USD flows: USD awaiting employment data

USD has recovered from post-ADP dip but risks on the downside

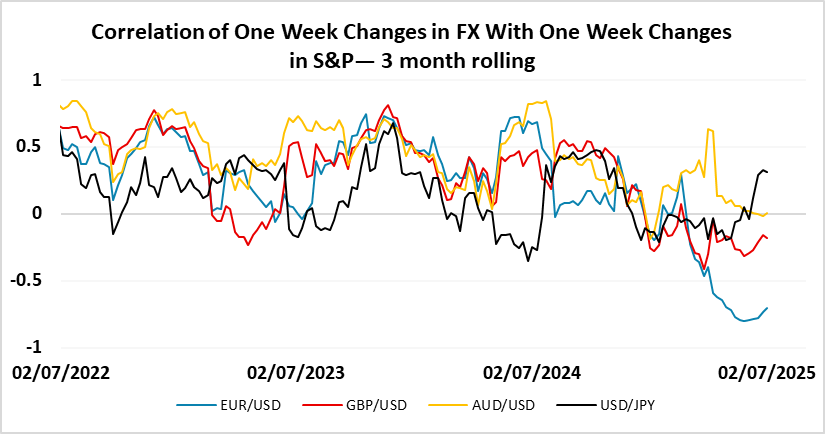

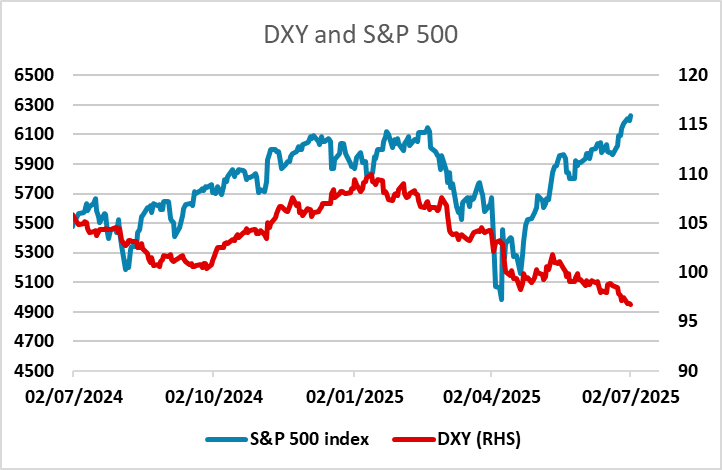

A quiet start for FX in Europe, with the US employment report looming on the horizon. The USD has recovered most of the ground lost after yesterday’s weak ADP number, and we wouldn’t put too much faith in the ADP as an indicator for the payroll data. Nevertheless, we do expect to see a smaller rise in payrolls than the market consensus, so we see the risks as being to the USD downside. The other factor to consider is the strength of the equity market in recent days. S&P 500 futures are enjoying their 9th consecutive day of gains, once again reaching new all time highs in Asia. While the rise was initially supported by declining US yields, this has not been the case in the last week, and the market must now be vulnerable to negative news. The JPY and CHF would likely benefit from any dip in equities, but it is less clear what the impact would be on the riskier currencies, as the USD fell back against most currencies on the equity dip seen from February to April.