CBR Reduced its Key Rate to 17% as Inflation Softened, but Warned Inflation is Still High

Bottom Line: As we expected, Central Bank of Russia (CBR) reduced policy rate by 100 bps to 17% on September 12 taking into account that inflation continued to slow down in Q3 but still warned inflation remains high. CBR stated in its written statement it will maintain monetary conditions as tight as necessary to return inflation to the target in 2026. We believe reaching 4% target will be tough in 2026, and CBR needs to be cautious since cooling off inflation will take likely longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong. Under current circumstances, we slightly decreased our end year key rate forecasts. Our 2025 end-year key rate forecast is now at 16% and 10.5% for end-2026.

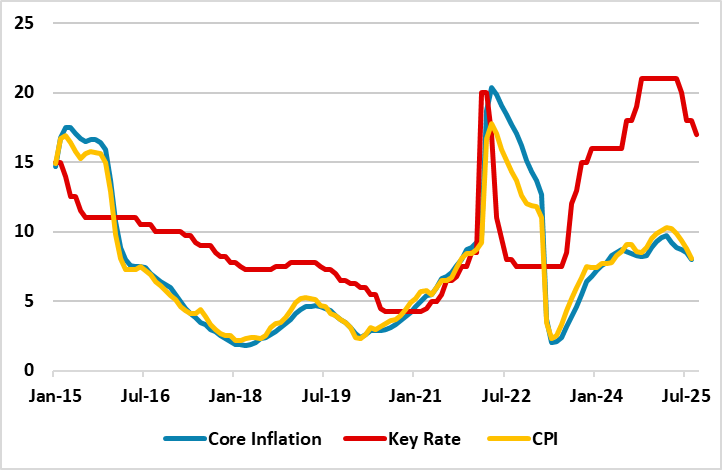

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – September 2025

Source: Continuum Economics

During its MPC meeting on September 12, CBR reduced the policy rate by 100 bps to 17%, its third reduction this year, as inflation continued to soften in Q3. (Note: Inflation slowed to 8.1% YoY in August after hitting 8.8% YoY in July). Despite decelerating trend in inflation, CBR warned that inflation expectations have not changed considerably in recent months, and added that they remain elevated which may impede a sustainable slowdown in inflation. (Note: As inflation expectations remain high, this makes the regulator to be more cautious about cutting too aggressively, which may be the reason why CBR did not reduce the key rate to 16% despite expectations).

CBR highlighted in its written statement on September 12 that it will maintain a level of monetary policy tightness necessary to bring inflation back to target at 4% by 2026. We still believe reaching 4% target will be tough in 2026, since cooling off inflation will take longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong.

Talking about the easing cycle early September, President Putin properly said that lowering key interest rate too quickly could result in rapid price hikes.

We continue to think a peace deal in Ukraine is the real key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia; despite sealing a full-scale peace deal in Ukraine is very unlikely in 2025. CBR needs to be cautious since the pace of state spending could turn pro-inflationary if Ukraine war continues in 2026.

Under current circumstances, we slightly decreased our end year key rate forecasts. Our 2025 end-year key rate forecast is now at 16% and 10.5% for end-2026 due to moderate fall in inflation.