German Data Review: Inflation Drop Resumes

Base effects continue to distort the German HICP/CPI readings, but the January data came in a notch below expectations, and reversed half of the surge in the y/y rate seen in December. Indeed, the HICP rate fell 0.7 ppt to 3.1% and the CPI core down a notch to 3.1% as the headline CPI rate dropped to 2.9%, the lowest value since June 2021 (Figure 1). Energy prices in January negative afresh to the tune of -2.8% lower despite the discontinuation of the brake on energy prices and the introduction of a higher carbon price. Services inflation picked up, very probably a result of higher VAT being levied on restaurant meals in January which has largely been passed on to consumers. Regardless, the disinflation backdrop is underlined by what may be still-soft core seasonally adjusted trend (Figure 2) which may be running just around 0.1% in m/m terms and where this very creaky waning price momentum should see headline HICP below 2% by May.

Figure 1: CPI Headline Core Inflation Drop

Source: German Federal Stats Office

As for the looming EZ January HICP (Feb 1), we still see lower fuel costs more than outweighing modest indirect hikes. Indeed, we see the headline down 0.3 ppt to 2.6% and the core down to a 21-month low of 3.2%, ie down 0.2 ppt. And particularly for that core reading, the message from the various national data released in the last few days very much corroborate such thinking.

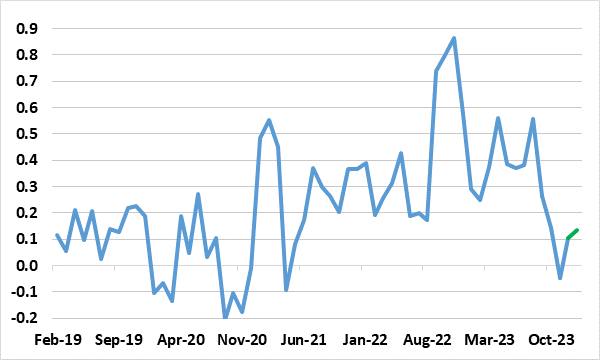

Figure 2: Adjusted Core Rate Falling Clearly

Source: German Federal Stats Office, CE, % chg m/m, smoothed

Disinflation Continues Meanwhile

Regardless, a further insight into the disinflation backdrop is provided by the seasonally adjusted data which we compute – the Bundesbank does its own measurement on this basis. As Figure 2 shows there has also been a clear slowing in the trend m/m changes on an adjusted basis, most notably for the core. This seemingly continued in January, with the smoothed (3-mth avg) adjusted rate staying around just 0.1% m/m.