Published: 2024-10-23T12:26:03.000Z

Preview: Due October24 - U.S. October S&P PMIs - Manufacturing slightly less weak, Services slightly less strong

1

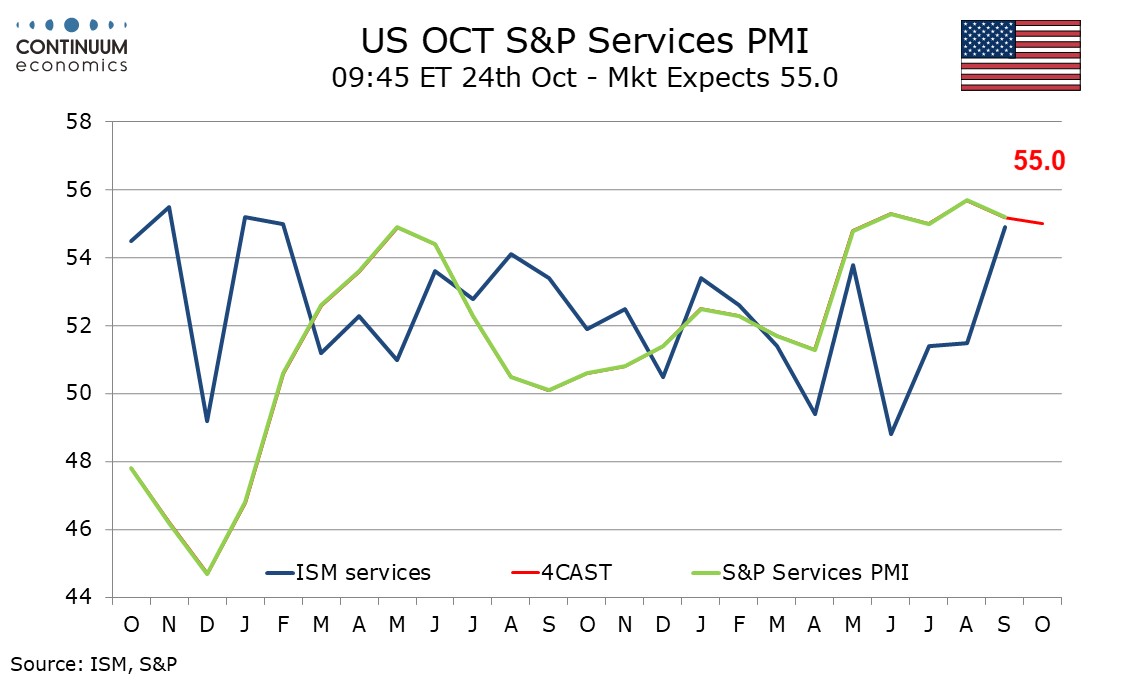

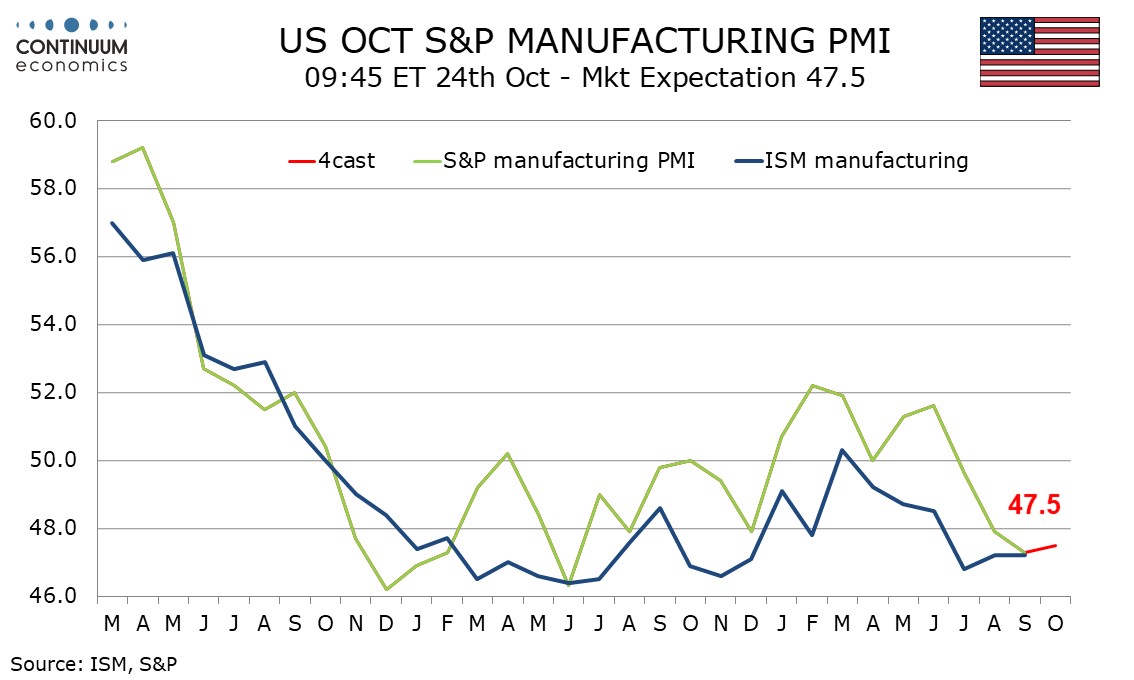

We expect October’s S and P PMIs to show a marginal increase in manufacturing, to a still weak 47.5 from 47.3, and a marginal dip in services to a still healthy 55.0 from 55.2.

Manufacturing has seen three straight declines after recording above neutral readings in the first six months of the year and in September was close to the ISM manufacturing index of 47.2. Over the past year the S and P index has tended to pick up after months which saw readings close to the ISM’s. October saw a stronger Philly Fed survey but a weaker one from the Empire State, but we would give more weight to the Philly Fed’s.

The S and P and ISM service indices are less well correlated, though a sharp bounce in the ISM services index brought the two series close to each other in September. The S and P index seems more sensitive to interest rate expectations than the ISM’s and easing expectations have faded a little in recent weeks, though we expect the index to maintain the healthy picture seen in the last six months.