FX Daily Strategy: Europe, February 5th

USD softer as tariffs off the menu

US data may put further downward pressure on the USD

CAD recovery looking overdone

GBP outperformance of the EUR may not last

USD softer as tariffs off the menu

US data may put further downward pressure on the USD

CAD recovery looking overdone

GBP outperformance of the EUR may not last

For the moment, the market seems prepared to assume that he Trump tariff threat is dormant, if not dead, so there may be more focus on the data on Wednesday. The main numbers are the ADP employment data and the ISM services survey.

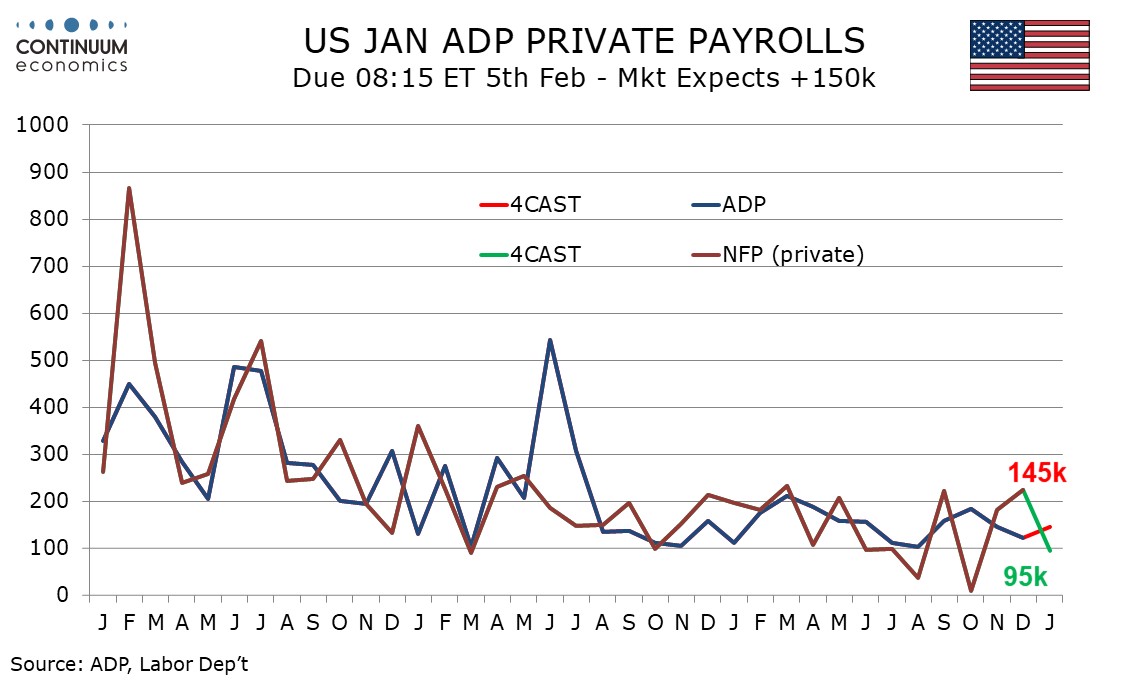

We expect a 145k increase in January’s ADP estimate for private sector employment growth, which is significantly above our 95k increase for January’s private sector non-farm payroll, which is likely to be more sensitive to bad weather than the ADP report. We expect overall non-farm payrolls, including government, to rise by 125k, which is some way below the market consensus, but the market consensus on ADP is essentially the same as our forecast at 148k. In practice, it takes quite a large miss on ADP to have any significant market impact, given the inconsistent correlation between the ADP data and the official employment report, so we doubt this will have a major effect.

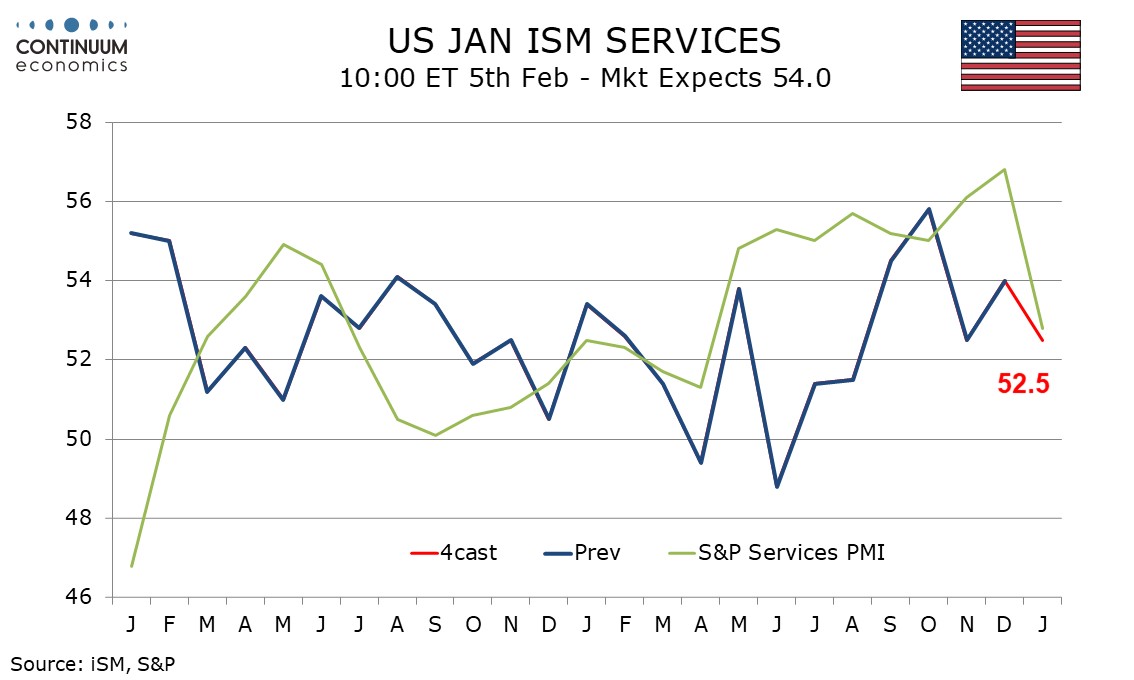

There could be more impact from the ISM services survey. We expect January’s ISM services index to slip to 52.5 from 54.0 in December, returning the index to November’s level. Unusually cold weather in much of the country and to a lesser extent the Los Angeles fires provide downside risk. January’s S and P services index slipped significantly from consistently strong readings in late 2024, and while not a reliable guide to the ISM data, most regional service sector surveys slipped in January, if not dramatically. The market consensus sees little change in the ISM services index, so the risks should be on the USD downside.

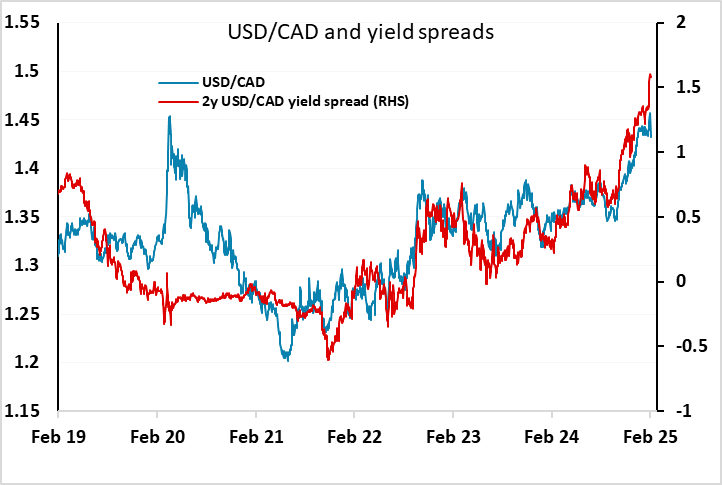

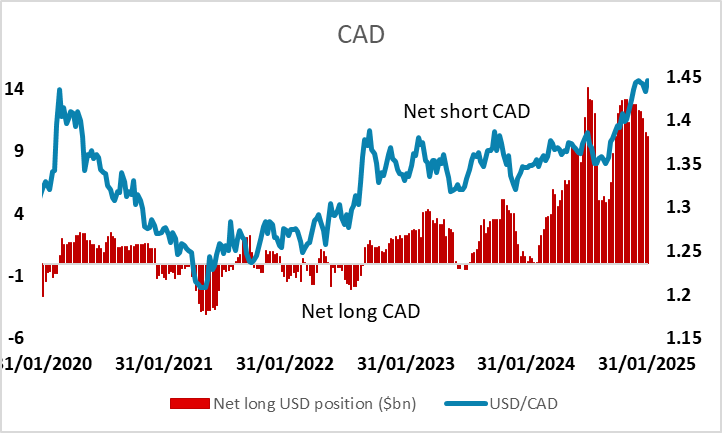

As far as the FX markets are concerned, the USD is now below its closing levels on Friday against most pairs, with only EUR/USD the exception. USD/CAD has recovered particularly sharply, after the delay to the imposition of tariffs as announced, but now looks quite low compared to the current yield spreads, as front end Canadian yields have held the lower levels. Some of the CAD recovery may reflect the fact that the CAD has been the largest speculative short position on the IMM futures for some weeks, and the reversal may have triggered some stops. It may well be that there are no tariff increases, but even then we likely need to see a recovery in Canadian yields to justify current USD/CAD levels.

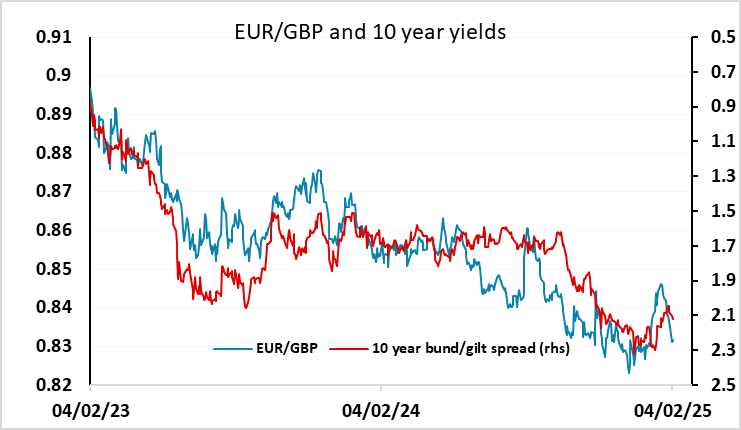

The EUR’s underperformance may relate to an expectation that the EU will be the next tariff target, with GBP’s relative strength similarly related to the belief that the UK is less likely to be targeted. But if the tariff threat evaporates, EUR/GBP is looking too low near 0.83, and should have scope for recovery, especially if we see some dovish commentary accompany the expected BoE rate cut this week.