USD flows: USD hit by downward revisions to employment

Big downward revisions to May and June employment data undermine labour market perceptions and weaken the USD

Huge downward revisions to the May and June data were the main story in the US employment report, with a total of 258k being lopped of the employment total for the two months, while the July data was also modestly weaker than expected, with a rise of 73k against market consensus of 106k. The USD has fallen back sharply across the board in response, losing 1.3% against the EUR and JPY, and around 1% against GBP and the AUD. While the market response has also been risk negative, it has been absorbed by the bond market rather than the equity market, with US 10 year yields down 8bps and equity futures little changed, although equities in general were already significantly weaker over the last two days.

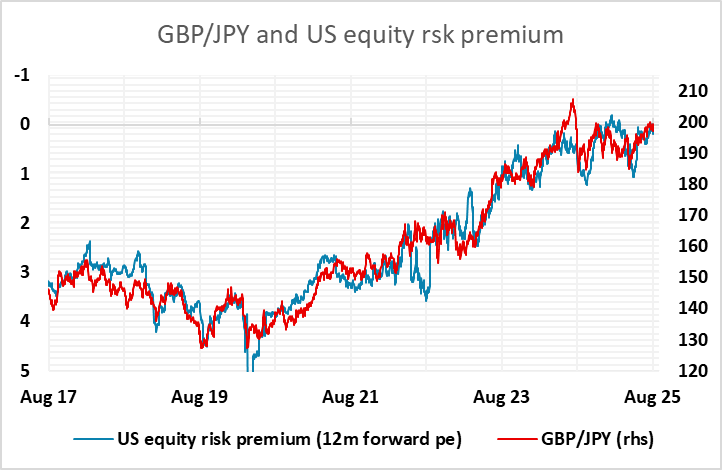

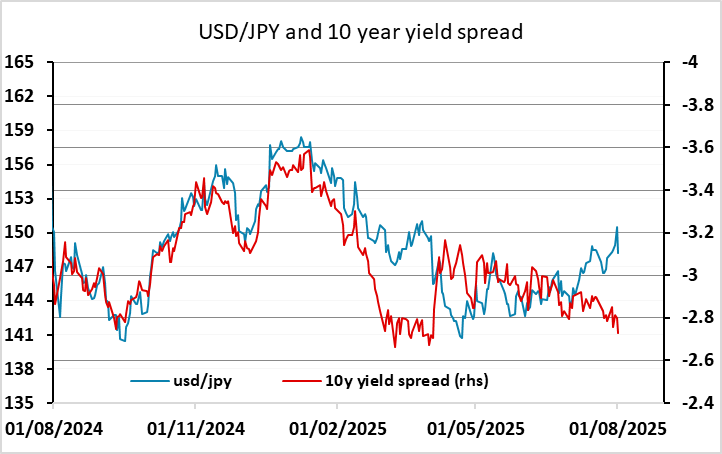

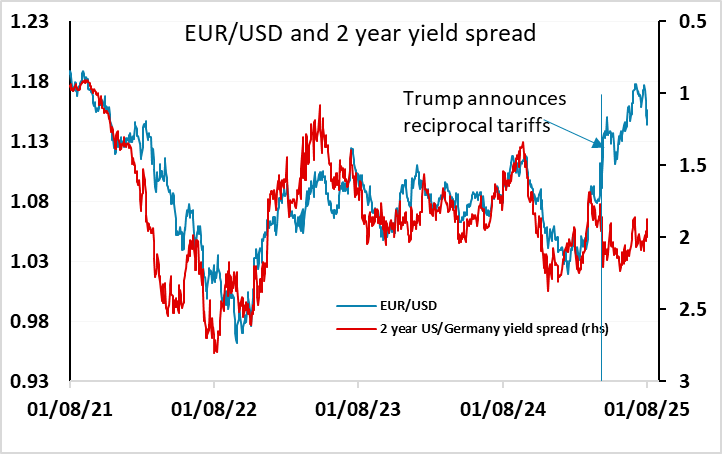

From here, the weaker risk tone and the decline in US yields suggests there should be more potential for JPY gains in particular, with the riskier currencies likely to slightly underperform. Yield spreads suggest there is scope for USD/JPY to slip to the low 140s, but more weakness in equities is likely to be necessary for the JPY to make significant gains on the crosses. For EUR/USD, the upside is more limited on lower US yields, as the EUR has already substantially outperformed yield spreads, but the correlation of EUR/JPY with risk premia suggests potential for the EUR to gain with the JPY if equities are resilient.