FX Daily Strategy: APAC, November 12th

UK labour market data important for BoE outlook

GBP remains biased higher against the EUR on neutral numbers

EUR/USD remains under pressure on tariff fears

2016 Trump victory suggests more USD gains to come

UK labour market data important for BoE outlook

GBP remains biased higher against the EUR on neutral numbers

EUR/USD remains under pressure on tariff fears

2016 Trump victory suggests more USD gains to come

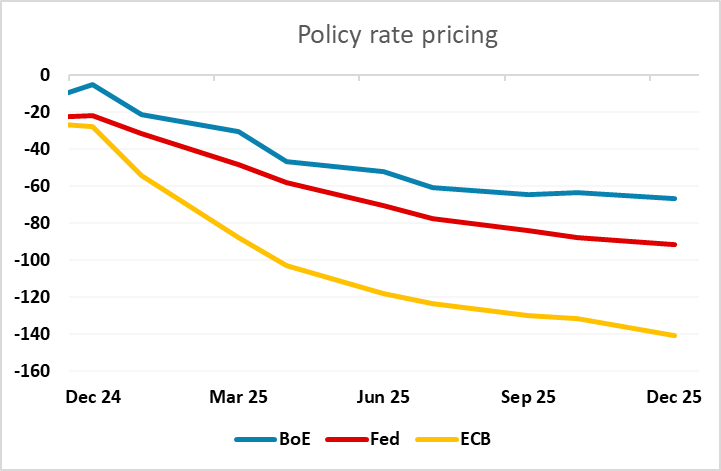

Tuesday sees UK labour market data, which will be of greater importance given the more hawkish tone to the BoE projections after last week’s meeting. The market reaction means that the market is now only pricing less than a 20% chance of a further BoE rate cut next month. Weak labour market data could consequently have a big impact. The data may show a fresh rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested a clearer slowing in private sector employment, if not an actual contraction – something PMI data are now echoing. However, the average earnings figures will be the most closely watched. We see a further slowing in both regular pay growth (3 mth mov avg) down to 4.6% and the headline rate down to around 4.3% on base effects. Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies in August alongside increased signs of employment contracting and not just in terms of self-employment. In short, we see the risks as clearly weighted towards weaker data and the GBP downside.

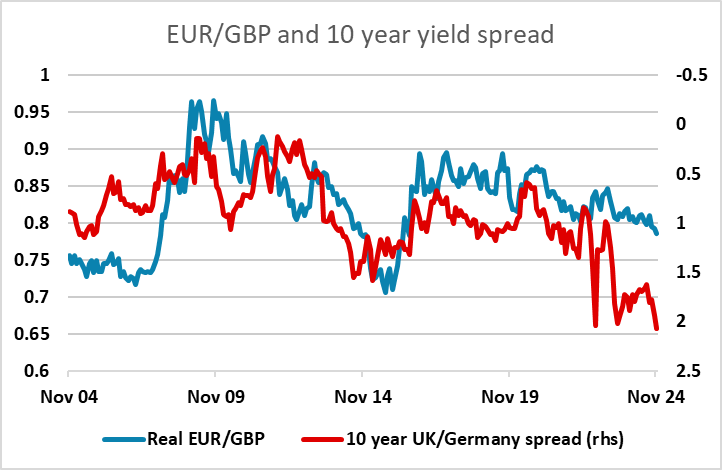

EUR/GBP hit its lowest level since April 2022 on Monday, due partly to the more hawkish BoE tone but mostly to the weakness of the EUR due to concerns about the likelihood of Trump putting significant tariffs on Eurozone exports to the US. The UK is expected to be less seriously affected than the Eurozone by the imposition of tariffs, and this is weighing on the EUR, but GBP is in any case at levels that look a little low relative to the longer term correlation with yield spreads, so it is hard to oppose GBP gains as long as market expectations of relatively tight UK monetary policy persist. The low of 0.82 from March 2002 is now a target unless we have data that indicates more rapid BoE easing is likely.

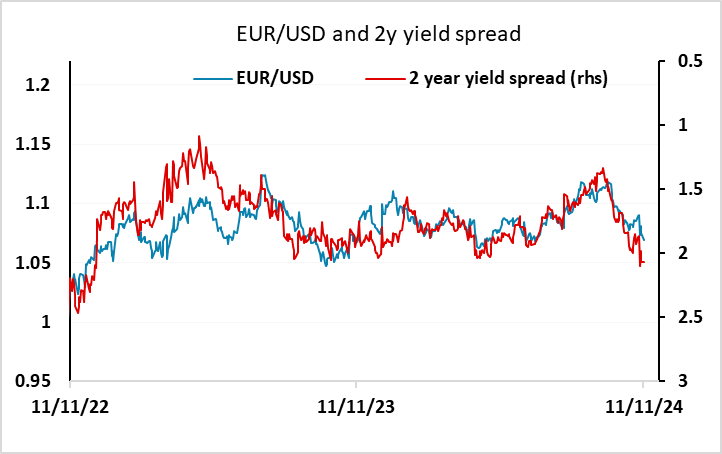

There isn’t a lot on the calendar other than the UK labour market data. The German ZEW survey may have some impact, but is not typically a big market mover of late. EUR/USD continues to look under pressure, and yield spreads suggest there is scope to 1.05, but the initial target will be the year’s low of 1.06 which was hit in April.

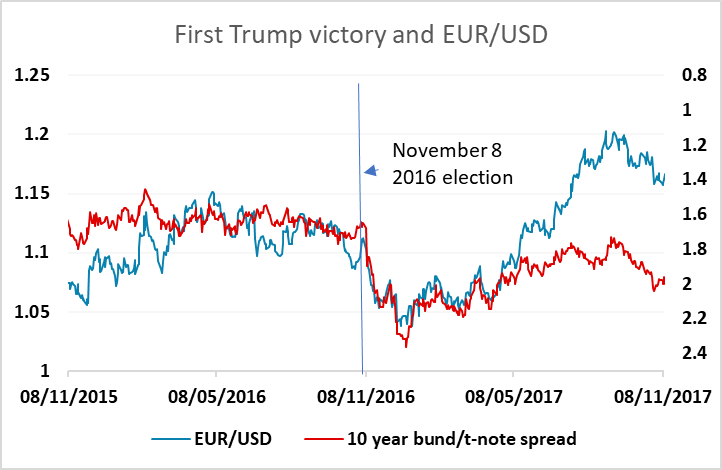

The USD remains well bid on a broad front, and if the Trump victory in 2016 is anything to go by, we may be in for a further month of USD gains. In 2016 DXY rose 5% from the election of Trump on November 8, peaking on December 20. The USD’s rise was driven by rising US yields, as it has been this time around. If anything, the USD rose less than the rise in yields suggested. Back then, EUR/USD tended to move more with 10 year yields, while currently it tends to move more with 2 year yields. Spreads have moved in the USD’s favour, and may have scope to move a little further. But at this stage we doubt the Fed will be changing their policy outlook. Trump’s tax cut promises have yet to be enacted, so it isn’t clear that monetary policy will be significantly affected. So while we can see the USD extend gains a little further, we wouldn’t at this stage be looking for a large move.