FX Daily Strategy: Europe, November 8th

FOMC and Trump Trade Remains Spotlight

The Rebound in Overall Household Spending is needed for BoJ but no

Employment Changes Unlikely to Tilt the Loonie

FOMC and Trump Trade Remains Spotlight

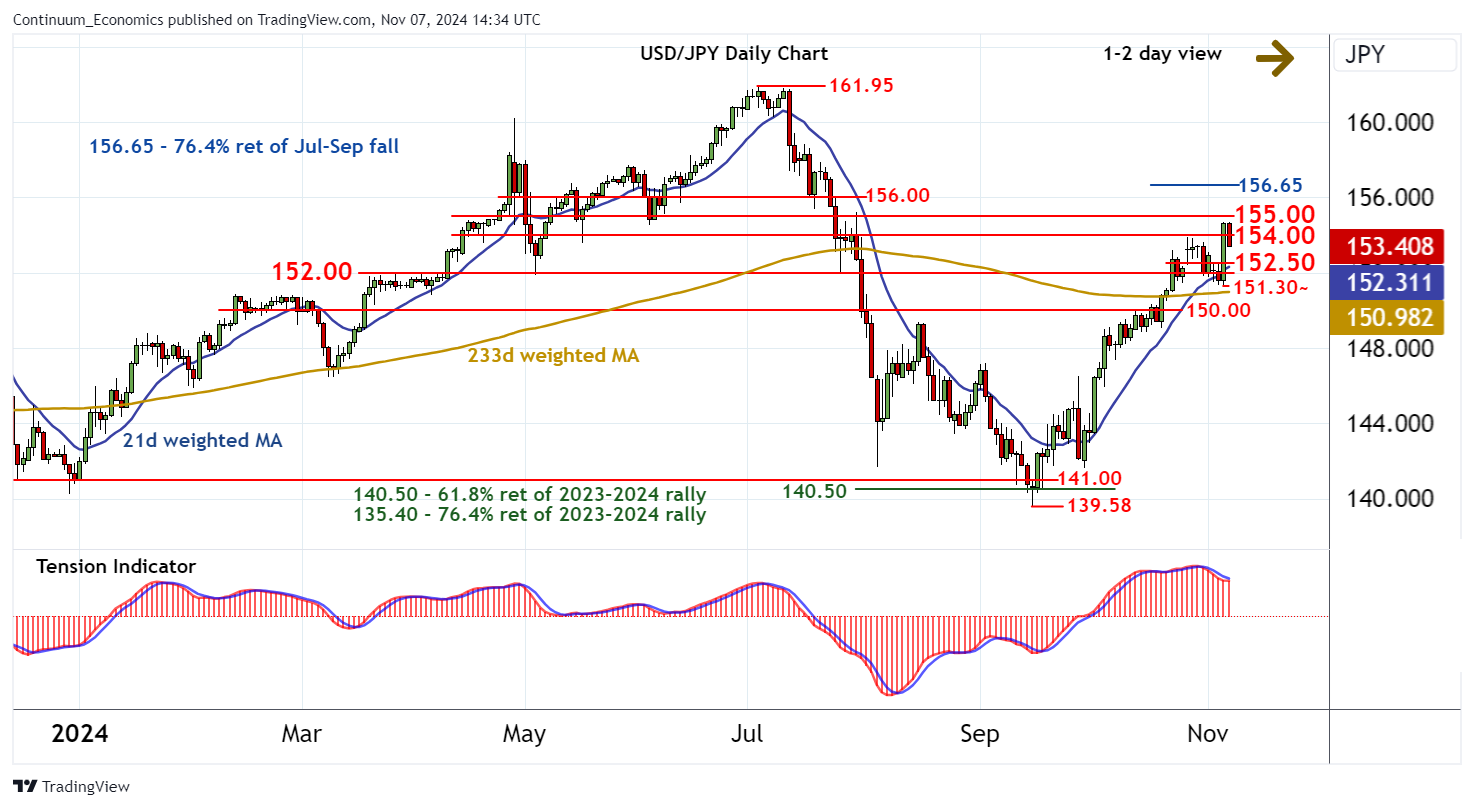

The Rebound in Overall Household Spending is needed for BoJ but no

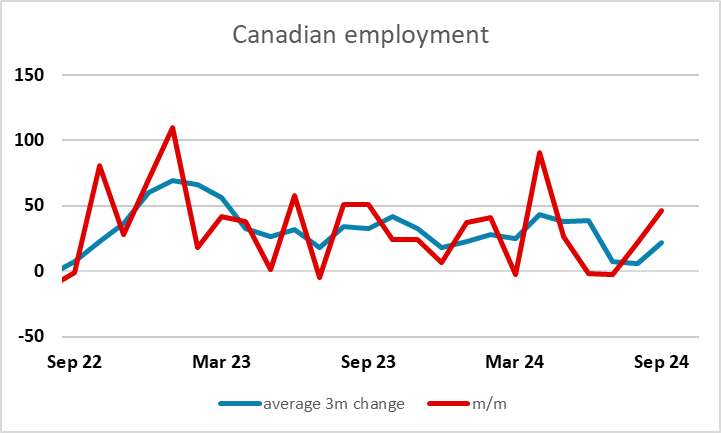

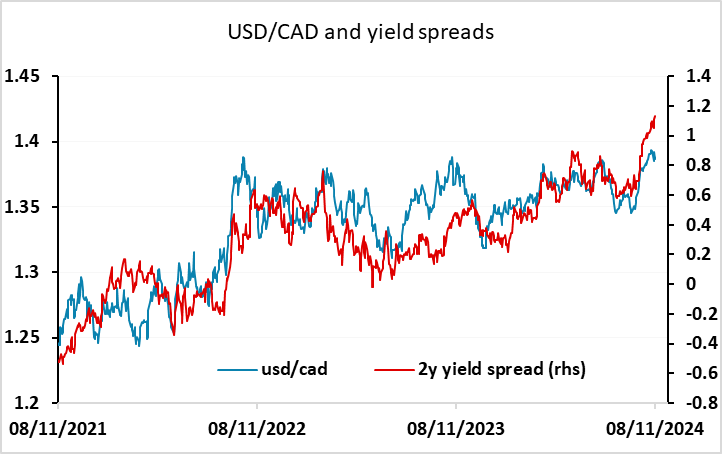

Employment Changes Unlikely to Tilt the Loonie

The FOMC eased rates by 25bps as expected with a statement that avoided making any further dovish signals beyond what were given on September 18. In his press conference Chairman Jerome Powell left his options open for December when the decision will be data-dependent. On balance we still lean towards a December ease, though we expect less easing in 2025 than previously given likely fiscal support. For 2026 tightening may resume if tariffs lift inflation.

On the chart, the consolidation beneath congestion resistance at 155.00 is giving way to a pullback in both USD- and JPY-driven trade, with the break below 154.00 currently balanced around 153.50. Negative intraday studies highlight potential for further losses towards support within the 152.00/50 area. But improving daily readings and rising weekly charts are expected to limit any tests in fresh buying interest/consolidation. A close below the 151.30~ low of 6 November, if seen, would turn sentiment negative and extend losses towards 150.00. Meanwhile, a close above 155.00, not yet seen, would turn price action positive and extend September gains beyond congestion around 156.00 towards the 156.65 Fibonacci retracement.

For today the Canadian employment report is the main data. The CAD has been helped by the generally stronger tone to commodity currencies, but has underperformed the AUD and NOK since the election. Yield spreads still suggests there are risks to the upside for USD/CAD, and if we see any sigs of softness in the employment report or a turn lower in equities we could well see pressure up towards 1.40.

On the chart, the anticipated break below 1.3850 has bounced sharply from above congestion support at 1.3800, in both USD- and CAD-driven trade, with prices currently consolidating the test of the 1.3958 current year high of 1 November. Intraday studies are mixed/positive, suggesting potential for a break above here. But negative daily readings are expected to limit initial scope in renewed selling interest towards the 1.3978 year high of 1 October. Broader weekly charts are positive, but any continuation beyond here should meet profit-taking towards critical resistance at the 1.4040 Fibonacci retracement. Meanwhile, support is raised to 1.3900. A close beneath here would turn sentiment neutral and prompt consolidation above 1.3850.