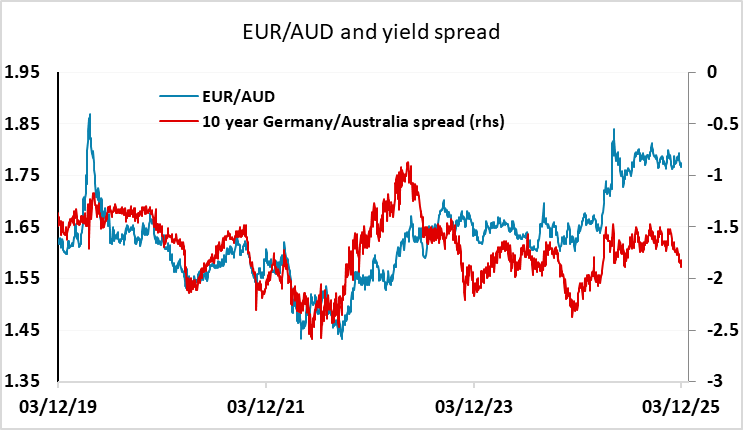

The USD held up reasonably well on Wednesday despite the weak ADP employment number, gaining a little initially after the ISM services index came in on the strong side. But the USD tone does look to be weakening a little. Stronger PMI data out of Europe weighed on the USD a little, and the AUD and JPY still look dramatically out of line with yield spreads which have moved substantially against the USD in the last few months. We still see scope for the AUD and JPY to play some catch-up, but the US data doesn’t look weak enough to trigger any substantial decline. The market is already pricing a Fed cut on December 10 as better than an 85% chance, so there is little scope for further yield spread moves against the USD at this stage. The EUR is already outperforming spreads, so looks to have the most limited upside of he majors.

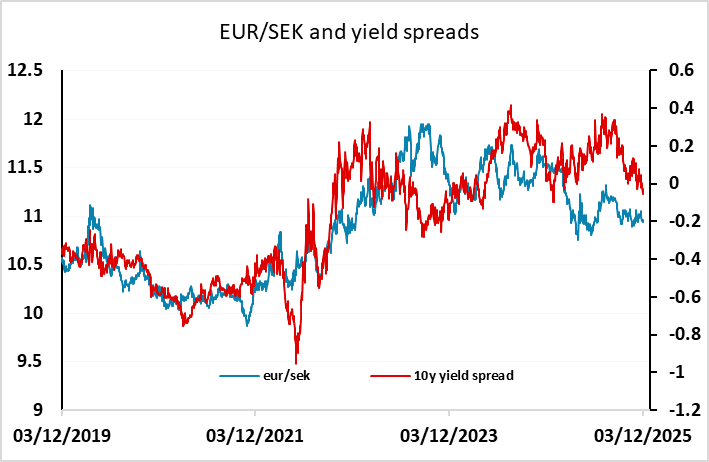

Weaker than expected Swedish CPI data this morning have pushed EUR/SEK slightly higher, gaining a figure to 10.95. Nevertheless, EUR/SEK remains fairly steady just below 11, with little chance of the Riksbank responding to softer inflation with further eaisng. The yield spread has been moving more in favour of the SEK in recent weeks, as Swedish real sector data has come out on the strong side and the market has priced out any expectation of further Riksbank easing. The Swedish curve is now flat out to one year with some risks of tightening now priced in on the 2 and 3 year horizon. However, the SEK had been outperforming yield spreads for much of the last year, so the recent rise in SEK yields has only caught up with the previous movement of the currency. Nevertheless, if we continue to see strong Swedish data there is scope for EUR/SEK to start to move lower, with the Eurozone looking less likely to generate sufficient momentum to trigger any ECB tightening in the next couple of years.

The general picture for the moment looks reasonably risk friendly, with most of the global activity data coming in on the strong side of expectations, but policy expectations still focusing mostly on the prospects for easing. The exceptions are the Japan and Australia, with the market now pricing an RBA hike by the end of 2026. This scope for tightening further underlines the scope for AUD and JPY gains from here. But a JPY recovery still looks hard in a risk positive environment given the extended downtrend, so there should be more scope for the AUD to stretch recent gains.