FX Daily Strategy: N America, February 28th

EUR holding close to 1.04

End of month likely to be USD positive

US PCE unlikely to move the market

CAD vulnerable but GDP may be supportive

EUR holding close to 1.04

End of month likely to be USD positive

US PCE unlikely to move the market

CAD vulnerable but GDP may be supportive

French February CPI and revised Q4 GDP have both come in weaker than expected at flat m/m and 0.6% y/y respectively, triggering general declines in EUR yields, which were already edging lower rafter US yields once again fell overnight. State CPIs suggest national German CPI will be close to consensus. NRW, Bavaria and Saxony are all seeing a 0.1% decline in the y/y rate in February, but the others are showing either no change or a rise, and the consensus for the national number is for the y/y rate to remain unchanged at 2.3%, although the HICP version is seen declining to 2.7% from 2.8%. German yields are not much changed after falling earlier in the session, and EUR/USD remains close to 1.04, with yield spreads to the US little changed.

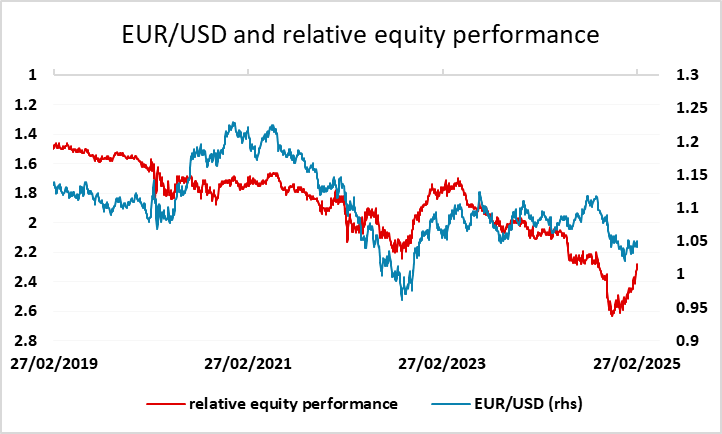

All this suggests that the EUR may remain under pressure, having lost ground on Thursday. This looked to be a consequence of general USD strength rather than EUR weakness, and may have been partially end of month flow related. Most models are suggesting USD demand at end of month with US funds needing to increase FX hedges on European equity holdings due to European equity outperformance. If so, more of the same is likely on Friday, suggesting some risk of a break below 1.04.

In North America we have the core PCE price index from the US and Q4 GDP from Canada. We expect a 0.3% rise in January’s core PCE price index, slower than the 0.4% seen from core CPI, while we expect a modest 0.3% rise in personal income to outpace an unusual 0.1% decline in personal spending. This is in line with consensus, so shouldn’t have any notable FX impact.

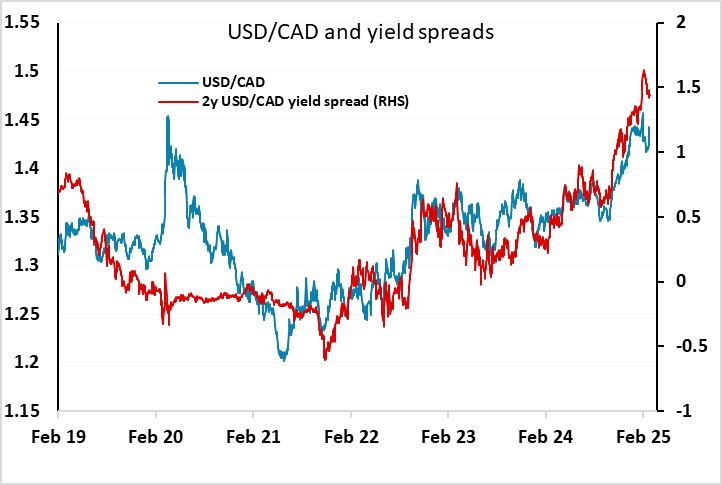

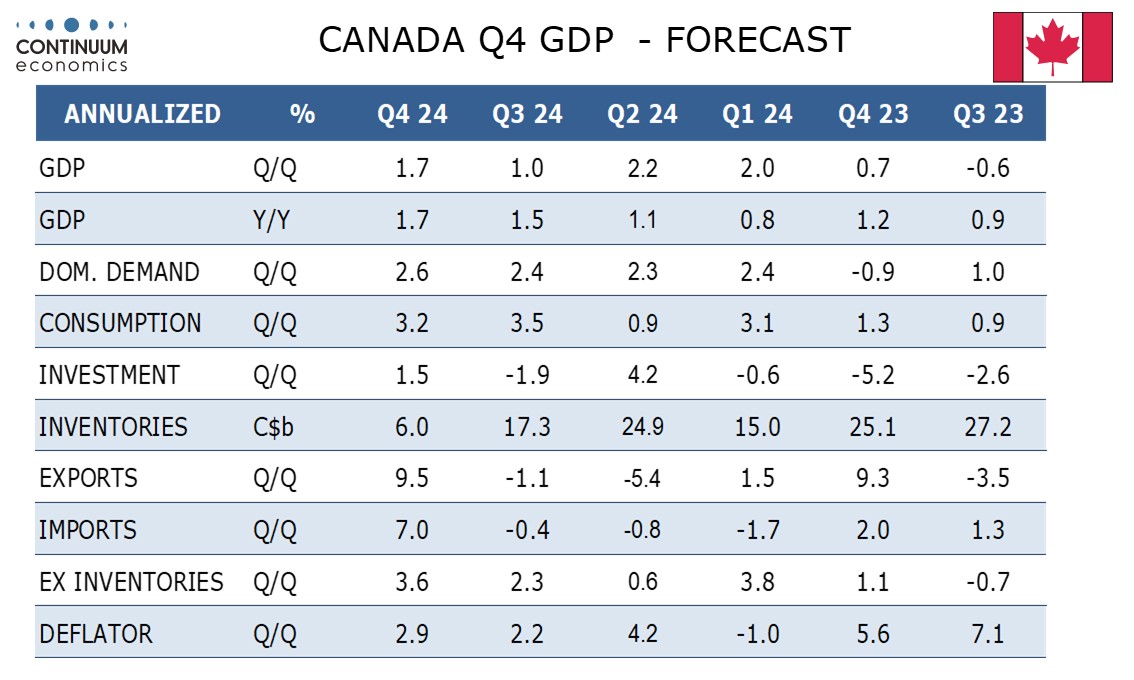

We expect Q4 Canadian GDP to rise by 1.7% annualized, marginally below a 1.8% estimate made with the Bank of Canada’s January Monetary Policy Report (which is also consensus) but with positive details outside inventories. We expect a 0.1% increase in December GDP, slightly below a 0.2% estimate made with November’s data. The CAD still looks vulnerable with the tariff threat still significant. But even without any further negative impulse, USD/CAD looks high relative to the normal yield correlation