FX Weekly Strategy: APAC, December 9th-13th

Focus shifts to central bank meetings

EUR has modest upside scope

SNB may be influenced by strong CHF

CAD downside favoured, but scope limited

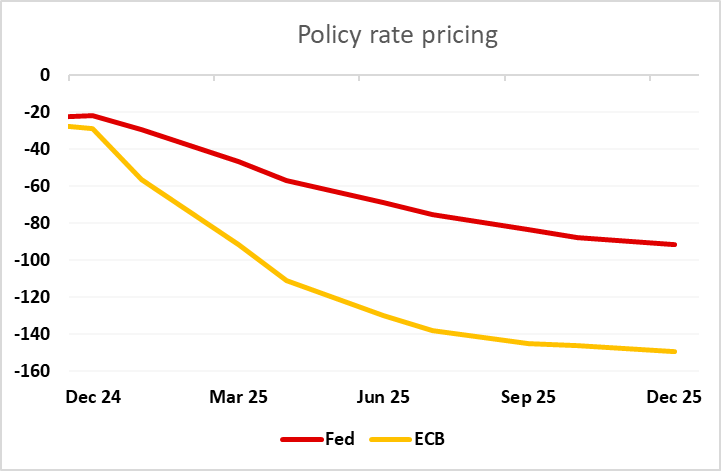

It as notable that the USD fell back after the US employment report, even though most aspects of the report were on the strong side of expectations. Both payroll growth and average earnings were higher than consensus, albeit marginally. The exception was the unemployment rate, which rose to 4.2% as expected, but was close to 4.3%, with the rise drawing comment from the WSJ’s Nick Timiraos, seen as a conduit for Fed guidance. US yields and the USD were consequently lower after the report, with the market now pricing a Fed rate cut on December 18 as an 85% chance. While we also expect the Fed to cut, this looks a little too confident, and there could consequently be a positive USD impact from the CPI data this week. With the cuts now mostly priced in, and the economic data still generally very solid, there is quite limited scope for further USD declines from the US side.

The focus should therefore be more on events elsewhere, notably the ECB and SNB meetings on Thursday and before them the RBA and BoC meetings on Tuesday and Wednesday. The ECB are priced to cut 25bps with a small risk of a 50 bp cut, while the market is pricing the SNB decision as a 50-50 call between 25bps and 50bps. The BoC are expected to cut 50bps with a small risk of a 25bp cut. The RBA are still not priced to move rates at all, with only a little better than a 50% chance priced for a 25bp rate cut at the next meeting in February.

Looking at the current yield spread situation, EUR/USD is continuing to track movements in the USD/EUR 2 year yield spread very closely, so if, as we expect, the ECB do cut just 25bps, there may be scope for a small EUR/USD rise. There are currently six 25bp ECB rates cuts priced in for the next year, taking the deposit rate down to 1.75% by the end of 2025, and it will be hard to price in more than this is the ECB only cut 25bp, even if the statement and Lagarde sound dovish. So the central view is for a small rise in front end EUR yields and the EUR. But it is still likely to be difficult for EUR/USD to extend far above 1.06.

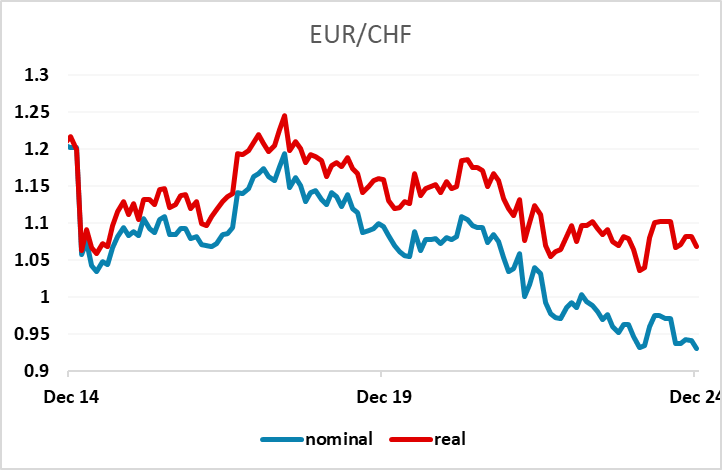

Given the market pricing of the SNB as being a close call between a 25bp and a 50bp cut, EUR/CHF can be expected to rise if they cut 50bps, fall if they cut 25bps, although the weakness of EUR/CHF in recent weeks suggests downside is more limited if there is no other clear EUR negative news. The SNB decision may be swayed by the weakness of EUR/CHF, with EUR/CHF now approaching the historic real terms lows.

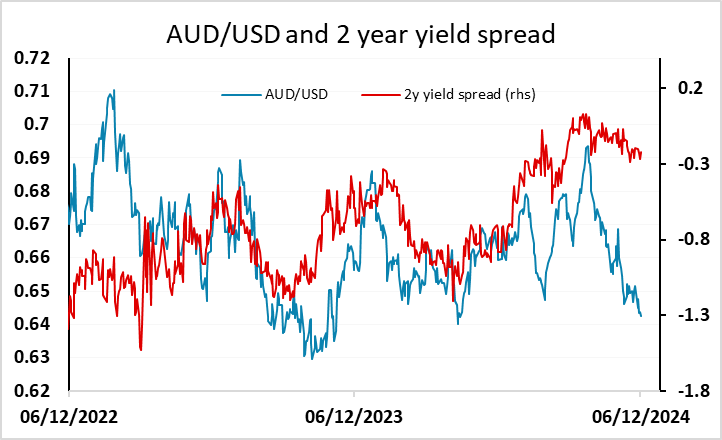

The RBA are not expected to change policy, but after the weak Q3 GDP data, the market will be looking for a signal that the February meeting represents a likely rather than a possible easing opportunity. As it stands, the AUD continues to look very weak relative to all the normal metrics (yield spreads, Chinese equities, commodity prices), but is close to the lows of the year below 0.6350, so may see a break lower on a dovish statement. Even so, we would regard AUD/USD dips as representing very good long term value here.

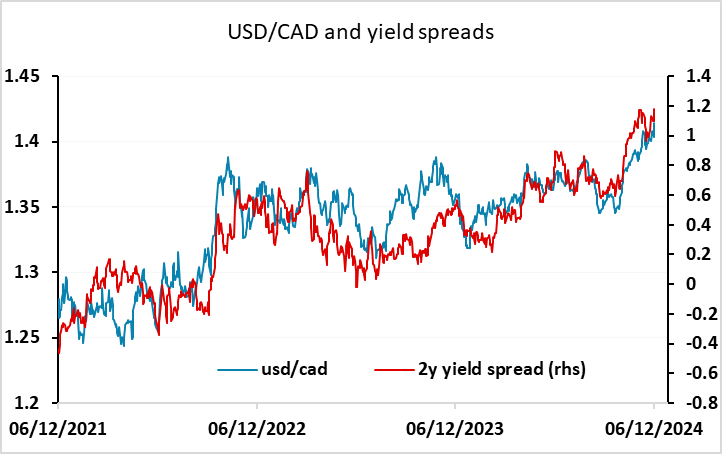

The BoC does look likely to cut 50bps, especially given the further significant rise in the unemployment rate seen in the employment report. Yield spreads continue to suggest upside scope for USD/CAD, so we would still see some upside risks. However, with a 50bp cut near enough priced in, and speculative positioning already extreme, we would be wary of gains beyond 1.42.

Data and events for the week ahead

USA

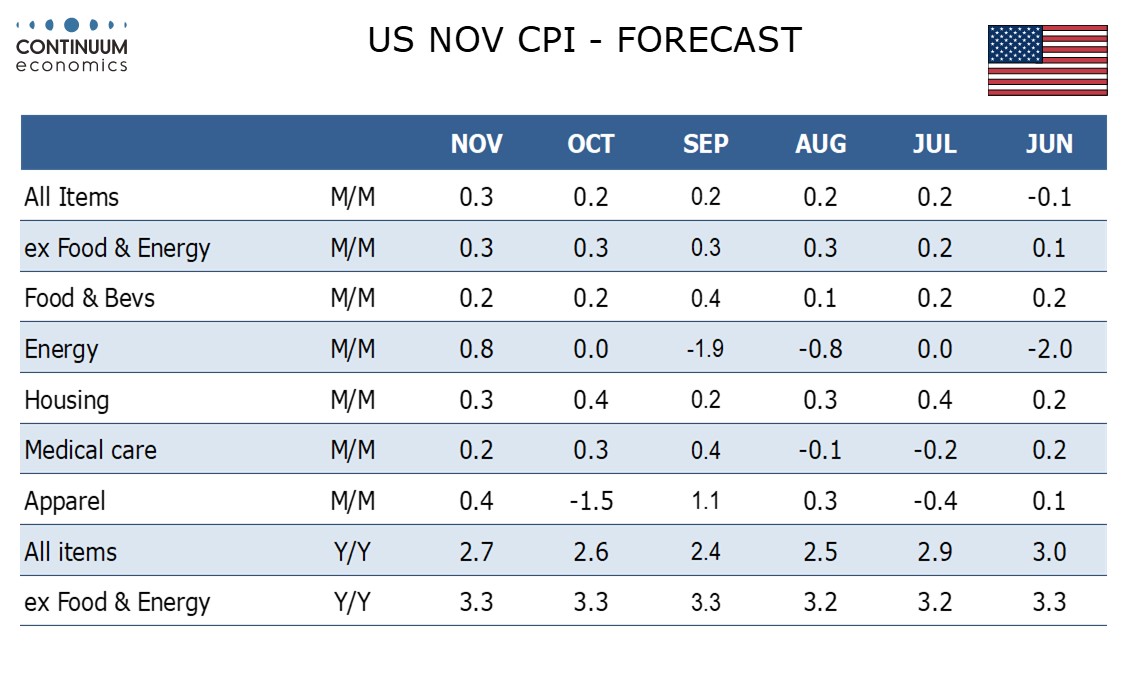

US focus will be on inflation data, particularly November CPI on Wednesday. We expect gains of 0.3% in both the headline and core rates, both a little high for comfort, with the headline slightly above 0.3% before rounding and the core slightly below. Thursday sees November PPI, where we expect slightly more moderate gains of 0.2%, both overall and ex food and energy.

Minor US data due in the week includes October wholesale trade on Monday, and on Tuesday November’s NFIB index on small business optimism and Q3 productivity and cost revisions. Wednesday sees November budget data, Thursday weekly initial claims and Friday November import prices. Fed speakers are expected to be quiet as the December 18 rates decision draws closer.

Canada

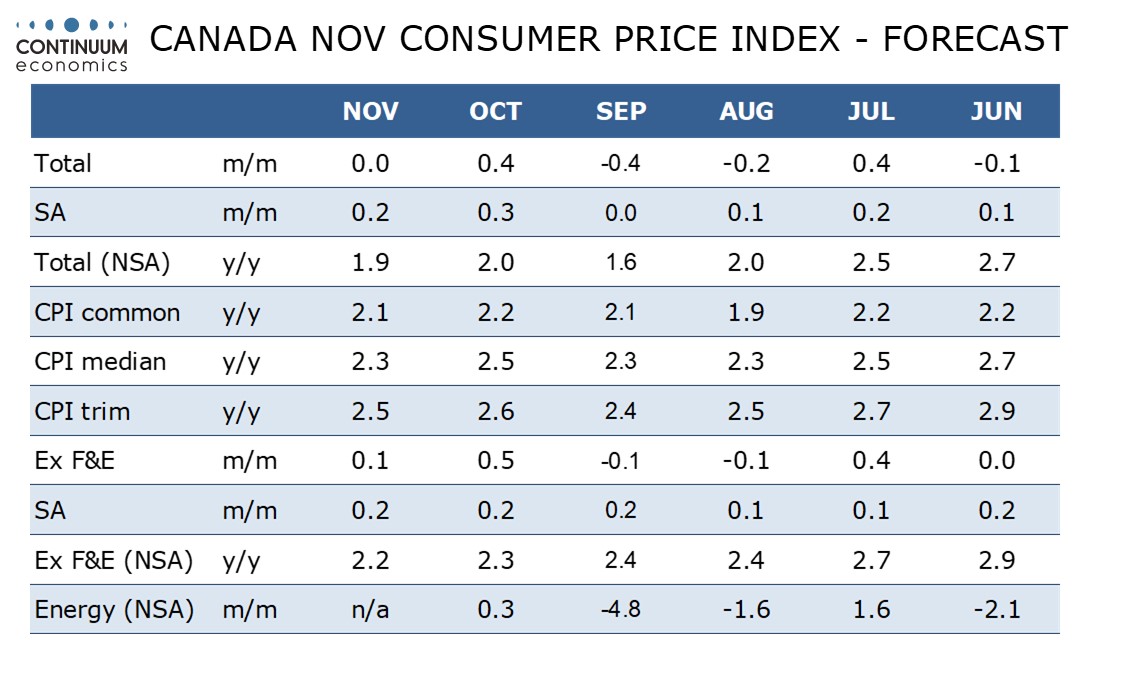

The Bank of Canada meets on Wednesday and we expect a 50bps easing to 3.25%. While some recent data has suggested easing is having some impact on activity and October CPI was slightly higher, a disappointing Q3 GDP and risk of tariffs inducing a recession in 2025 are likely to persuade the BoC to deliver a second straight 50bps move. October building permits will be released on Thursday. Friday sees October manufacturing and wholesale sales, for which preliminary estimates were for gains of 1.3% and 0.5% respectively.

UK

The main interest is October GDP and inter-related data on Friday. There are increasing questions about the UK’s economy’s apparent solidity, as GDP growth has been positive in only two of the last six months of data and worth a cumulative 0.3%, and where even that much more modest momentum looks to have ebbed given that September GDP fell 0.1% m/m. Moreover, we think the weakness has continued with a further 0.1% m/m drop envisaged for the October update, this chiming with already released weak(er) survey data, payroll numbers and retail sales data for the month. Friday also sees BoE household inflation expectations survey numbers while Thursday sees a housing market survey update from the RICS.

Eurozone

The ECB takes centre-stage this week. While a larger move is possible, we think that the ECB will instead opt for a fourth 25 bp discount rate cut at Thursday’s Council meeting, to 3%. But this meeting may be as important for what may be a change in forward guidance in which the ECB accepts that on-target inflation is likely to be durable enough to end policy restriction in due course. In this regard, the first glimpse of 2027 ECB economic projections may support this as they may point to a second successive year of around-target inflation. Friday sees what may be more weak industrial production figures

Rest of Western Europe

There are key events in Sweden, most notably labor market data (Fri) which have been volatile but trending higher as the jobless rate. Tuesday sees the monthly GDP indicator and related data, albeit numbers that have not proved authoritative of late. Norway has high-profile CPI data (Tue) and where the targeted inflation measure (CPI-ATE) may rise a notch or two from October’s 2.7% y/y on base effects but remain below the Norges Bank’s projection of 3%.

Finally, in Switzerland the SNB offers in quarterly assessment, the first for new President Martin Schlegel (previous Vice Chair). Whatever the SNB does this month is likely to be merely a further staging post in an easing cycle that has to date delivered three 25 bp moves since March, ie taking the policy rate to 1.0%. More likely, the SNB will again cut by 25 bp this month, but amid downside real economy risks and inflation both below target and below SNB recent projections, a bigger move is possible.

Japan

We will have Q3 GDP data on Monday. Preliminary data is decent but we will need to see the magnitude of revision to be sure. Would be great to see more upside but unfortunately it is more likely to be revised lower. PPI will be on Wednesday with some tier two data on Friday.

Australia

The RBA interest rate decision will be announced on Tuesday where we expect no change in rate. While CPI is heading towards 3%, the RBA has downplayed it by suggest most weight being lifted come from government subsidy. The new “target” would be mid range, likely 2.5% for CPI or for trimmed mean to be at 3%, before we see any easing. Else, we have labor data on Thursday where it is expected to stay solid.

NZ

Business PMI on Friday, rather empty calendar for NZ.