FX Daily Strategy: N America, January 28th

Quiet calendar suggests a more stable market

US equities the focus with DeepSeek story highlighting vulnerabilities

JPY has the most potential to gain, but needs further equity weakness to extend Monday’s rise

CHF strength looks less likely to persist

Quiet calendar suggests a more stable market

US equities the focus with DeepSeek story highlighting vulnerabilities

JPY has the most potential to gain, but needs further equity weakness to extend Monday’s rise

CHF strength looks less likely to persist

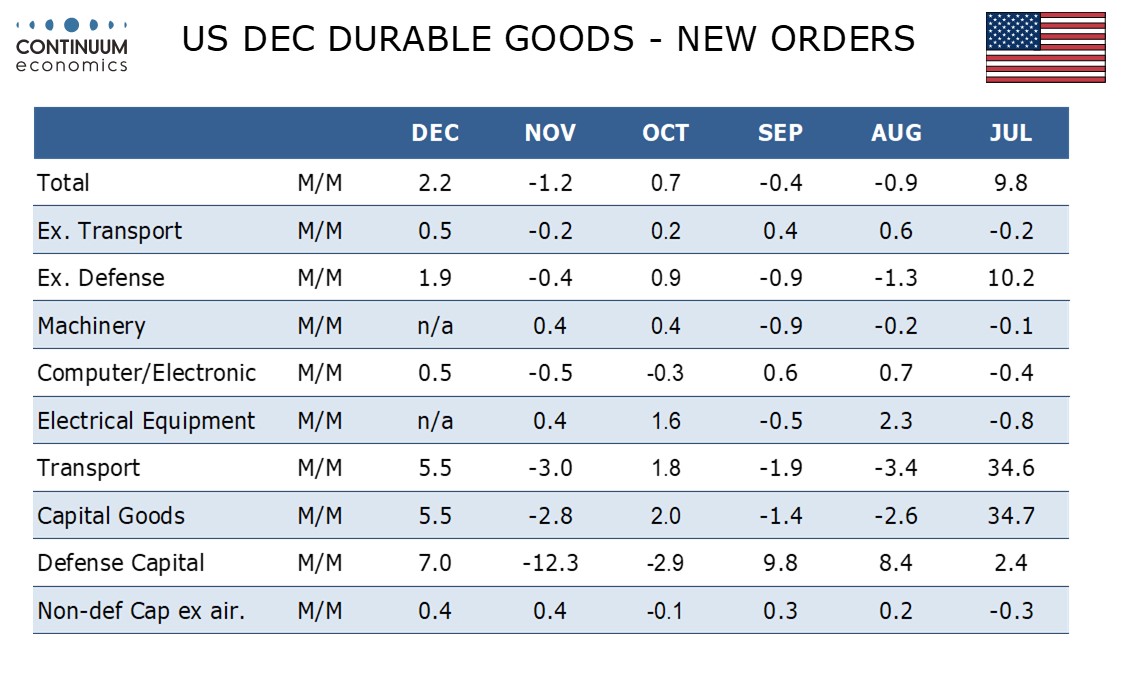

Tuesday’s calendar is quiet, and with Chinese New Year also likely reducing activity in Asia, we may see a fairly static market ahead of the bigger events later in the week with the Fed and ECB meetings. The only significant data is US durable goods orders. We expect December durable orders to increase by 2.2% overall with a 0.5% increase ex transport. This would suggest some improvement in underlying trend, more than fully reversing November’s declines of 1.2% overall and 0.2% ex transport.

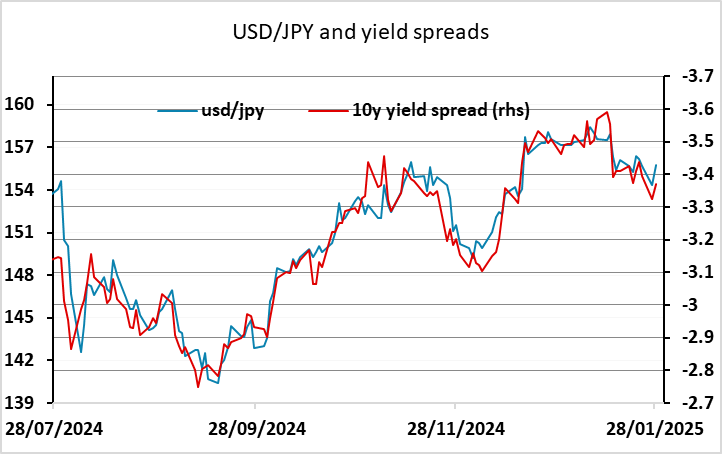

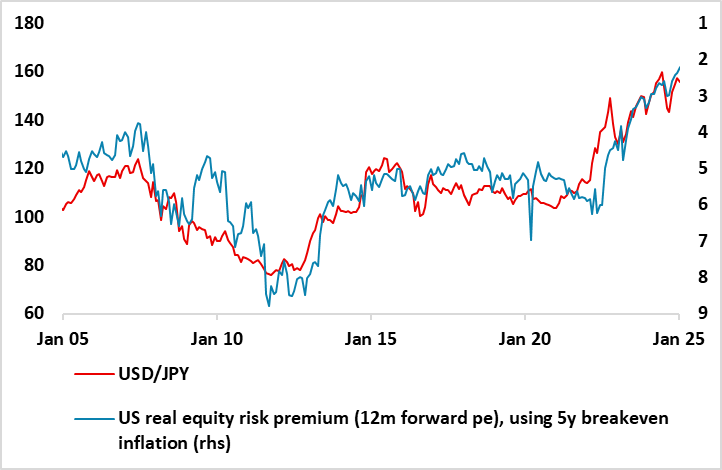

However, the numbers look very unlikely to have any market impact, with the focus on any developments in the China DeepSeek story, and any Trump comments on tariffs as the deadline of February 1 for the Canada and Mexico tariffs approaches. FX wise, we saw general USD losses as equities fell back on the DeepSeek story, but the JPY and the CHF made the most significant gains. JPY gains are mainly a consequence of the US yield declines that resulted from the declines in equities, with USD/JPY still very much tracking moves in the 10 year US/Japan yield spread. Whether the US yield decline holds will depend on how the equity market behaves from here. The DeepSeek story itself may or may not have legs, but it was a catalyst for an overdue correction in the tech sector. This far, the correction has been very modest, and we see the sector as vulnerable to further corrections. The underlying issue is US equity market overvaluation, and while the US economy may continue to do reasonably well, it will struggle to do well enough to justify current equity market valuation. But as long as 10 yar yields hold near current levels, we may not see any further short term gain in the JPY.

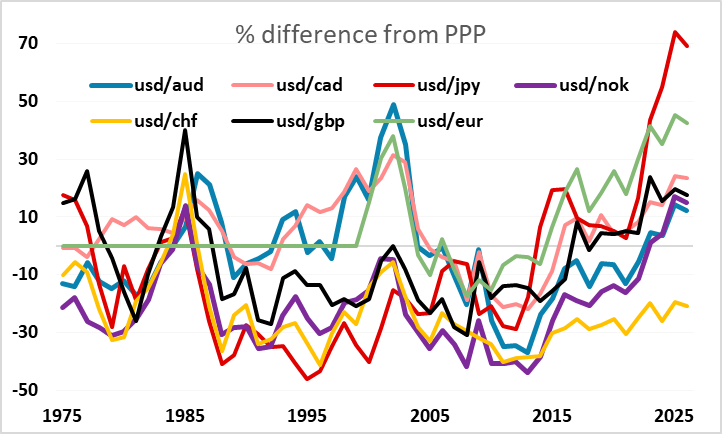

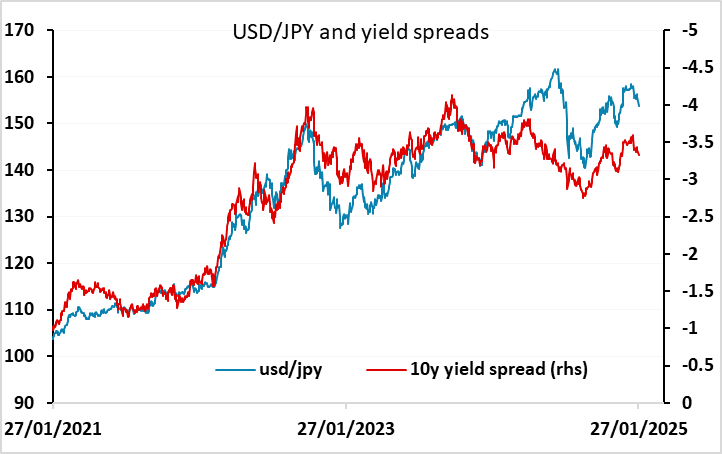

Even so, while the correlation with yield spreads has been very tight since last August, before that the correlation was similarly tight, but the correlation implied lower levels. The shift came around the time of the Japanese intervention, but it isn’t clear why the JPY was seen as less attractive after that at the same level of yields. This provides one possible reason for further JPY gains. The vulnerability of the US equity market and the huge JPY undervaluation mean there are risks of a very sharp JPY rise if the market loses confidence.

US equity risk premium and USD/JPY

The CHF also performed well on Monday, but the case for CHF gains is much harder to make. While the CHF is still very much seen as a safe haven, it is starting at very high levels, and the CHF tends to gain more when there are problems in the Eurozone than when the problems are more global and less Eurocentric. The European equity market is much less vulnerable than the US due to much lower valuations and a much smaller (and less expensive) tech sector. Europe has other problems, but any further equity weakness is more likely to benefit the JPY than the CHF.