FX Daily Strategy: APAC, May 8th

SEK upside risks on Riksbank

German production data may underpin EUR

JPY still struggling to show general strength

AUD may test upside, but break higher still looks unlikely at this stage

SEK upside risks on Riksbank

German production data may underpin EUR

JPY still struggling to show general strength

AUD may test upside, but break higher still looks unlikely at this stage

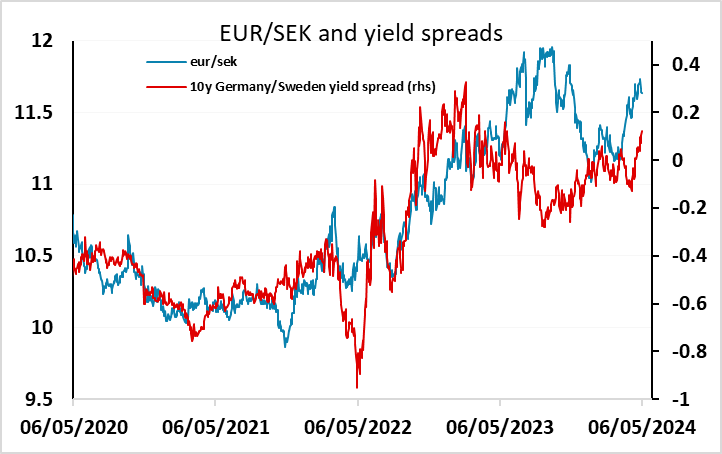

Wednesday is another fairly quiet day on the calendar, but there is the Riksbank meeting which is likely to trigger some volatility in the SEK. The majority expect a rate cut. 16 of the 22 surveyed by Reuters are looking for a 25bp cut, but there are 6 looking for no change, and we see this as a higher risk than seems priced in, mainly because of the weakness of the SEK. The Riksbank are sensitive to this, and the underperformance of the SEK relative to yield spreads may lead them to delay a move until June. Given the market pricing, there would likely be a more significant positive SEK reaction to no change than a negative reaction to a cut, and given the low starting level of the SEK relative o yield spreads, we see risk/reward favouring the downside for EUR/SEK.

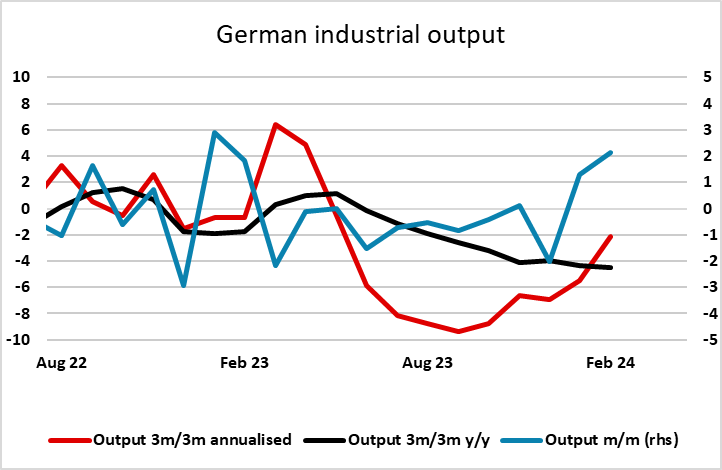

There isn’t a great deal else on the calendar, with nothing of real note in the US and German and Spanish industrial production numbers in the Eurozone. However, the German production numbers will be of some interest as the better data in the last couple of months suggests there could be some sort of recovery underway. A decline is expected to compensate for the strong rises in the last two months, but the consensus expectation of a decline of 0.6% would not be enough to offset the strength of the January and February data. While a slightly larger decline might well be seen, we would still see anything better than -1.0% as a reasonable outcome. Any evidence of an improving trend ought to be seen as positive for the EUR, which we believe may have bottomed out against the USD just above 1.06. While more evidence of European recovery will be required for the EUR to advance, we would expect to see buying on any dips towards 1.07.

USD/JPY has seen a modest recovery from the declines seen last week, but we still see scope for losses from here. As it stands, solid equity market performance continues to limit the downside for EUR/JPY, with the correlation between equity risk premia and EUR/JPY still holding up. USD/JPY declines may therefore only materialise in the short run if we see EUR/USD gains, even though we see a lot more potential ofr JPY gains than EUR gains longer run.

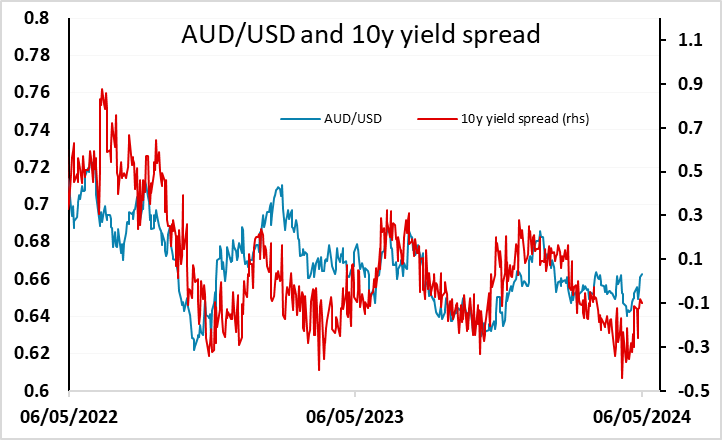

After dipping in Asia time following the RBA meeting yesterday, AUD/USD pushed back above 0.66 in European hours, and we don’t see anything in the RBA language to prevent a retest of the resistance near 0.6650. Solid global equity performance would continue to favour AUD gains, but at this point yield spreads don’t suggest a successful break higher is likely. Further declines in US yields look necessary to underpin an extended AUD rally.