U.S. October ISM Services - Bounce led by new orders, prices remain firm

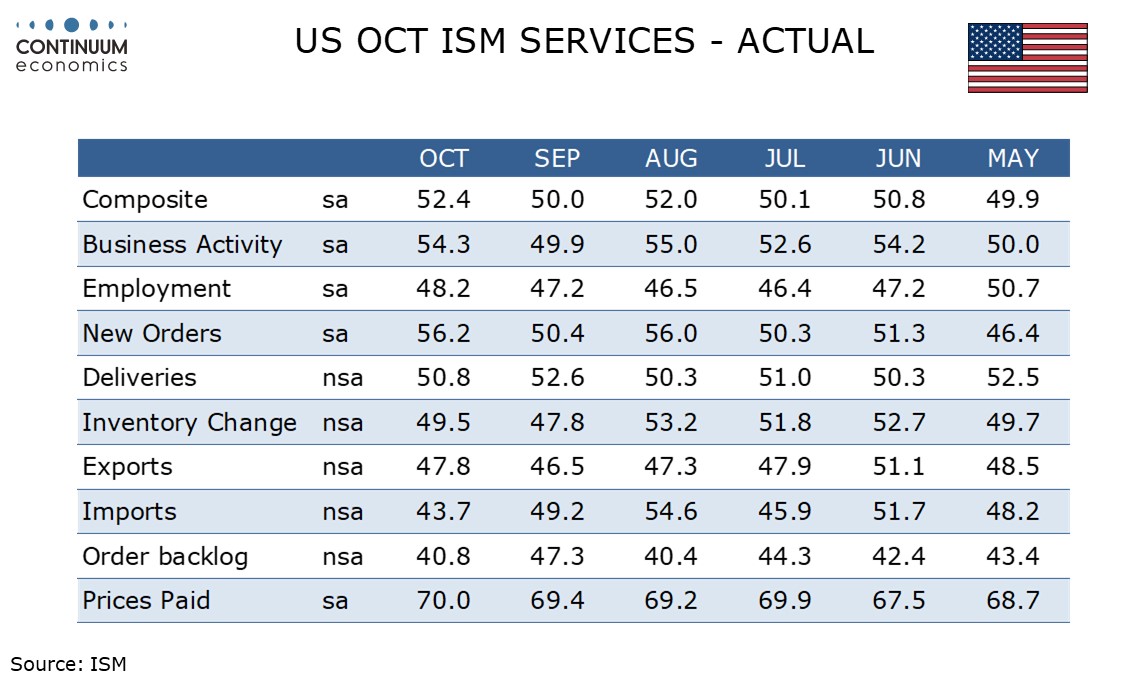

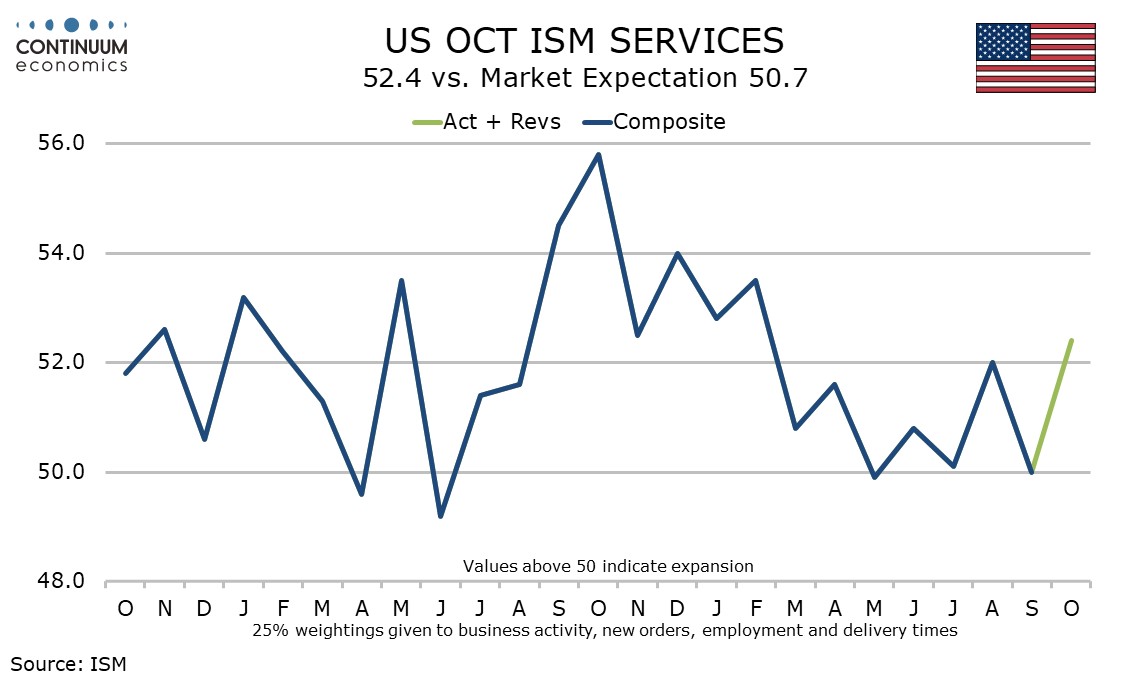

October’s ISM services index is not as strong as the S and P Services PMI which was revised to a still firm 54.8 from 55.2, though at 52.4 is still the strongest since February and up from a neutral 50.0 in September.

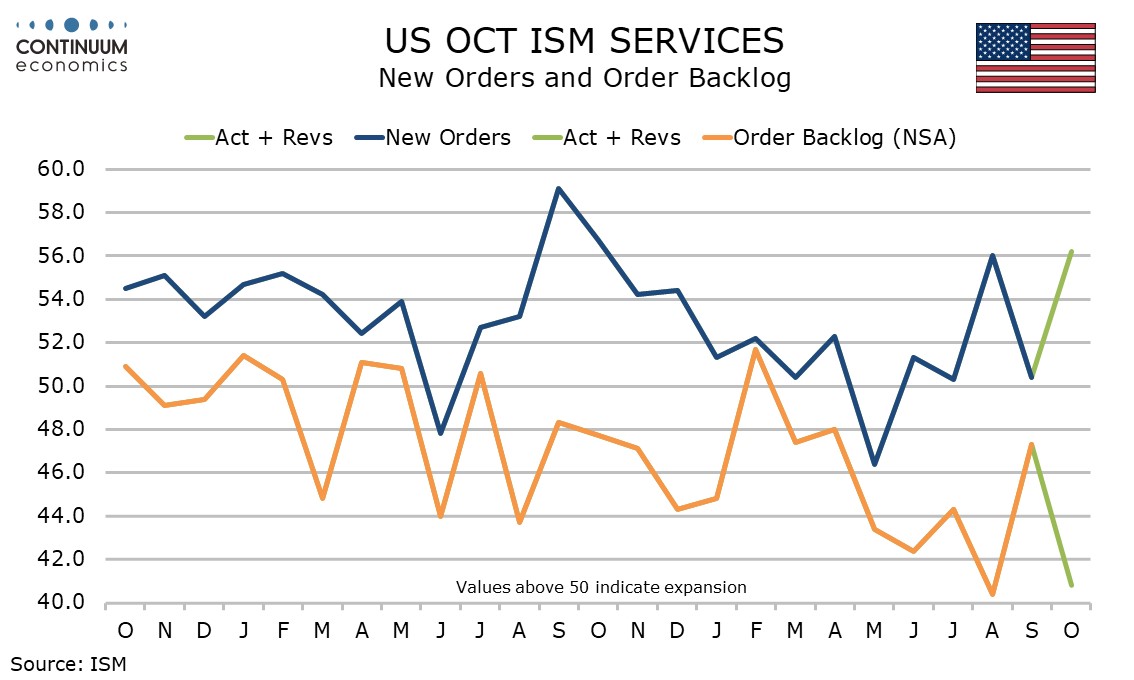

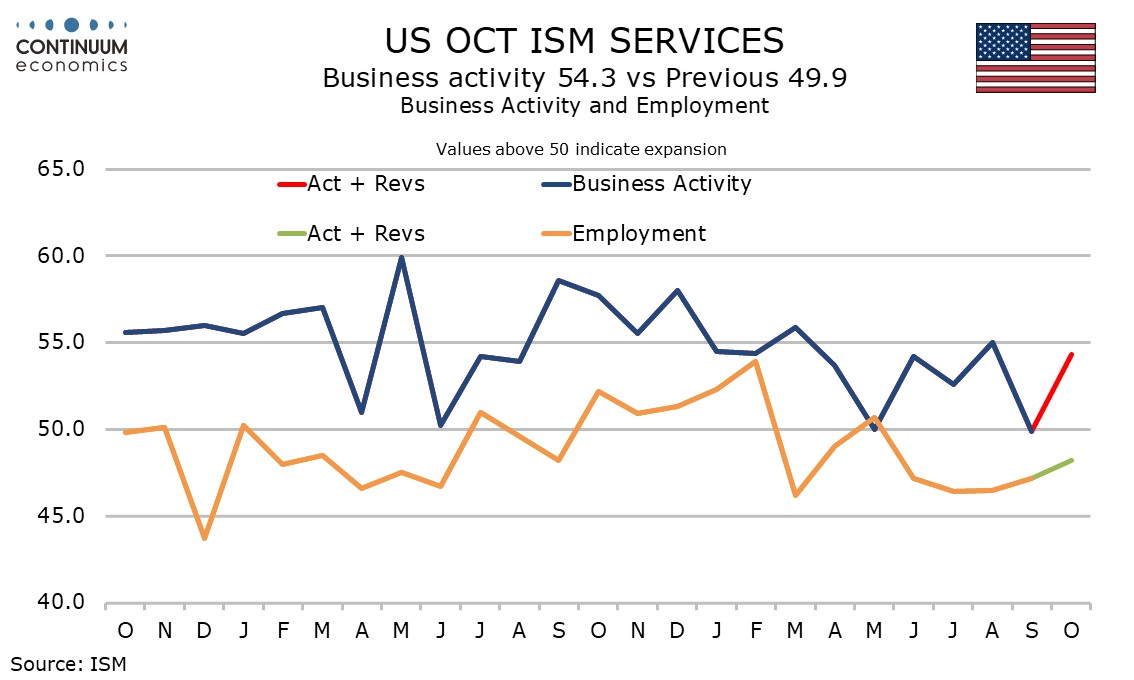

We had expected the index to be supported in October by more favorable seasonal adjustments, contrasting tougher adjustments in September, particularly in new orders and business activity. However, the bounces in each of those indices exceeded what can be explained by seasonal adjustments.

New orders are particularly impressive at 56.2 from 50.4, reaching their highest since October 2024, if only marginally above August’s 56.0. Business activity increased to 54.3 from 49.9, still slightly below August’s 55.0.

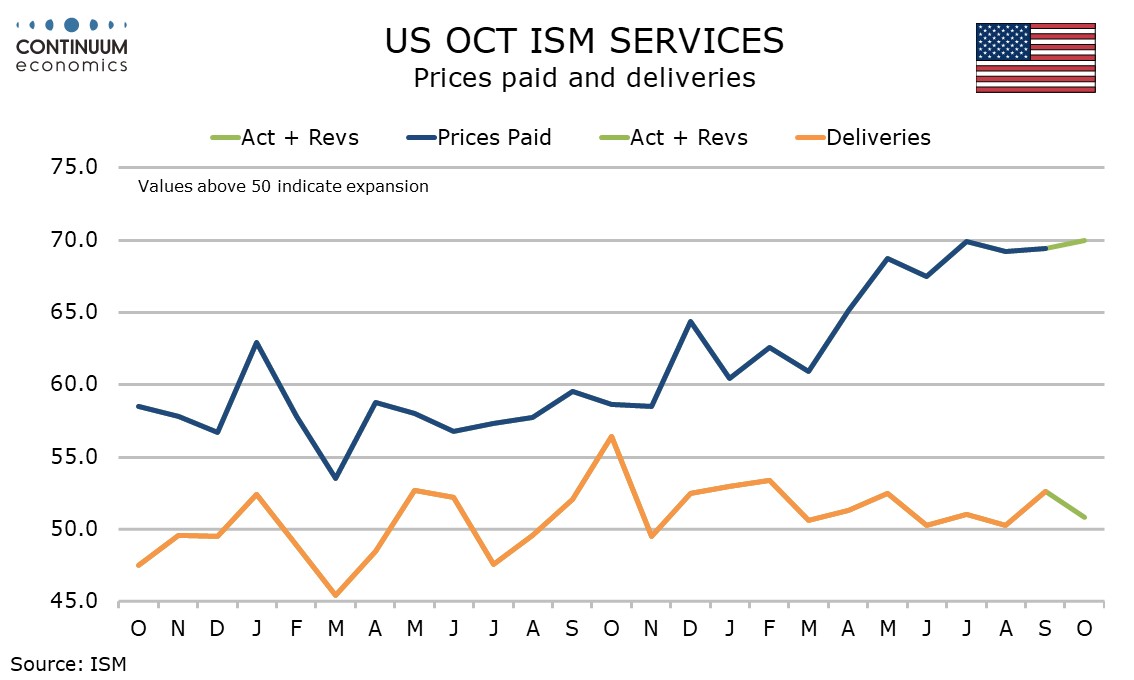

Employment remains below neutral at 48.2 but up from 47.2 in September. The final contributor the composite, delivery times, slipped to 50.8 from 52.6.

Prices paid do not contribute to the composite but at 70.0 are at their highest since October 2022, if up only marginally from 69.4 in September. The series has been above 65, a level previously not exceeded since January 2023, ever since April’s tariff announcement.

An explanation for the bounce is not easy, though the most obvious is the start of Fed easing. If expectations of further Fed easing start to fade, the latest bounce may also do so. Both the ISM and S and P service indices are stronger than most regional Fed service sector surveys.