FX Daily Strategy: Asia, June 6th

USD may remain under pressure on softer employment report

JPY still looks to have the most potential for gains

EUR a little stretched after gains post-ECB

CAD vulnerable if employment data shows another unemployment rise

USD may remain under pressure on softer employment report

JPY still looks to have the most potential for gains

EUR a little stretched after gains post-ECB

CAD vulnerable if employment data shows another unemployment rise

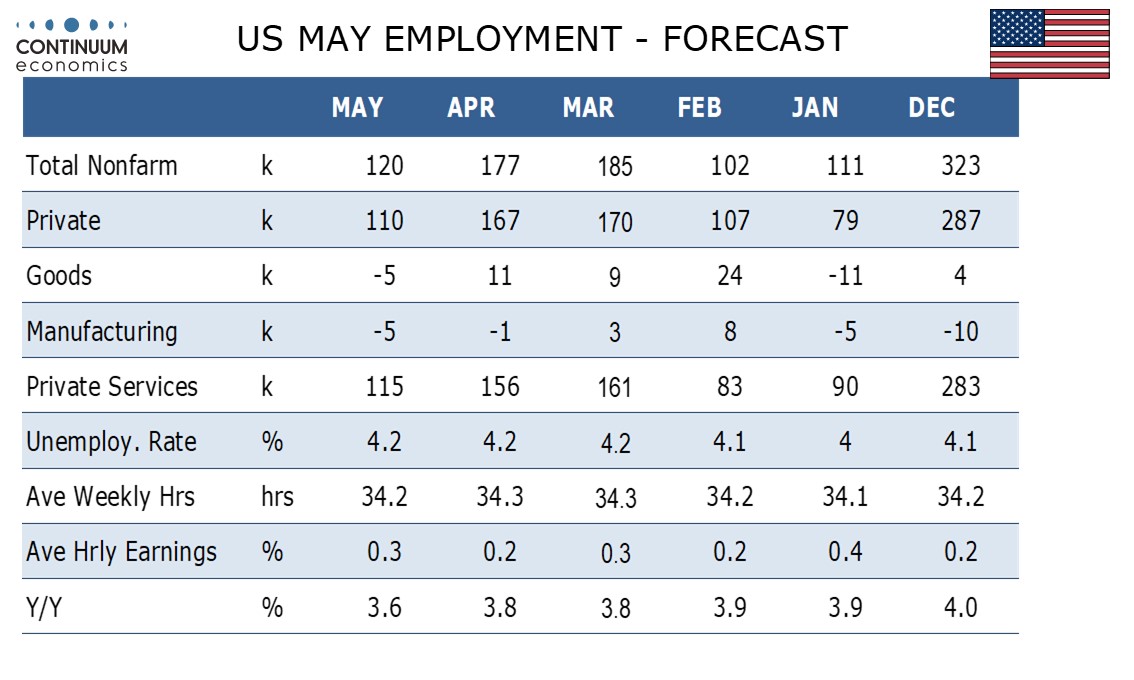

The US employment report is the main focus for Friday, and all the more so after the weaker than expected ADP employment data released on Wednesday and the higher initial claims data on Thursday (although this was not survey week data). We expect a 120k increase in May’s non-farm payroll, with 110k in the private sector, slower than seen in March and April but stronger than what may have been weather-restrained months in January and February. We expect a slightly stronger 0.3% rise in average hourly earnings and an unchanged unemployment rate of 4.2%.

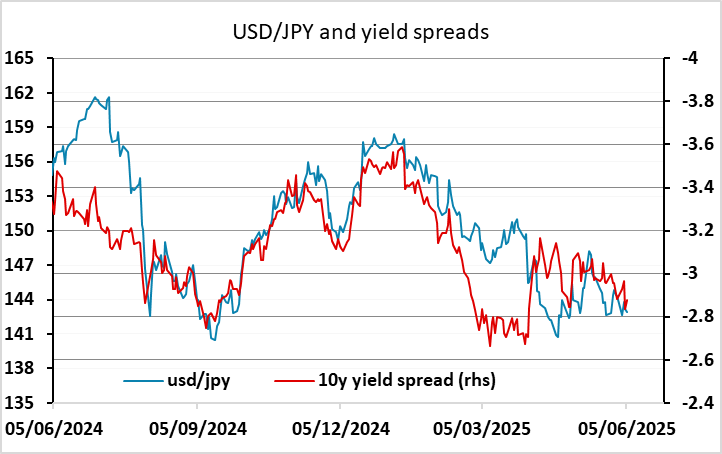

These numbers are all near enough bang in line with the market consensus, so any USD reaction on this data should be quite muted. Even so, inasmuch as such numbers would suggest a mild slowdown, they might still be seen as slightly USD negative. In particular, the current level of the US equity market still looks very high in a slowing growth environment, so another piece of evidence suggesting growth is slowing to sub-trend levels ought to be seen as negative for equities. If so, this would be more supportive for the JPY than the riskier currencies, as the JPY continues to show a positive correlation to equity risk premia, particularly on the crosses.

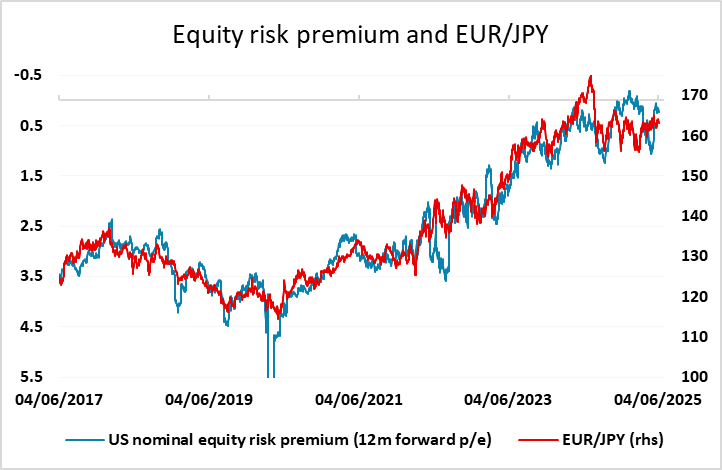

Thursday saw general gains for the EUR after the market interpreted Lagarde’s comments at the press conference as indicating a pause in or even possibly an end to the easing cycle. This wasn’t a complete surprise, as many had speculated that a pause was likely, but the language was seen as less dovish than expected and the market is now pricing in a floor in rates around 10bps above the previous expected low, with only one more cut expected this year, rather than the risk of two as previously seen. But we are a little wary of this EUR strength, both because any further US tariff increases, particularly on the European sensitive areas like pharma, could put the ECB back into easing mode, and because the EUR’s gains this year haven’t really shown much relation to moves in yields and yield spreads. While the ECB’s positive talk about medium term growth being supported by defence and infrastructure spending might also be seen as EUR supportive, a sustained break above 1.15 ought to require some evidence of solid European growth or a generally weaker USD. Gain against the JPY look hard to justify on value or yield spread grounds, and also seem unlikely to be sustained by the current low levels of equity risk premia.

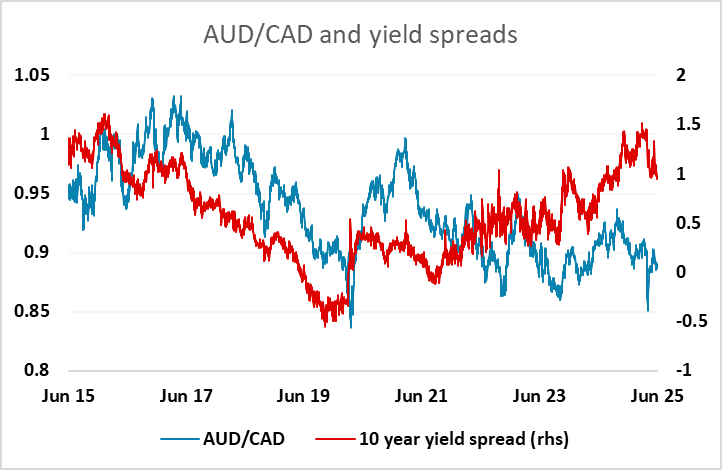

The Canadian employment report is also due on Friday, with the market consensus looking for a decline in employment of 12k in May and a rise in the unemployment rate to 7.0%. The CAD continues to look vulnerable on the crosses to evidence of economic weakness, with yield spreads suggesting scope for gains in AUD/CAD and a weaker USD environment normally also leading to CAD weakness against other G10 currencies. While European currencies are already quite elevated against the CAD, the AUD and JPY should have scope for gains on as expected data.