FX Daily Strategy: N America, June 11th

U.S. - China Trade Talk In Focus

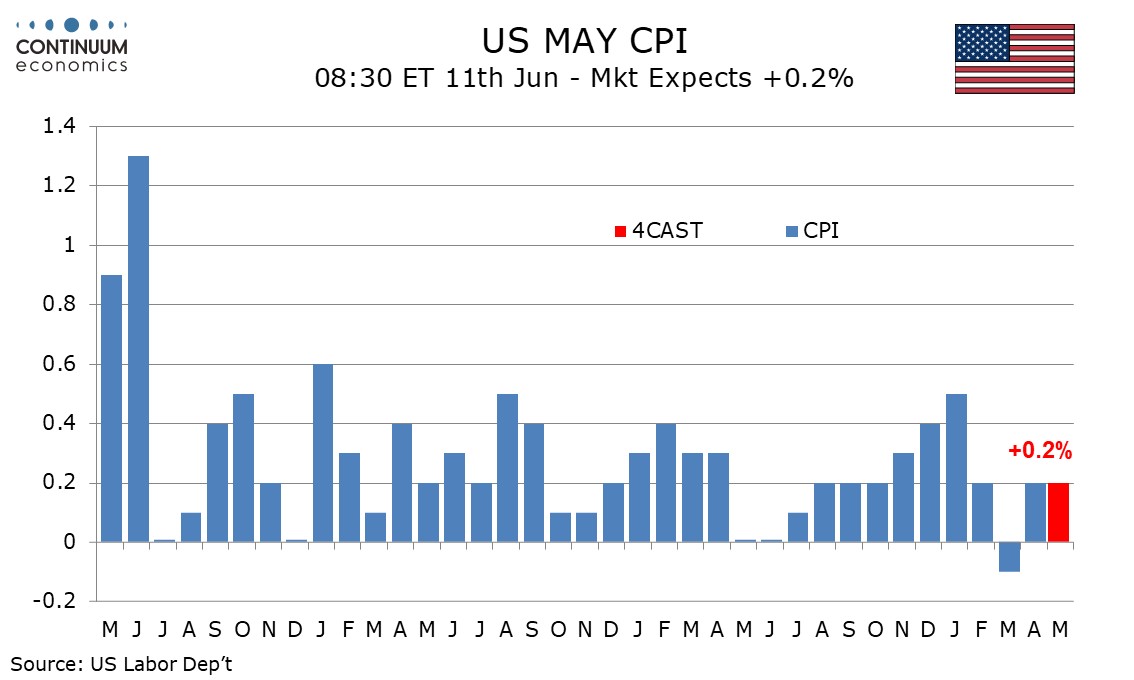

Tariff impact still modest, but starting to build for U.S. May CPI

DXY Likely to Dominate Movement

Following the talks in Geneva in May, there seems to be little progress and much finger pointing between the U.S. and China in their trade negotiation. While they are signaling good will again lately, there has not been anything concrete coming out yet. The latest talks in London are giving positive feedback from the Trump front but we have not heard from China. It will be critical to see Chinese confirmation as we all know Trump like to exaggerate.

Any outcome will be market moving and seems likely tilted towards the positive side. China is offering rare earth export and U.S. on technology export. Such gesture are likely good steps to further descaltion and potentially a framework of trade deal. Yet, there seems to be a lot of optimism priced in the market, which may lead to some "sell the fact" trade if we are hearing a positive outcome.

We expect May CPI to increase by 0.2% overall and by 0.3% ex food and energy, the core rate still seeing a modest impact from tariffs given a Q1 inventory build up and uncertainty over low long tariffs will persist, though at 0.32% before rounding we expect the strongest rise in the core rate since January, and up from 0.24% in April. The core rate is likely to accelerate further in coming months. We expect commodities ex food and energy to rise by 0.4%, up from 0.1% in April, with some of the components that were surprisingly negative in April, notably used autos and apparel, to rebound. This will suggest that tariffs rate starting to have some impact. We expect services less energy to match April’s 0.3% increase. Air fares are likely to remain weak after three straight significant declines though the negative may be less pronounced in May. Auto services are however likely to see a slower rise than in April which corrected a very weak March, when services less energy rose by only 0.1%.

Gasoline prices look set to fall, particularly in the seasonally adjusted data. We expect a 0.2% rise in food after a 0.1% decline in April. Eggs are likely to continue reversing from recent inflated levels but prices of some imported foods may pick up on tariffs. Our forecasts would see yr/yr growth edging up to 2.5% from 2.3% overall and to 3.0% from 2.8% ex food and energy. Further gains are likely in coming months as tariffs are increasingly passed on. April’s yr/yr core rate was the weakest since February 2021, but likely to prove a floor for this year.

Double teamed by U.S. CPI and potentially U.S-China trade outcome, DXY will likely see much movement on Wednesday. With the lack of other economic data elsewhere, the greenback will dominate the direction against major currency. The DXY has been under pressure as the broad risk sentiment continues to point towards more optimism. With U.S. Treasury Yields did not see any breakout, there seems to be little support for the USD. The effect of tariffs on U.S. CPI may change market pricing of Fed's rate and could trigger another leg.

On the chart, the anticipated test above resistance at 99.00 has met selling interest beneath congestion around 99.50, as overbought intraday studies unwind, with prices once again trading below 99.00. A move towards the 98.35 weekly low of 5 June is highlighted. But rising daily readings and mixed weekly charts are expected to limit any initial tests in consolidation. A close beneath here, however, will open up critical support at the 97.70 weekly low of early-March 2022 and congestion around 98.00. Meanwhile, resistance is up to 99.50. But a close above congestion around 100.00 is needed to improve sentiment and open up a test of 101.00.