GBP flows: GBP slightly firmer after as expected CPI

EUR/GBP slightly lower as expected rise in core CPI sustains expectations that BoE will leave rates unchanged tomorrow

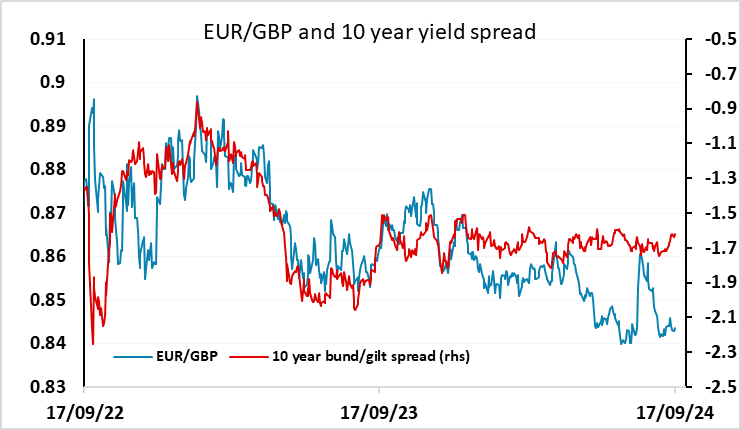

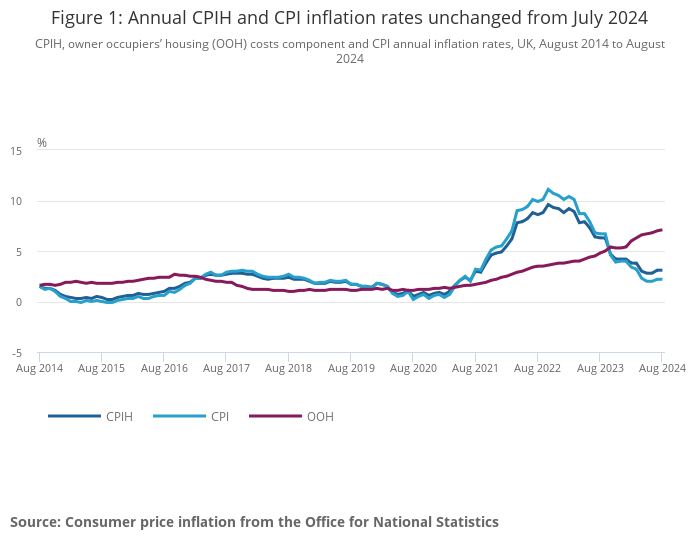

UK CPI has come in in line with expectations, and GBP has risen modestly in response. The reaction probably reflects the view that the rise in core CPI to 3.6% y/y in August from 3.3% in July will prevent the BoE MPC from cutting rates tomorrow. While the CPI data was as expected, the risks were on the downside, and a weaker than expected number might have increased the chances of a rate cut tomorrow. EUR/GBP had in any case struggled to recover above 0.8450. However, the market may still reconsider if the FOMC decide to cut rates 50bps this evening, but with risk sentiment also slightly improving, GBP looks likely to remain well supported near term. Even so, it is getting expensive here, and some more convincing evidence of strength in the UK economy in H2 looks necessary if EUR/GBP is to break below 0.84.