FX Daily Strategy: Europe, November 12th

Will the BoJ Step in to Stop JPY Fall

USD to Consolidate before Government Reopening

Broader Risk Sentiment Looks Optimistic on Reopening

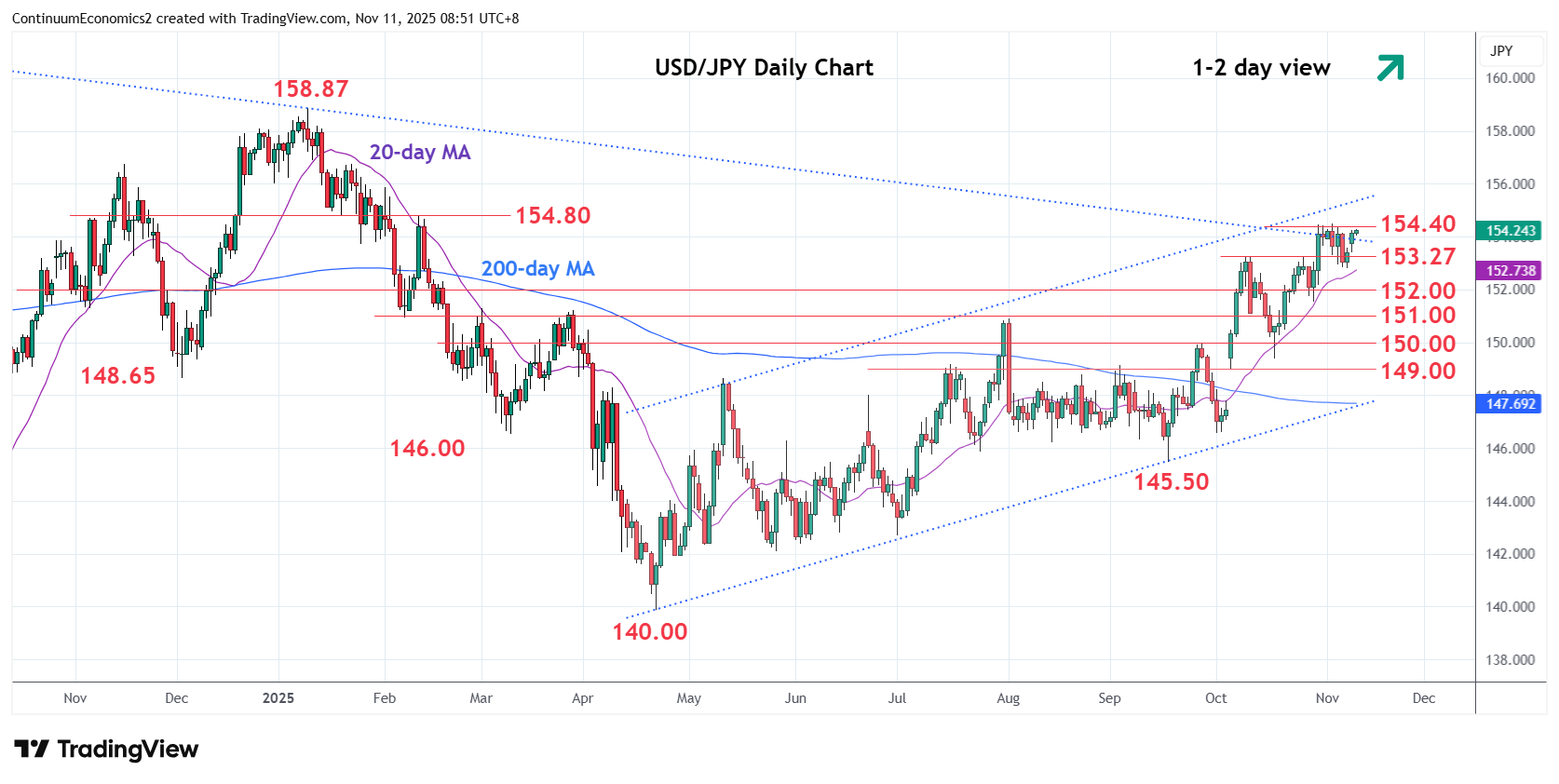

The JPY is weakening steadily since the new PM Takaichi took post. She pro-spending fiscal policy will likely further worsen the financial picture of the alreadily heavy indebted Japanese government. Combined with her vocal remark on inflation target not reached, she seems to be over reaching to curb the BoJ from further tightening. The overall inflationary picture in Japan has been supportive for the BoJ to tighten, yet the change of leadership in the Japanese government and soft wage growth in Q3 has been giving Ueda second thought. In a medium run, more stimulus will likely lead to higher inflation and could see the BoJ to raise rates above 1%. However, if wage does not sustainably pick up, it would likely to hinder BoJ's willingness to hike.

Thus, the JPY's weakening seems inevitable in a short run and could we see an actual intervention to stall the fall? We feel that is unlikely despite USD/JPY is once again closer to historic high. Firstly, the pace of USD/JPY's strength is a slow grind higher, which is unfavorable but in BoJ's eyes are not "rapid" enough. Secondly, such intervention maybe fruitless if it is not speculation, but longer term positioning from dovish policy that drove USD/JPY higher. It will just empty their pocket without a significant impact.

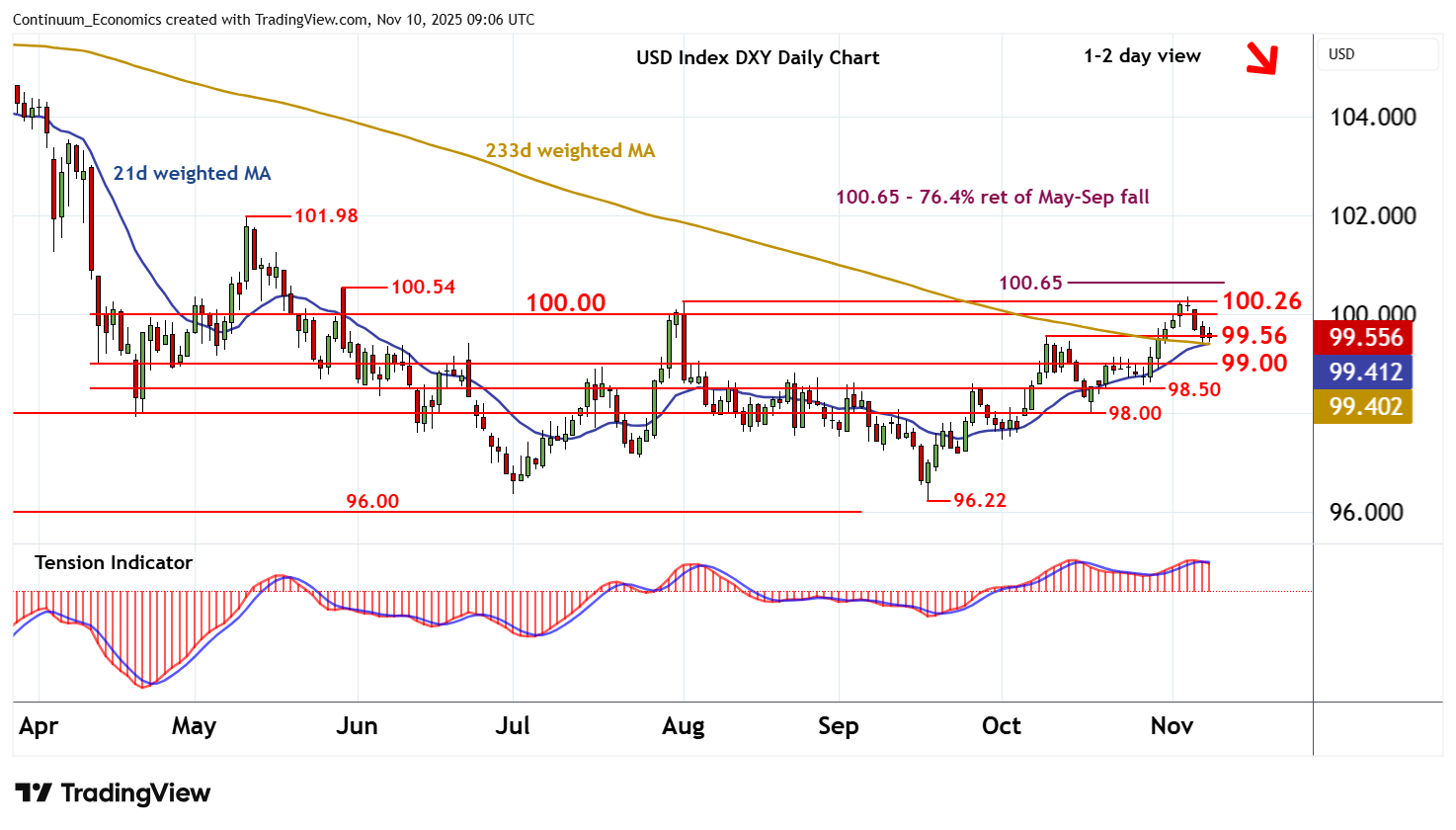

The House will vote on Wednesday to reopen the U.S. government. It is widely expected that the vote will pass with some Democrat divergent. While it is a generally risk positive event, the USD will likely be in consolidation. The ebb and flows are likely to be neutral for USD and see the next trigger to be the Fed. There will be multiple Fed speakers on Wednesday's NA session and they should set the tone for the anticipation of next rate changes.

On the chart the greenback is little changed, as mixed intraday studies keep near-term sentiment cautious and extend consolidation around support at the 99.56 weekly high of 9 October. Daily readings are falling and overbought weekly stochastics are flattening, suggesting room for fresh losses in the coming sessions. A break below 99.56 will open up congestion around 99.00. But the rising weekly Tension Indicator should limit any initial tests in short-covering/consolidation. Meanwhile, resistance remains at congestion around 100.00 and extends to the 100.26 monthly high of 1 August. A close above here is needed to improve sentiment and extend mid-September gains initially to the 100.54 weekly high of 29 May and the 100.65 Fibonacci retracement.

As one of the longest U.S. government shutdown, the reopening of which will be a risk positive event. Disruption will likely dissipate within days but the market will be alert on any permanent changes Trump will be doing with the excuse of this shutdown. So far, we are not hearing any update and no news should be read as good news for now. The reopening of the government also meant U.S. economic data will return with the key being October CPI. October US CPI may never be released even if the government shutdown is resolved, given lack of data collection during the month of October. However what the number would have been does matter. Our forecast is for a 0.2% increase overall, with a 0.3% rise ex food and energy, with the respective gains before rounding being 0.16% and 0.26%.