FX Daily Strategy: N America, Oct 21st

CAD risks slightly on the downside from Canadian CPI

UK PSNB could be a focus for GBP

JPY watching politics and BoJ

CAD risks slightly on the downside from Canadian CPI

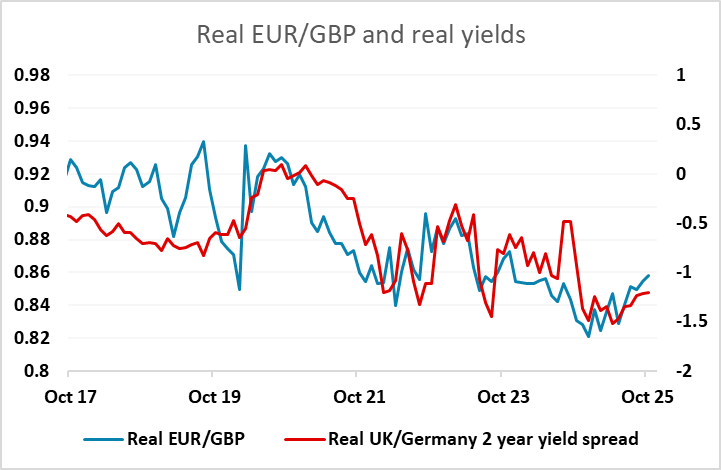

UK PSNB could be a focus for GBP

JPY watching politics and BoJ

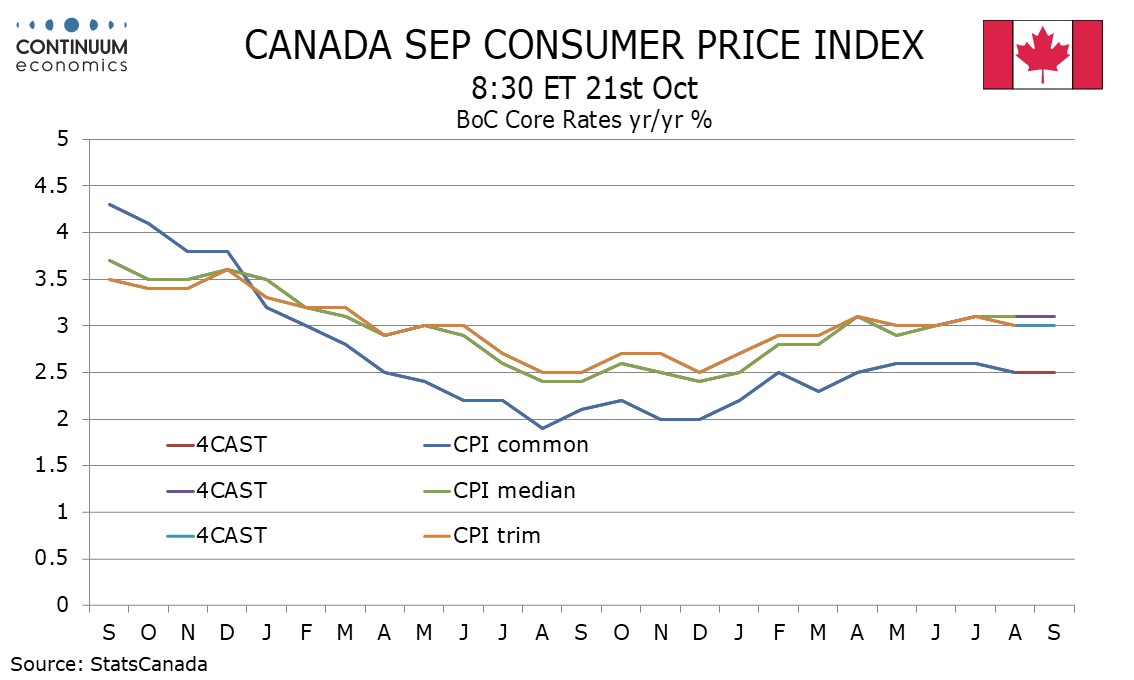

Tuesday sees Canadian CPI data, which will get more attention than usual given the lack of any US data at the moment. The BoC is not yet fully priced for a 25bp cut on October 29, so today’s data has two way risks. Our forecast is in line with the consensus expectation of a rise in y/y inflation to 2.2%, but we see no change in the core rates and as long as this is the case the market is likely to move further towards expecting a BoC rate cut, which may prove slightly CAD negative. Of course, there will be more focus on the US numbers due on Friday, but with the Fed already fully priced to cut rates on October 29, there may be more potential for the Canadian data to affect rate expectations.

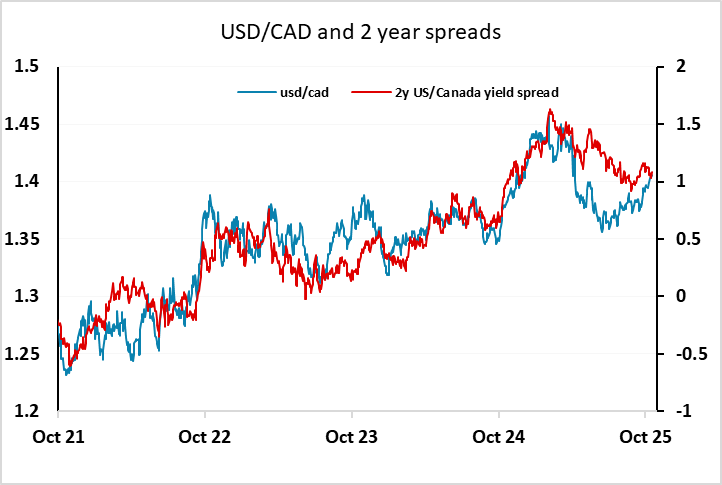

Recent movements in front end yields have brought USD/CAD back in line with the historic yield spread correlation, also suggesting that the risks are now two-way, although the recent rise in USD/CAD means the technical momentum is on the upside.

Otherwise, we have the UK public sector borrowing data for September, but this was in line with consensus and had no GBP impact.

USD/JPY has gained strongly in early Europe in reaction to the appointment of Takaichi as the new Japanese PM. This should have been fairly well expected after the announcement of the link-up of the LDP and the Innovation Party yesterday, but USD/JPY has nevertheless risen half a figure in the official announcement.

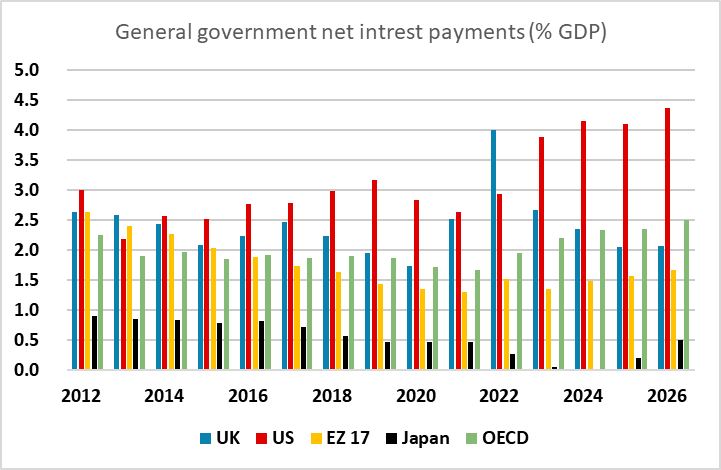

From a fundamental perspective, the case for a weaker JPY due to Takaichi becoming PM looks pretty flimsy. She is an adherent of Abenomics, which has led some to expect she will try for both easier fiscal and monetary policy. But whatever some believe, the BoJ is independent and an expansionary fiscal policy will likely lead to higher rather than lower Japanese yields. The other argument put forward for a weaker JPY is that the Japanese fiscal position will become unsustainable if fiscal policy is eased further. But while the level of government debt is very high, interest payments on the debt are very low, and are dwarfed by US and UK levels, so it will take a long time before these will become a problem, especially since Japan runs a big current account surplus and the debt is 88% domestically funded, with almost half owned by the BoJ.

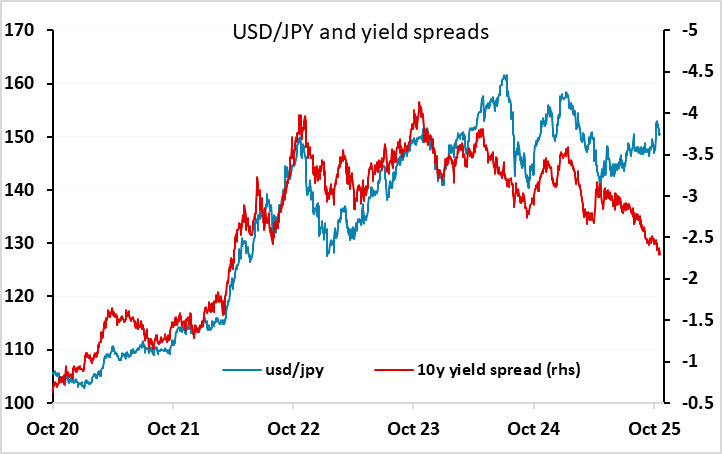

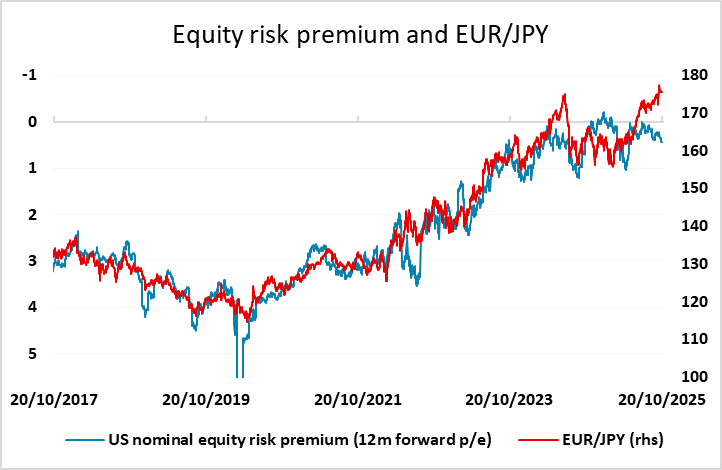

There have been some hawkish BoJ comments in recent days, and we would not rule out an October rate hike at the meeting on the 29th, even though this is only 20% priced in, so caution is required from JPY bears. Certainly, traditional relationships with yield spreads and risk premia suggest there is substantial upside risk for the JPY.