FX Daily Strategy: N America, October 18th

JPY still on the back foot – Japan CPI in focus

Risk sentiment remains positive after strong US data on Thursday

EUR/USD retains a downside bias

GBP risks on retail sales skewed to the upside

USD could benefit if housing starts robust despite hurricanes

JPY still on the back foot – Japan CPI in focus

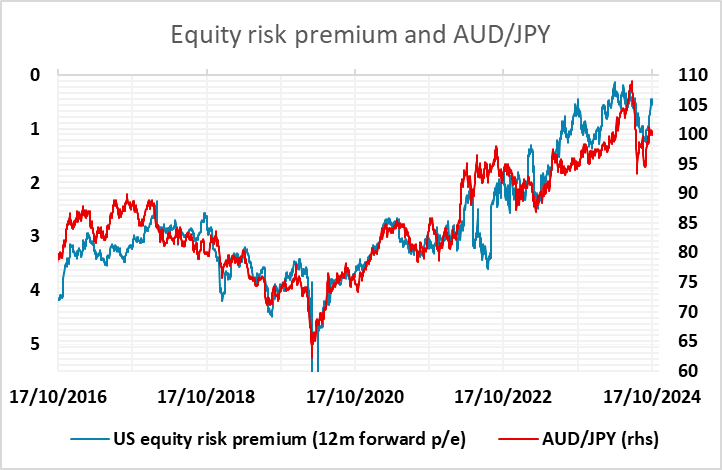

Risk sentiment remains positive after strong US data on Thursday

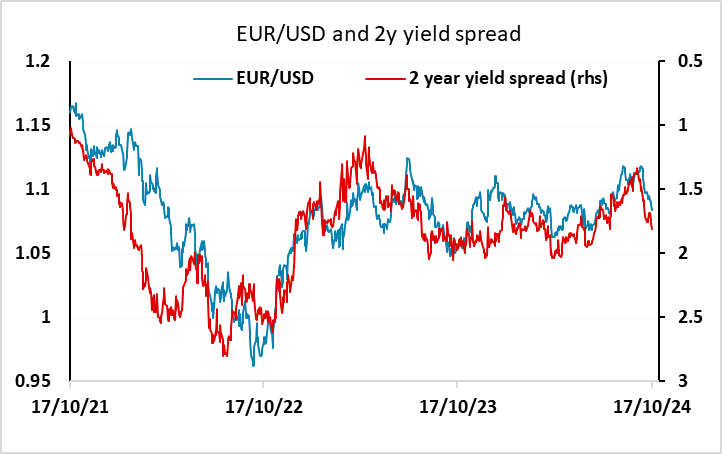

EUR/USD retains a downside bias

GBP risks on retail sales skewed to the upside

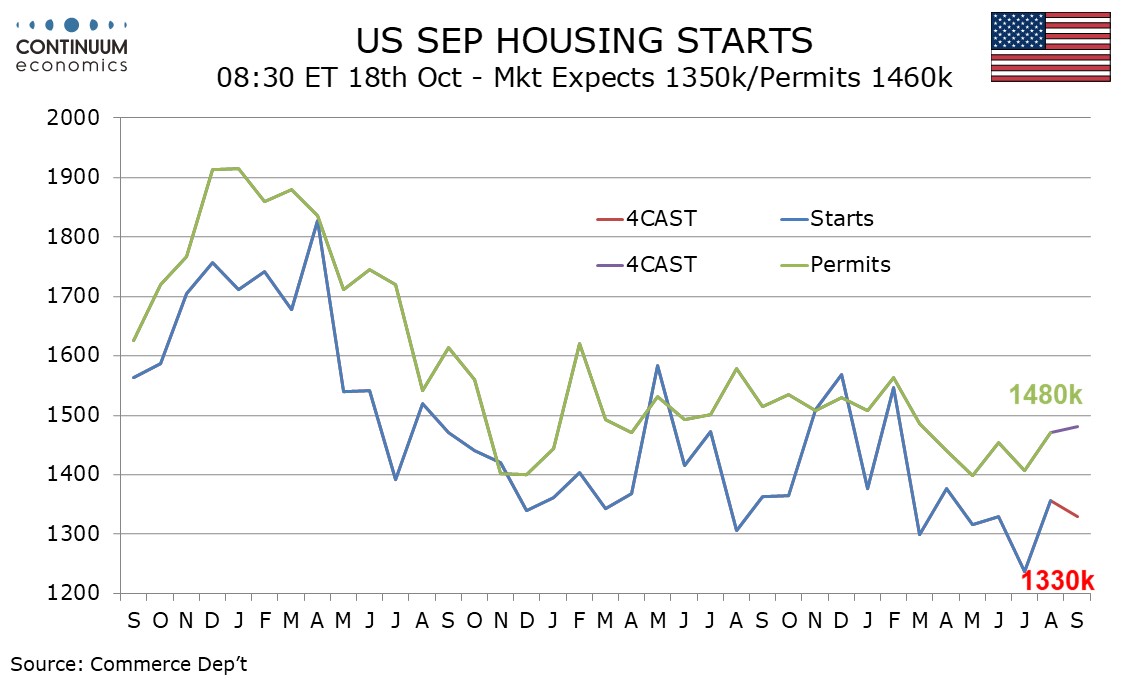

USD could benefit if housing starts a robust despite hurricanes

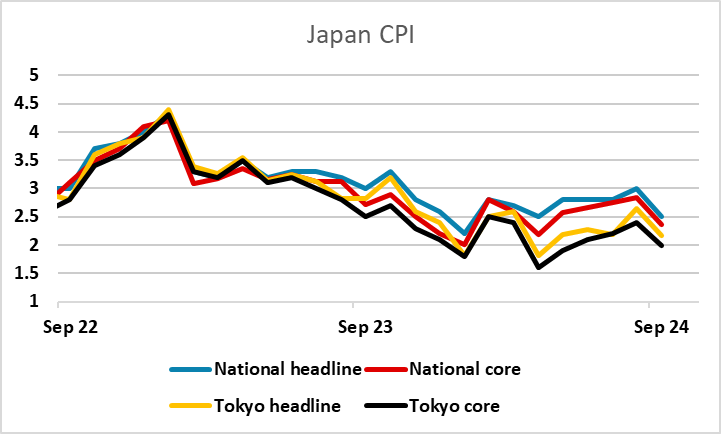

Friday kicked off with Japanese CPI data, but as usual the national CPI data is typically well predicted by the Tokyo data already released, although the national numbers have been a little stronger than the Toky numbers of late. Even so, there was a significant dip in the y/y inflation rate in the September Tokyo data, and the market was expecting a similar dip in the national CPI, with the core rate expected to fall to 2.3% from 2.8% in August. The data came in slightly above expectations at 2.4% y/y, but given such a large fall in the y/y rate, the JPY stayed quite soft. The USD/JPY break of 150 may extend to the upside unless we get some statements from Ueda or others suggesting tighter policy is still likely. We may see verbal intervention but this typically has very little impact.

There was also a big set of Chinese data, with the Q3 GDP data howing a slightly smaller than expected 0.9% q/q gain, but retail sales and industrial production both stronger than expected in September. The market may be less sensitive to this than it has been due to the recent Chinese stimulus announcements which may prop growth up a little going forward. But we still don’t expect the new measures to do more than limit the weakness. Risk sentiment in general remains quite solid, helped by the strong US data on Thursday, and this also suggests some downside risk for the JPY, with the AUD likely to be among the most favoured after Thursday’s strong US data.

EUR/USD fell back after the ECB meeting on Thursday, but the move was due more to the US data and general USD strength than any surprises from the ECB. There may still be some risk of a break below 1.08, but we are expecting EUR/USD to find some support near current levels, with spreads now unlikely to move significantly further in the USD’s favour.

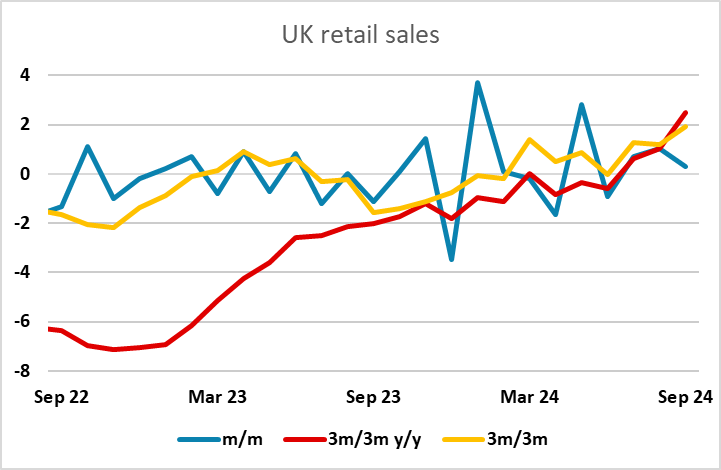

The European session kicked off with strong UK data. While UK retail sales only rose 0.3% m/m, this was well above consensus expectations of a 0.3% decline and follows gains of 0.7% and 1.0% in the previous two months, so that the 3m/3m trend is at its highest since the recovery from the pandemic. EUR/GBP has dipped below 0.83 for the first time since April 2022.

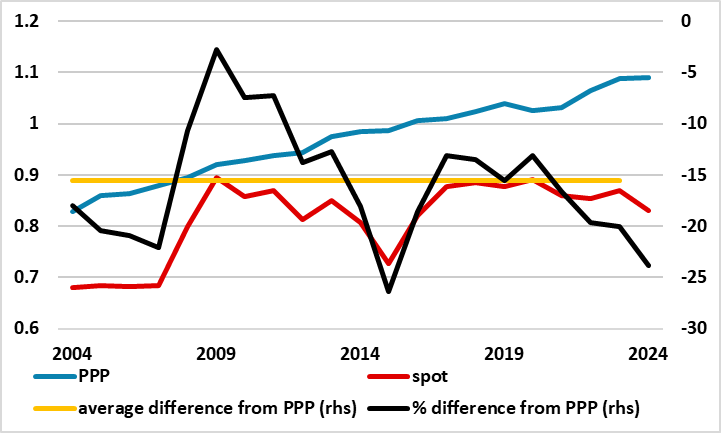

While we doubt this data will prevent the BoE from cutting rates in November, given the latest weak inflation data, this sort of relatively strong data will tend to push up longer term UK yields and maintain the current high level of GBP against the EUR. Even so, progress below 0.83 is likely to be tough. The UK economy is still only growing very modestly, and EUR/GBP is at historically low levels in real terms. The October 30 budget may turn out to be less contractionary than feared, but is unlikely to be significantly stimulative. GBP will continue to benefit from risk positive sentiment globally, but looks overextended on a 0.82 handle in anything other than the short term.

The main US data is hosuing starts. We expect September housing starts to see a 1.9% decline to 1330k after a 9.6% August increase though without Hurricane Helene a rise would probably have been seen. We expect permits to rise by 0.7% to 1480k, extending a 4.6% August increase. New home sales surprised on the upside in July and August and housing survey evidence for September is generally stronger with Fed easing starting. Construction details in September’s non-farm payroll, surveyed before Hurricane Helene, were also positive. So while weak data might be dismissed as hurricane affected, stronger data might suggest a housing market recovery due to the recent decline in US yields, which could be expected to provide further USD support.