FX Daily Strategy: Asia, August 8th

Looks Like a Quiet Friday

But the Tariff Man Does Not Sleep

Employment Data Could Weakens the Loonie

Inflation Expectation Could Support DXY

It looks like to be a quiet Friday as we have little economic data release until the New York session. In very early Asia, we have Japan's June Overall Household Spending that is expected for household spending to continuously grow after a strong May. However, we doubt such data would be market moving as the focus remain on U.S.-Japan trade agreement and its details. Without the trigger more economic data, the last trading day could see market participants taking it easy and on a wait & see mode to brace for any weekend Trump remark.

As we all know the Tariff Man does not sleep, after mentioning 100% chip and semiconductor tariffs and extra sanction for countries purchasing Russia oil, he is likely to keep up his comment and tariff strategy over the weekend. While "TACO" has been common, his unpredictability and policy uncertainty will keep market participants on their toes. Any remarks he made on his social media will affect market significantly, at least in a short run. We will likely hear more about Japan's tariff and details after Japan's trade negotiator wrap up this round of discussion.

The Canadian July employment figure will be released in the New York session. It is widely expected there will be a positive yet soft headline number with unemployment rate likely in line with prior months. However, market focus remain on the ongoing U.S.-Canada trade condition. Being one of the major countries being hit with the highest tariff, Canada has to find a way to make a deal or else it risk a huge hit to the Canadian economy. So far, there seems to be little progress from the new Canadian PM Carney. The Loonie may be offered on the data release after its correction this week.

On the chart, cautious trade is giving way to the anticipated pullback in both USD- and CAD-driven trade. Intraday studies are falling and daily readings are also turning down, highlighting room for a test of congestion support at 1.3700. A further break cannot be ruled out. But rising weekly charts should limit any deeper losses in renewed buying interest above congestion around 1.3600. Meanwhile, resistance remains at congestion around 1.3800 and extends to the 1.3860 weekly high of 29 May. This broad range should cap any immediate tests higher.

The UoM consumer inflation expectation is likely going to show an elevated result as people will see Trump's tariff tactic to be inflationary. As the last U.S. economic data release for the week, an elevated result could trigger a wave of USD bids after the greenback being beaten down almost for the whole week.

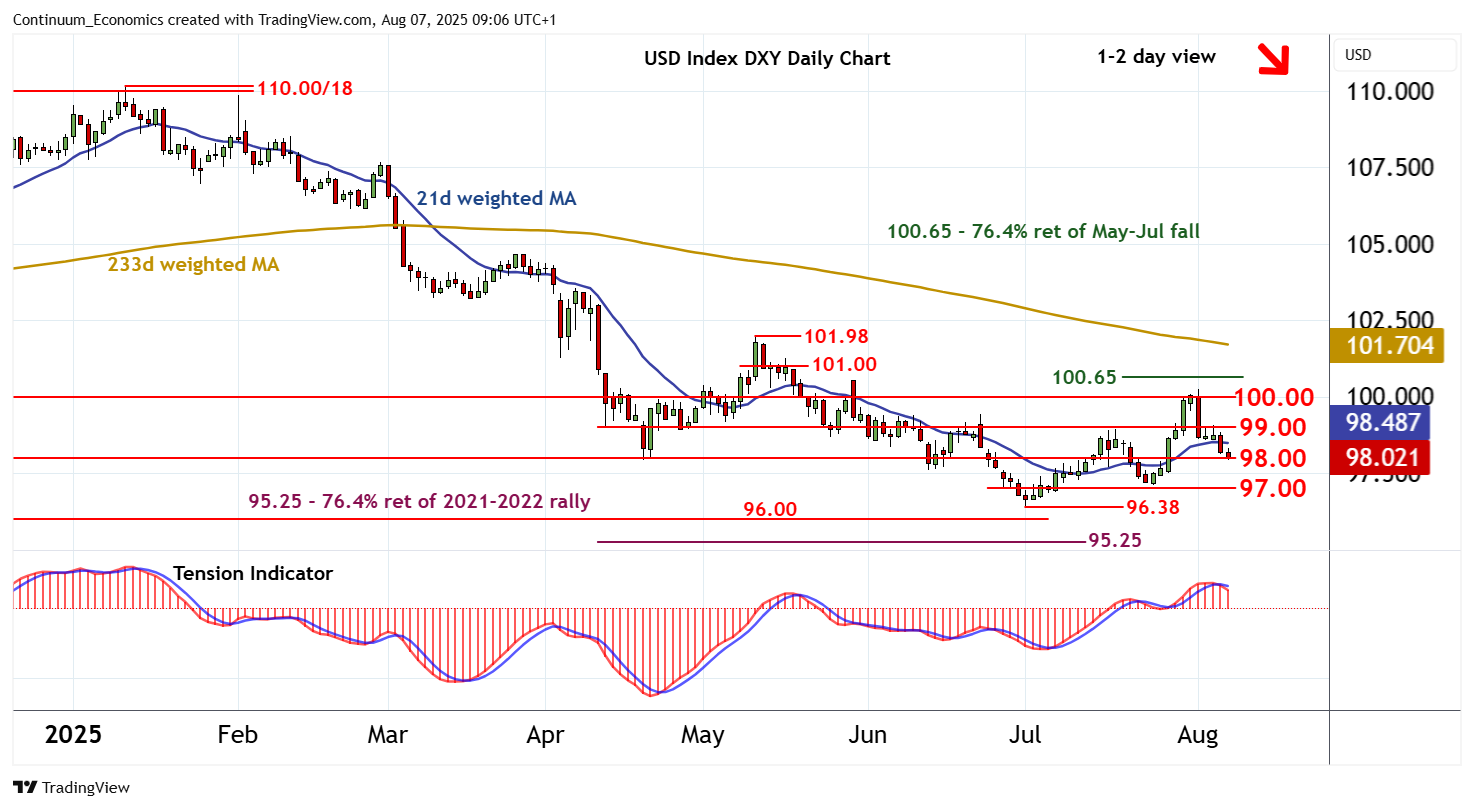

On the chart, cautious trade is giving way to a drift lower, as intraday studies turn down, with prices currently pressuring congestion support at 98.00. Daily readings have turned down and overbought weekly stochastics are also under pressure, highlighting a deterioration in sentiment and room for further losses in the coming sessions. A break below 98.00 will open up congestion around 97.00. But by-then oversold daily stochastics should limit any initial break in consolidation/short-covering above critical support at the 96.38 current year low of 1 July. Meanwhile, resistance remains at 99.00. An unexpected close above here will help to stabilise price action and prompt consolidation beneath congestion around 100.00.