Preview: Due April 30 - U.S. Q1 Employment Cost Index - Trend slowing, but still quite firm

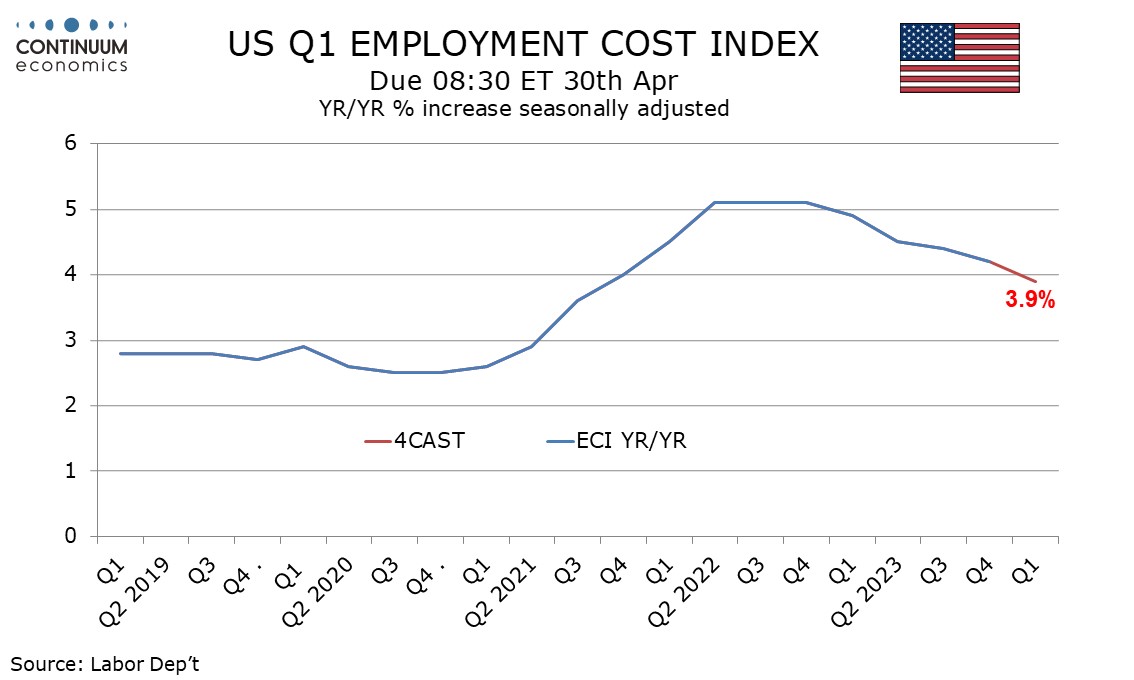

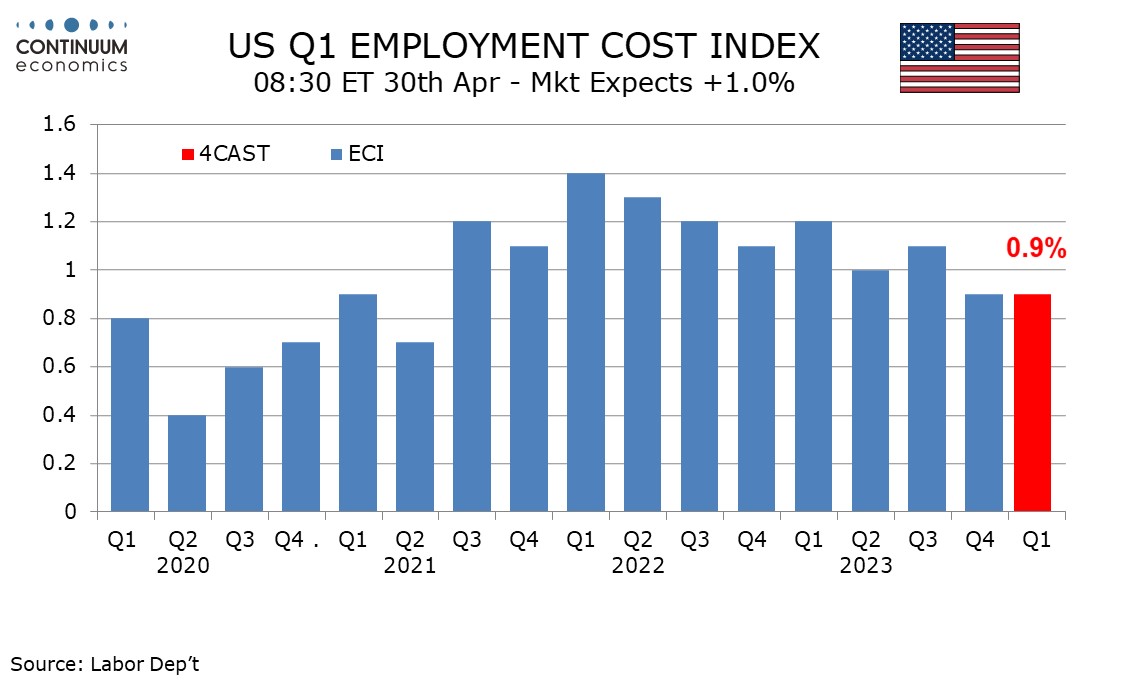

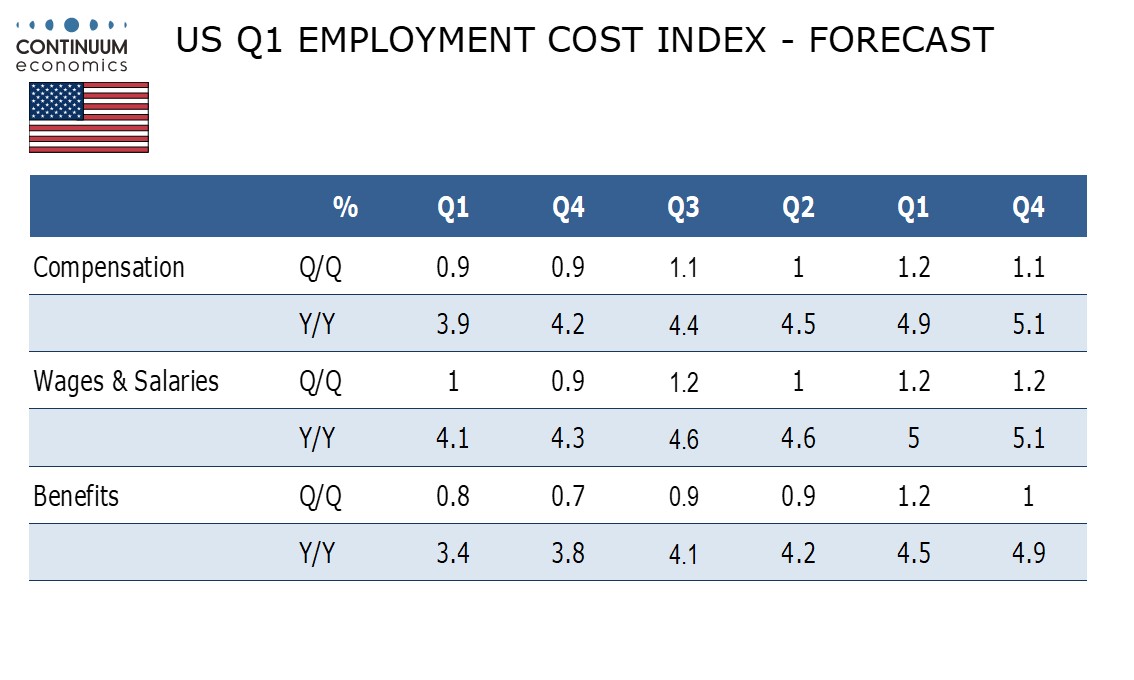

We look for the Q1 employment cost index (ECI) to increase by 0.9%, matching the Q4 increase that was the slowest since Q1 2021. Yr/yr growth will continue to slow, to 3.9% from 4.2%, reaching its slowest since Q3 2021, but will remain well above the pre-pandemic trend.

We expect wages and salaries to increase by 1.0% versus 0.9% in Q4 with payroll average hourly earnings having seen slightly stronger growth in Q1. We expect benefits to increase by 0.8%, above Q4’s 0.7% but below the 0.9% gains seen in Q2 and Q3 of 2023.

With our forecasts for both wages and salaries and benefits above those of Q4 we expect Q1’s increase to come in on the firm side of 0.9% rather than on the low side as was the case in Q4. Q1 data carries extra risk of volatility because health premiums see annual updates in this quarter.

Before the pandemic no quarterly increase had exceeded 0.8% since Q2 2007, before the 2008 financial crisis, and yr/yr data was trending slightly below 3.0%. Inflationary pressures in the labor market are easing, but may still be too high to be consistent with inflation returning to target.