GBP flows: GBP firmer after CPI inflation falls less than expected

EUR/GBP dipping to test 0.8530 support after stronger than expected CPI, but downside looks limited ahead of Bailey speech this evening

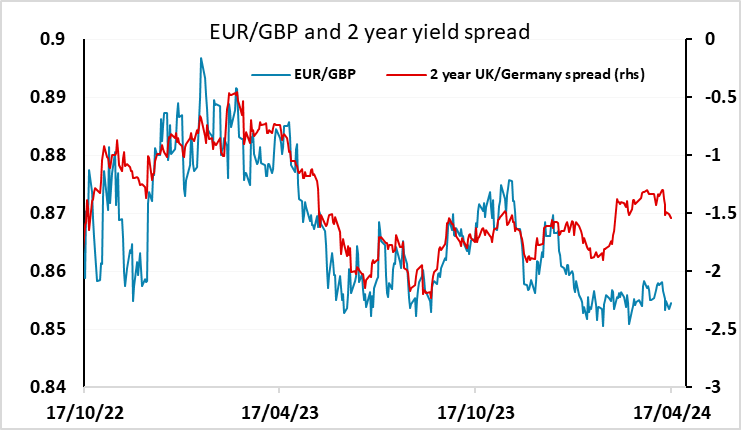

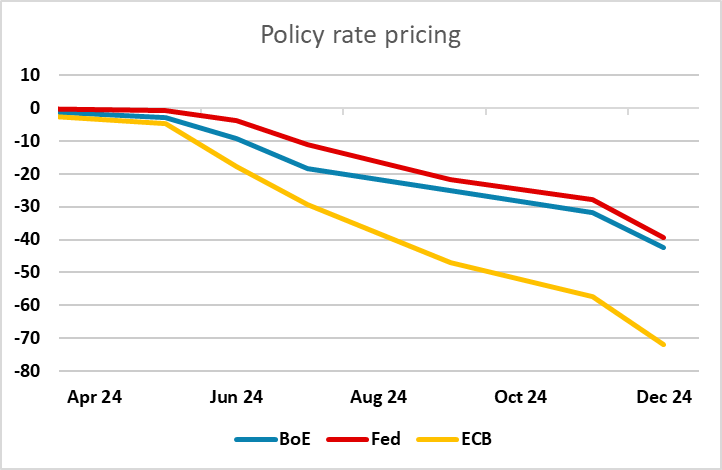

UK March CPI is in line with our forecasts but slightly on the strong side of market consensus. EUR/GBP has dipped as a result, once again testing support at the 0.8530 level. There is scope to break below here and test 0.85, but we don’t see scope for any sustained break lower. The UK curve is already pricing quite a hawkish story for BoE policy, with the first rate cut not fully priced until September, and even though today’s number is slightly above expectations, there is every chance that CPI is below 2% y/y by summer. The weak employment data seen yesterday also suggests the BoE may see a case for easing by August or even by the June meeting even though the earnings data and CPI data have come in marginally stronger than expected. Governor Bailey speaks this evening, and may provide some hints on the trajectory of policy. He would need to sound outright hawkish to justify a EUR/GBP move below 0.85, and that was not the tone he took after the last MPC meeting.