FX Daily Strategy: N America, January 16th

UK earnings data triggers some GBP losses

GBP risks on the downside given strong starting point and relatively hawkish BoE

Canadian CPI likely to show y/y rise but little change in BoC core measures seen

CAD vulnerable given strong starting point and weak BoC survey

UK earnings data triggers some GBP losses

GBP risks on the downside given strong starting point and relatively hawkish BoE

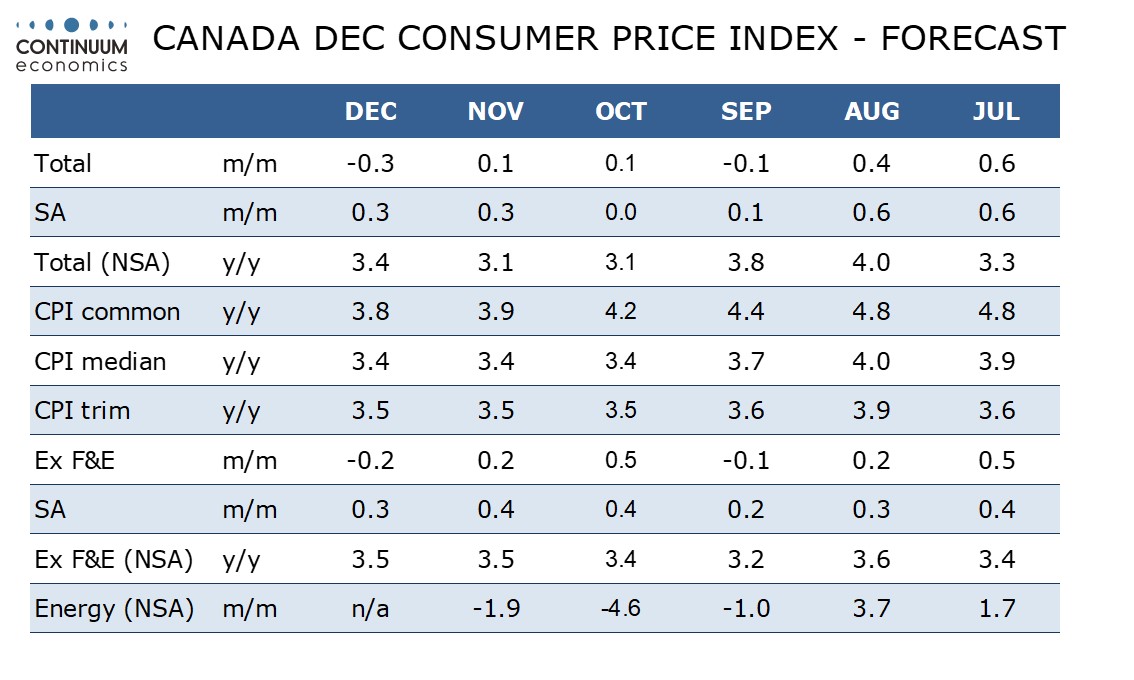

Canadian CPI likely to show y/y rise but little change in BoC core measures seen

CAD vulnerable given strong starting point and weak BoC survey

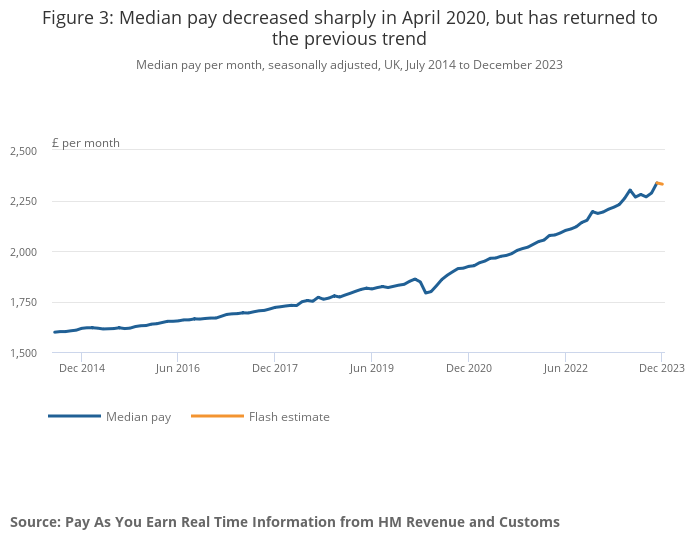

EUR/GBP is modestly higher after the UK labour market data, which could be seen as mixed but crucially saw a decline in the growth of average earnings in the official ONS data for the 3 months to November. While the more up to date (and possibly more accurate) HMRC data for December showed a small increase in the y/y growth of earnings, this was due to a base effect and the level of earnings actually fell in December. Unusually, and coincidentally, the HMRC data for December and the ONS data for November both show earnings growth of 6.6% y/y. This is clearly still too high, but if we see earnings staying flat or even negative in the coming months, the y/y rate will decline rapidly.

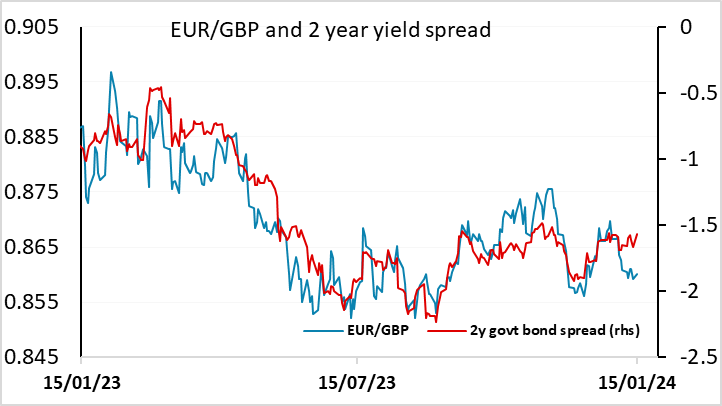

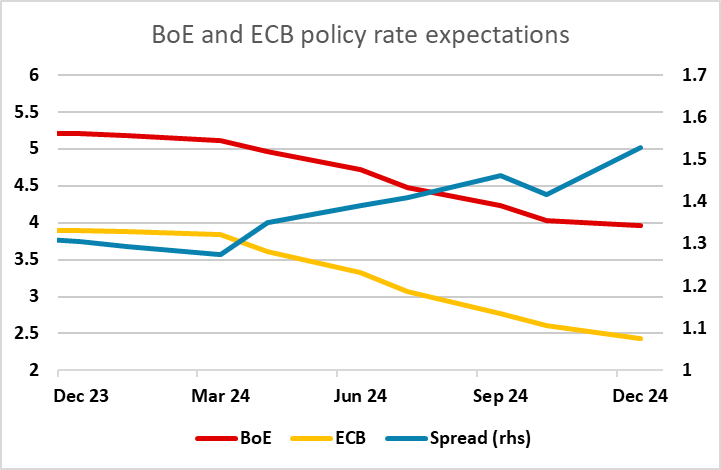

For GBP, the risks were always to the downside as EUR/GBP was trading on the low side relative to the normal yield spread correlation going into the data. It is also the case that the market is pricing in fewer rate cuts from the BoE than from the ECB over the next year, despite the higher starting point for UK rates. While today’s data, which showed a dip in the unemployment rate to 4.2% from 4.3% as well as the decline in earnings, won’t lead to an immediate change in BoE stance, there is potential for a decline in UK rates relative to the ECB, given the likelihood of similar growth and inflation profiles going forward. Tomorrow’s CPI data will also be important, but the bias is towards a EUR/GBP move up to 0.8650.

We expect December Canadian CPI to rise to 3.4% yr/yr after two months at 3.1%, and we expect only marginal downward progress in one of the three Bank of Canada core rates, showing that inflation remains stubborn in Canada. We expect the monthly data to show overall CPI down by 0.3% with a 0.2% decline ex food and energy, but these declines will be largely seasonal. The ex food and energy rate is not one of the BoC’s core rates. Here we see a marginal decline in CPI-common to 3.8% yr/yr from 3.9%, but we expect CPI-trim and CPI-median to remain at their paces seen in both October and November at 3.5% and 3.4% respectively.

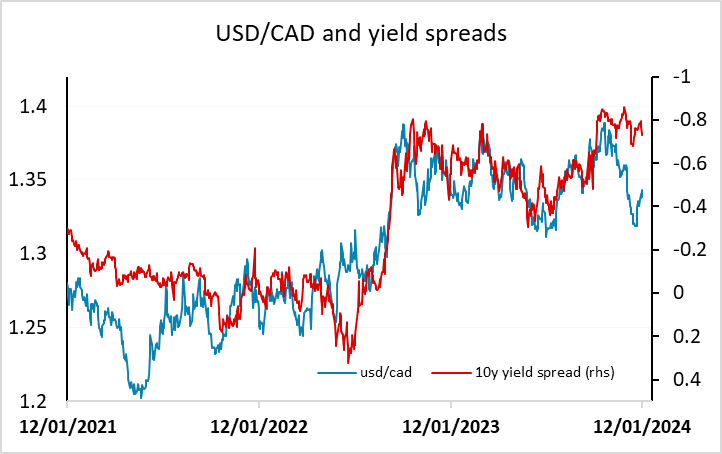

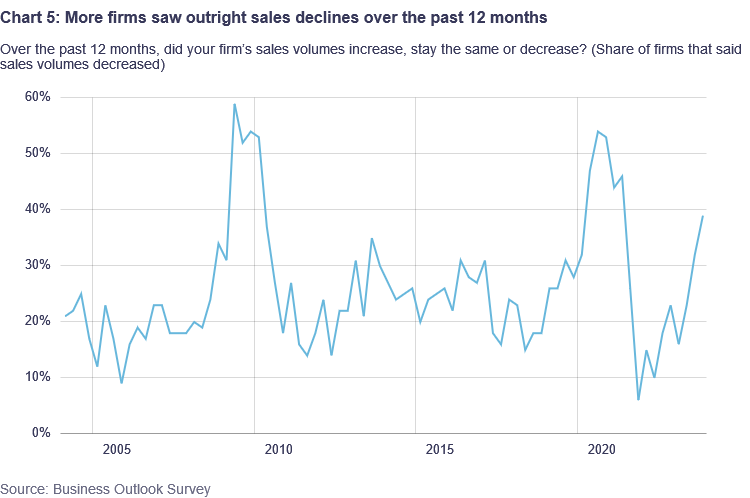

However, much like GBP, the CAD has been outperforming its yield spreads of late, and looks more vulnerable to weak data than strong data. The Bank of Canada’s business survey released on Monday indicated deteriorating conditions and outlook through Q4, with the percentage of firms indicating that their sales had decreased over the last year the highest since the GFC (excluding the pandemic).

So if inflation does undershoot, there is more pressure on the BoC to ease policy. The market is currently only pricing 132bps of easing from the BoC this year – 34bps less than the Fed – so the risks look to be towards more easing and spreads moving in the USD’s favour. With the CAD starting from already strong levels relative to the recent yield spread correlation, the risks look to be on the USD/CAD upside.