FX Daily Strategy: N America, Oct 14

GBP weaker after mixed UK labour market data

GBP risks on the downside given the lack of BoE easing priced in

NFIB survey unlikely to disturb firm USD tone

AUD still supported as long as risk sentiment holds up

GBP weaker after mixed UK labour market data

GBP risks on the downside given the lack of BoE easing priced in

NFIB survey unlikely to disturb firm USD tone

AUD still supported as long as risk sentiment holds up

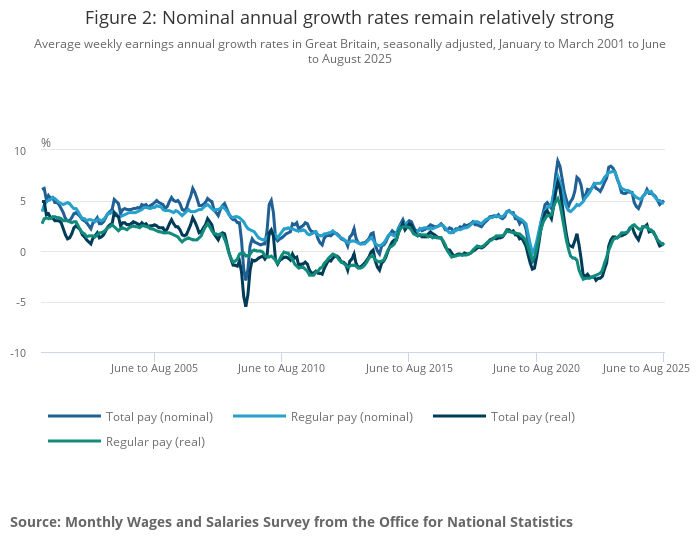

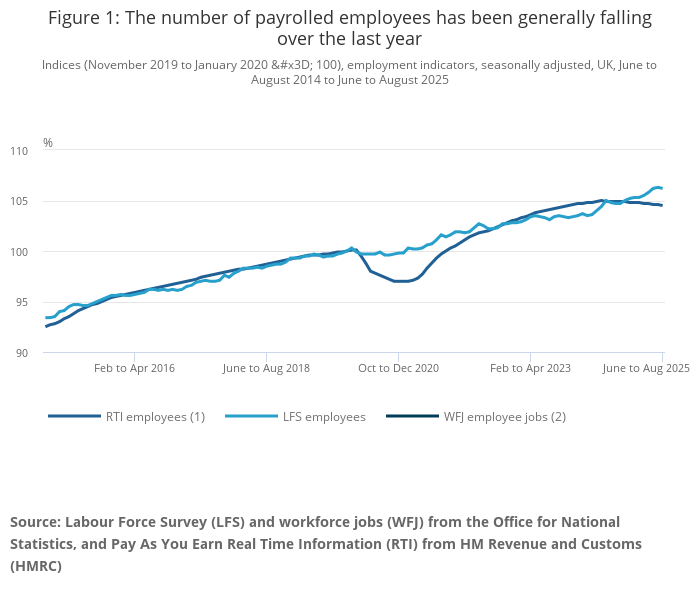

GBP has moved lower after the UK labour market data, although the data is probably best described as mixed. Total average earnings growth was actually stronger than expected in the 3 months to August at 5.0% y/y, although excluding bonuses it was in line with consensus at 4.7% y/y, down slightly from 4.8% in July. However, the more up to date (but provisional) HMRC data showed a weakening in payrolled earnings growth in September to 5.5% y/y. Payrolled employment growth remained modestly negative in the HMRC data, with a 10k decline in September following an 8k decline in August, although the ONS data still showed a 91k increase in employment in the 3 months to August. However, the unemployment rate rose to 4.8% and the economic activity rate dropped due to an increase in labour supply.

All in all the data doesn’t significantly change perceptions of the UK labour market. There is still evidence of weakening employment, and while the trend in earnings growth is slightly lower, it is still too high for the BoE MPC to be looking to cut rates in the near future. The decline in GBP in response to the data looks a little overdone, but suggests the market is prioritising the deteriorating employment picture, which is likely to lead to weakening earnings growth in the future. We do still think there is scope for earlier UK rate cuts than the market is pricing in (the next rate cut is not fully priced until April next year) so we favour the GBP downside medium term. However, the market seems unlikely to price in significantly faster rate cuts before the end November Budget unless we see a significant general global weakening in risk assets. The modest decline in equities overnight, reflecting continued concern over the US/China tariff situation, has no doubt helped the GBP decline this morning, but the year’s high at 0.8763 in EUR/GBP should not be in immediate danger.

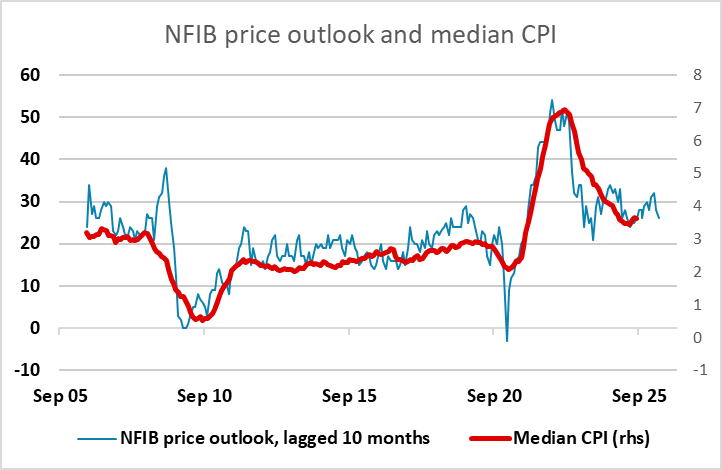

The US does release the NFIB small business optimism survey on Tuesday, which takes on slightly greater importance given the lack of official data. This has recovered since April, having dipped on the Trump reciprocal tariff announcement, following a strong rally on the election result, similar to 2016. It’s unlikely we will see a lot of change in the optimism index this time around, but there will also be interest in the price index, which has some leading indicator properties relative to CPI inflation. However, the main focus for the USD will be on the China tariff issue, although Trump may well now stay quiet on this until nearer the November deadline for the introduction. The USD retains an underlying firm tone, but we still see it as being vulnerable against the JPY as the USD/JPY rally on the LDP election looks flimsily based.

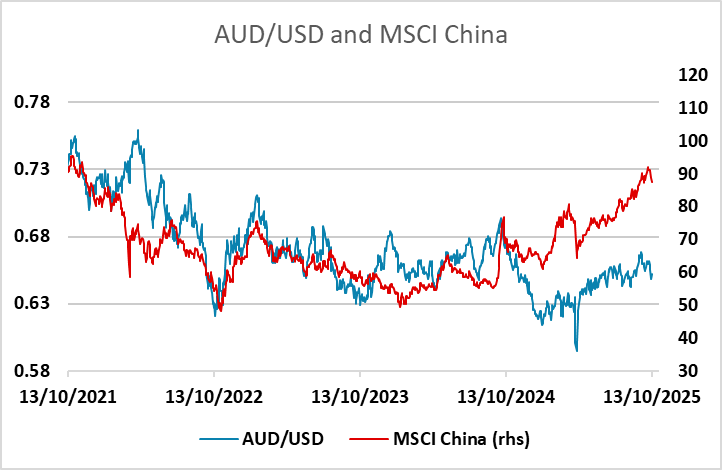

The RBA minutes signalled patience on rate cuts and we continue to see one more rate cut in the coming quarter. Nevertheless, the Aussie fell further on poor sentiment. The AUD is still just about holding the shallow uptrend seen since the April dip despite some recent softness against the USD. We would still expect the AUD to perform solidly unless we see a more general decline in risk sentiment, although it is vulnerable to any deterioration in sentiment towards China.