FX Daily Strategy: Europe, January 23rd

New Zealand CPI Remain Above Target Range

BoJ Kept Rates Unchanged

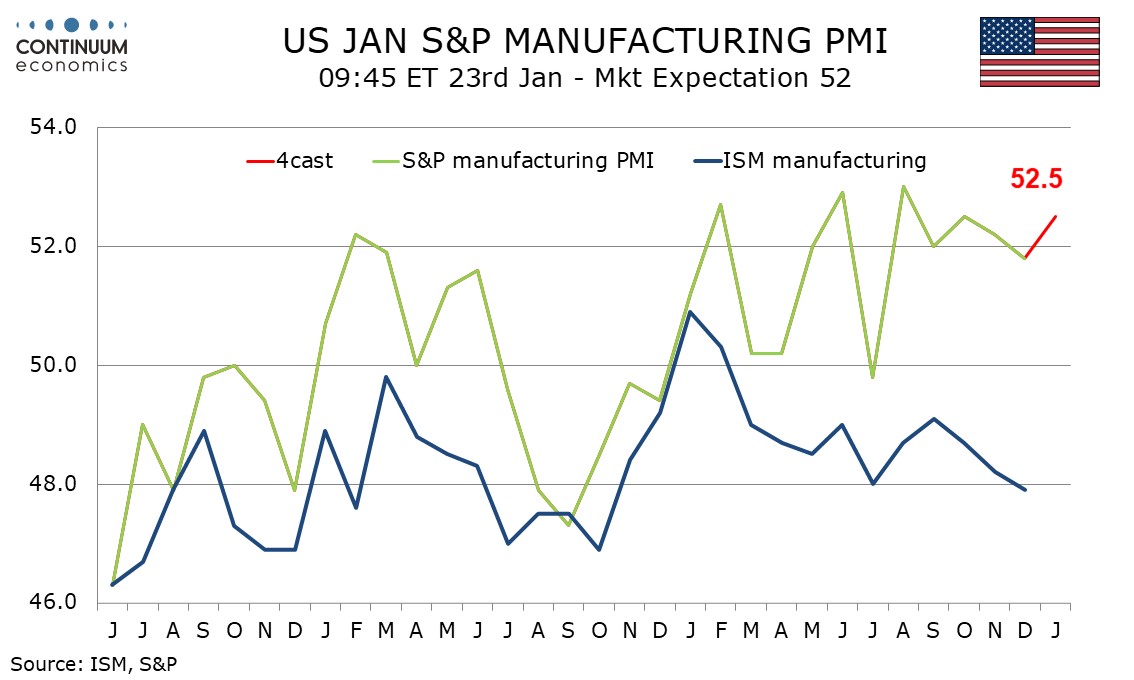

U.S. January S&P PMIs to Rebound after December dips

No News from Trump is Good News

The RBNZ has previewed higher short term CPI but eases regardless. They are seeing medium term spare capacity to be more important than short term inflation, which is forecasted to return below target range in 2027. And indeed we do have a higher than target range Q4 CPI from the New Zealand at 3.1% y/y. It is slightly above market estimate of 3% but not by large. A big chunk of inflationary pressure seems to be derived from domestic cost.

On the chart, the pair break above resistance at the .5800 level has seen sharp gains to tag the .5850 resistance. Prices has since settled back to consolidate strong gains this week from the .5755/35 area and unwind overbought intraday studies. The positive daily and weekly studies suggest this giving way to renewed buying interest later to further retrace the July/November losses. Clearance will see room for extension to the .5910, 61.8% Fibonacci level. Meanwhile, support is raised to the .5800 level which should now underpin and sustain gains from the .5710 low.

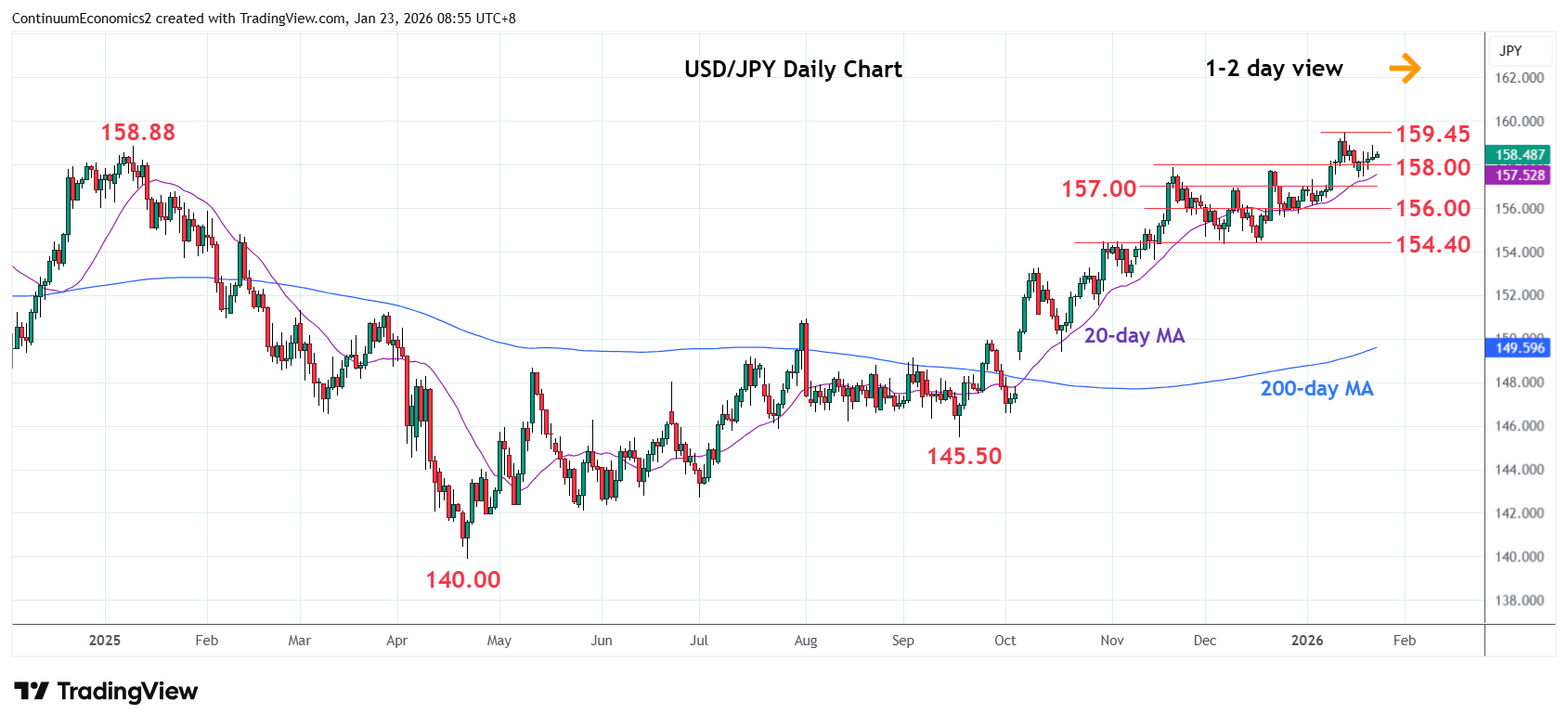

The BoJ keep rates unchanged at 0.75% as expected. There is one dissent vote who hopes to increase rate to 1%. Their inflation forecast has been revised higher for ex fresh food an energy to 3% in 2025, 2.2% in 2026 and 2.1% in 2027. GDP has also been revised higher for 2025/26 but lower in 2027. Earlier, we had all three items of Japanese CPI moderating in December. While the headline show a large degree of moderation, it is mostly from base effect from 2024's energy rebate expiration. However, we do see ex fresh food CPI eases to 2.4% while ex fresh food and energy more stubborn at 2.9%. The BoJ will unlikely change their stance on rates after reading this report.

We expect some improvement in January’s S and P PMIs, largely reversing slippage in December, manufacturing to 52.5 from 51.8 and services to 54.0 from 52.5. Signaling a stronger manufacturing index are bounce backs above neutral from the Empire State and Philly Fed manufacturing surveys. December’s ISM manufacturing index however gives a less positive signal, having slipped to its lowest level since October 2024. Our forecast for January’s S and P manufacturing index would be the highest since July.

The S and P services PMI slipped to its lowest level since February in December which contrasted a third straight increase in the ISM services index to 54.4, its highest level since October 2024. The ISM and S and P service indices are not well correlated, but it is likely that the December S and P weakness will prove erratic. A rebound to 54.0 would put it close to November’s reading of 54.1.