USD, EUR, JPY flows: Tariffs awaited

A quiet calendar today with tomorrow's reciprocal tariff announcement the main focus

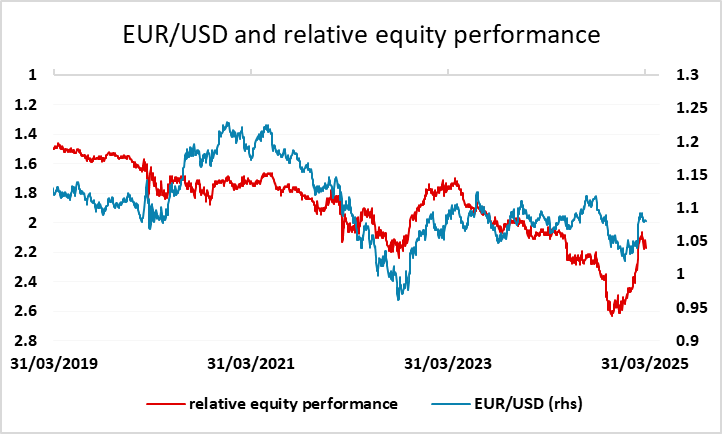

A quiet overnight session saw relatively little FX action. The RBA produced no surprises in leaving rates unchanged and AUD yields were little changed after their meeting. The main focus is tomorrow’s US announcement of reciprocal tariffs, with most countries fearing some fairly substantial tariff hikes. At this stage it looks like few countries will be spared, but there is scope for some tariffs to be removed after negotiation. Up to now, then market has not tended to buy the USD on news of higher tariffs. This is partly due to the impact being seen as negative on the US economy, and consequently leading to lower US yields and lower US equities. Although there are likely to be greater negative economic impacts abroad, the US equity market has to some extent been seen as more vulnerable due to high valuations. There has been a substantial rise in European equities this year relative to the US, although some of this has been due to the announcement of the German defence and infrastructure stimulus.

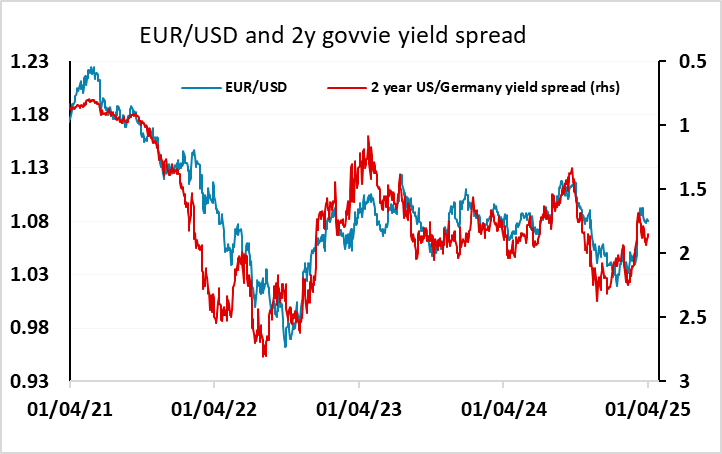

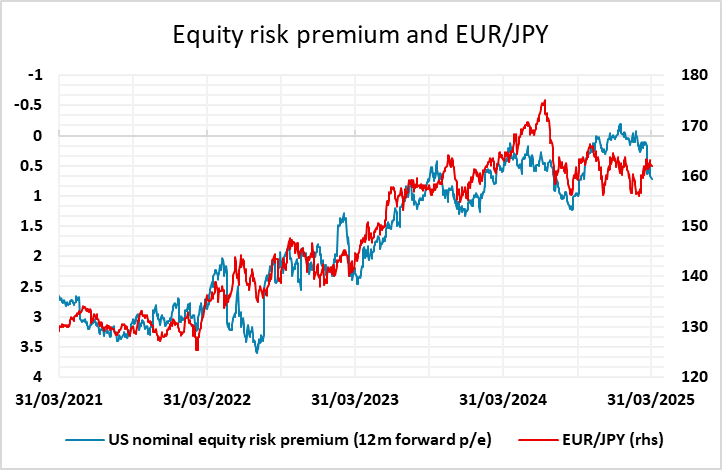

But the latest equity market dip has seen foreign equity markets suffer as well, and if this continues, the USD may well benefit. EUR/USD looks a little vulnerable based on yield spreads. However, the JPY still looks likely to be resilient, benefiting from any decline in US or European yields or equities.