FX Daily Strategy: Europe, February 14th

Some USD downside risks on retail sales

US yields fall back after post-CPI rise

Peace dividend from Ukraine could prove elusive

EUR strength relies on continued strong European equity market performance

Some USD downside risks on retail sales

US yields fall back after post-CPI rise

Peace dividend from Ukraine could prove elusive

EUR strength relies on continued strong European equity market performance

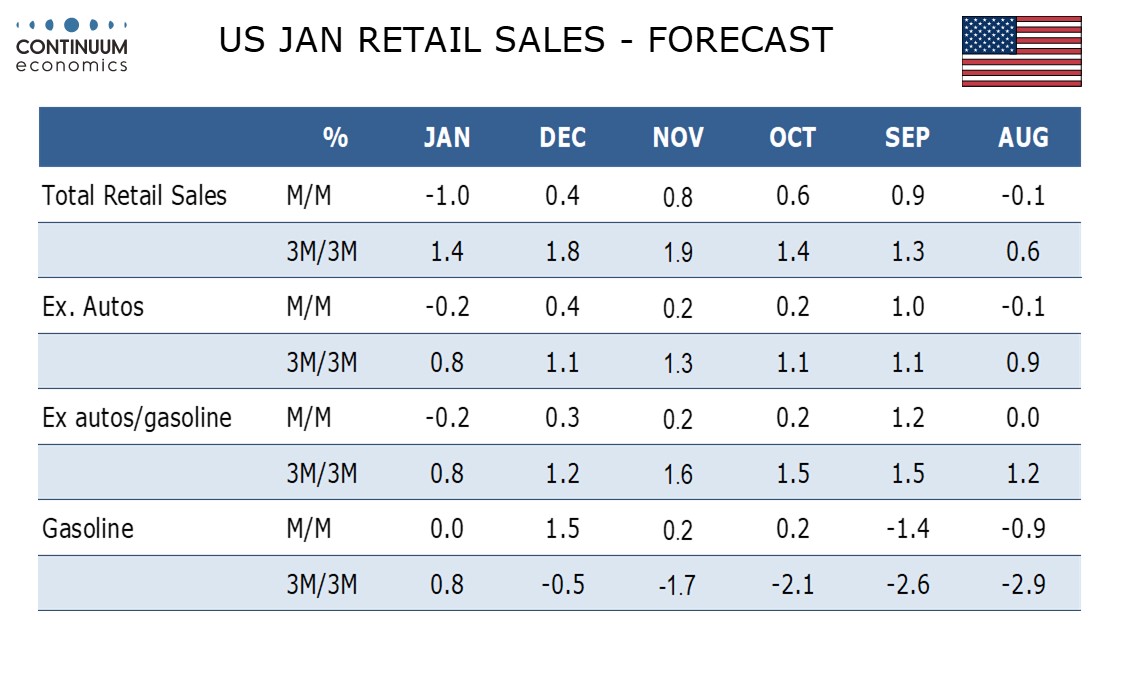

Friday sees US retail sales and industrial production data, while there is employment data for the Eurozone. We expect US retail sales to fall by 1.0% in January with declines of 0.2% both ex autos and ex autos and gasoline. The monthly weakness is likely to be largely due to bad weather with potential for a correction from Q4 strength adding to downside risk. Our forecast is significantly weaker than the market consensus of a 0.2% headline decline and a 0.3% core rise, so suggest the risks are on the USD downside on the data, even though the impact may be modest if the market sees any weakness as weather related.

There could also have been some impact from rising doubts about the potential for an end to the Russia Ukraine war. The hopes of a peace deal were raised after news of a Trump-Putin call surfaced on Wednesday, and this may have increased market optimism about growth prospects in both Europe and the US. But Thursday saw some pushback from Ukraine to what looks like a deal that concedes a lot of ground to Russia. While in the end Ukraine may not have a lot of choice, the peace process is unlikely to be smooth and the peace dividend may not be obvious, as a resumption of supply of Russian gas to Europe may not be seen quickly.

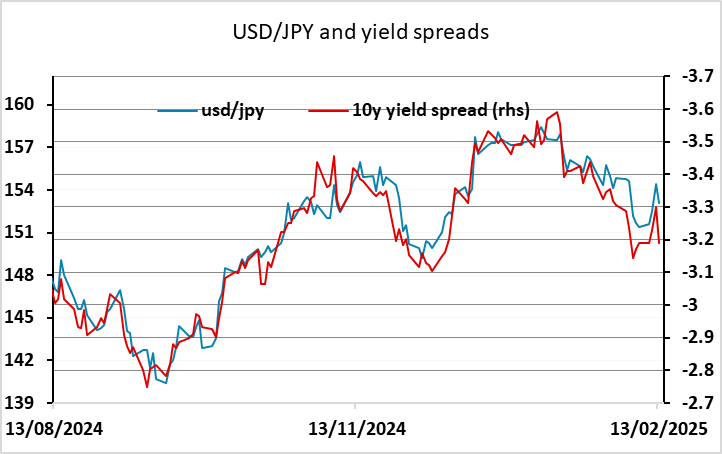

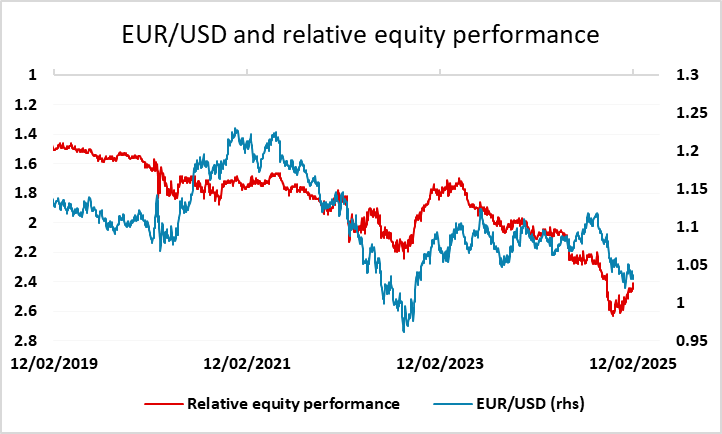

In any case, yield spreads do still suggest downside risks for USD/JPY, while the picture for the riskier currencies is less clear if we are entering a trade war and peace in Ukraine is far from guaranteed. The EUR has been supported in part because of the strong performance of European equities, both absolutely and relative to the US. If this continues, there is scope for EUR/USD to trade back up towards 1.05. But there are downside risks to US equities due to valuation concerns, and if the US market weakens, the rest of the world is rarely immune.