AUD, JPY flows: AUD firm on CPI, JPY testing lows

AUD has scope to test highs after CPI. JPY weak but bears should be wary

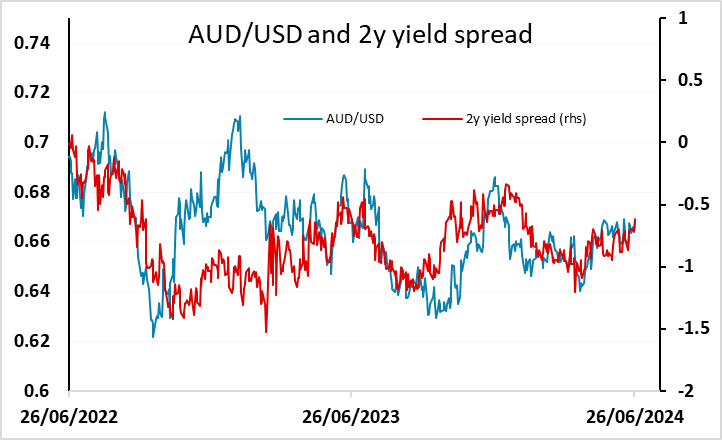

A quiet start to what looks like a quiet day, with very little on the calendar to trigger FX movement. The AUD has been the best performer overnight after CPI came in stronger than expected in May, pushing up towards the top of the range at 0.67. The market has now shifted away from seeing some risk of the RBA easing this year to seeing some risk of tightening, and the rise in AUD yields supports a test of the highs. However, more general USD weakness may be required for a proper break, and this looks unlikely to be seen in a day with little on the calendar.

Otherwise, JPY weakness continues to be the main theme, with JPY bears perhaps encouraged by the lack of new verbal intervention from the BoJ. But current levels are clearly dangerous. USD/JPY is above the level seen when the BoJ intervened in NZ hours in early May, and since then yield spreads have moved substantially in the JPY’s favour. The BoJ aren’t going to allow a sustained move above 160, but would prefer and organic decline in USD/JPY. The conditions are in place for this, but a BoJ shove may be needed to break technical levels and trigger unwinding of momentum trades.

usd/j