Reserve Bank of India Review: No Rate Cut On The Horizon

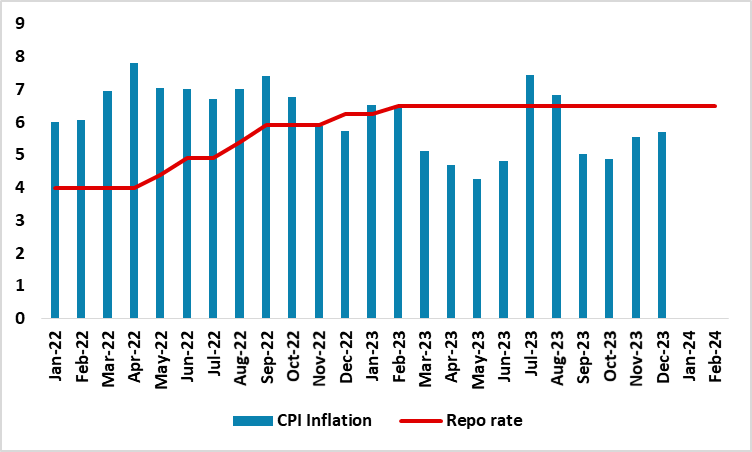

The Reserve Bank of India's Monetary Policy Committee, led by Governor Shaktikanta Das, chose to keep the repo rate unchanged at 6.5% for the sixth consecutive time, aiming to support ongoing economic recovery while ensuring a sustained decline in inflation. Despite signs of inflation moderation and positive domestic economic indicators, uncertainties persist, prompting a cautious approach to balance growth and inflation concerns. The near unanimous decision reflects the MPC's commitment to curbing inflation expectations, emphasizing the need for continued monetary policy tightening in the face of potential risks.

Anticipations before the meeting leaned towards the likelihood of the Reserve Bank of India (RBI) maintaining the repo rate at 6.5% for the sixth consecutive time, considering that retail inflation persists above the RBI's upper tolerance limit of 6%. Consequently, the decision of the RBI came as no surprise. Governor Das, in his announcement, highlighted a significant decrease in inflation, albeit still above the 4% target. He underscored the imperative for monetary policy to be actively geared towards disinflation. On the growth front, Das mentioned that the economy has seen an upswing, supported by increased exports and government capital spending. Looking ahead, he was of the view that global growth is expected to remain stable in 2024, but inflation has softened and is projected to further moderate throughout the year. Nevertheless, risks persist due to potential global recession and volatility in commodity prices and currency markets.

Figure 1: India Main Policy Rate and CPI Inflation (%)

On the domestic front, Das further pointed out the increasing momentum in the investment cycle, propelled by rising capital expenditure. However, uncertainties surrounding food prices continue to impact headline inflation. He also acknowledged that financial market segments have adapted to evolving liquidity conditions. Das added that the MPC believes the monetary transmission of the 250bps rate hike carried out in 2023 is still underway. Projected CPI inflation for the current year FY24 is 5.4%. Assuming a normal monsoon in the next year (FY25), CPI inflation is projected at 4.5%, with evenly balanced risks.

Considering these factors, the MPC voted 5:1 to keep the repo rate steady at 6.5% and continue liquidity withdrawal, ensuring sustained growth while keeping inflation within the target. Additionally, the central bank will continue to focus on liquidity management through VRRR auctions.

In summary, the RBI has taken a cautious approach, balancing concerns of inflation and growth. While inflationary pressures are diminishing, existing upside risks warrant a continued tightening of monetary policy. The decision to maintain a stable rate is expected to bolster ongoing economic recovery without stifling growth momentum. In our view, the RBI will retain the rate at 6.5% till H1-2024, with two small cuts of 25 bps each in H2-2024.