USD flows: USD surges on super strong employment report

USD up sharply as employment report shows employment growth and earnings growh both well above consensus. Gains to be sustained, but may not extend far

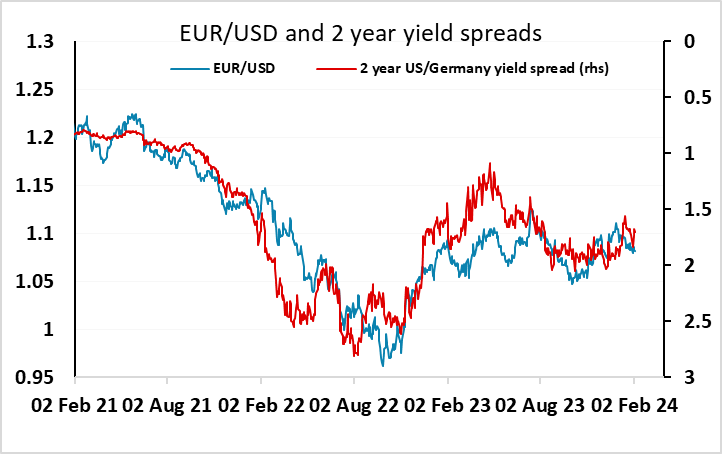

A much stronger than expected employment report in almost all categories. Non-farm payrolls were not only 176k stronger than expected in January at 353k, but saw December revised up to 333k from 216k. But the strength of the average earnings numbers was perhaps the most significant for the Fed, rising 0.6% m/m, equalling the largest monthly rise since May 2021. The USD is unsurprisingly sharply higher across the board on the news, with US yields up 17bps in the 2 year tenor. Even though European yields have generally followed US yields higher, and the impact on yield spreads has been modest thus far, the negative impact on equities will help the USD gain against the riskier currencies awhile the rise in yield spreads supports the USD against the JPY.

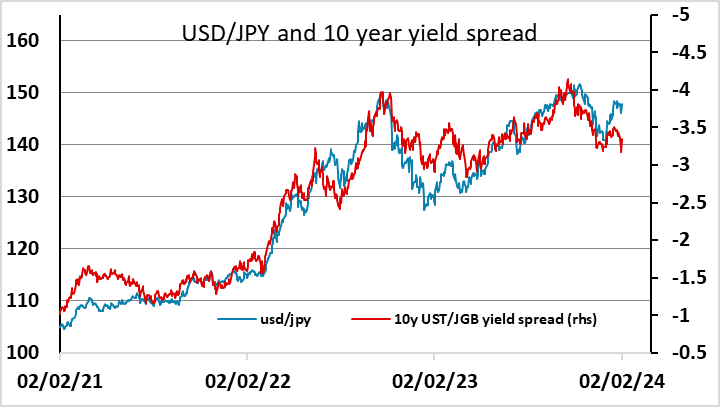

Bigger picture, the US/Japan 10 year spread still hasn’t risen to levels that have been consistent with the current level of USD/JPY in recent history, so we still doubt that there will be scope for a break above 148. Also, the negative equity response has so far been quite modest, so the impact on the risky currencies shouldn’t be too large. So there may not be much more initial USD strength beyond the knee-jerk reaction, but it will be hard to oppose USD strength in general with the expectations of Fed easing this year likely to come under pressure.