BCB Review: Confirming More Hikes

The Brazilian Central Bank (BCB) raised the policy rate by 100 bps to 14.25% and signaled further hikes, likely reaching 15.0% by May, potentially ending the current tightening cycle. The BCB emphasized inflation concerns and strong economic activity, suggesting a hawkish stance. Fiscal policy was noted as negatively impacting inflation expectations. The bank's risks are skewed to the upside, with inflationary pressures outweighing risks of economic deceleration, indicating a strong commitment to controlling inflation towards the 3.0% target.

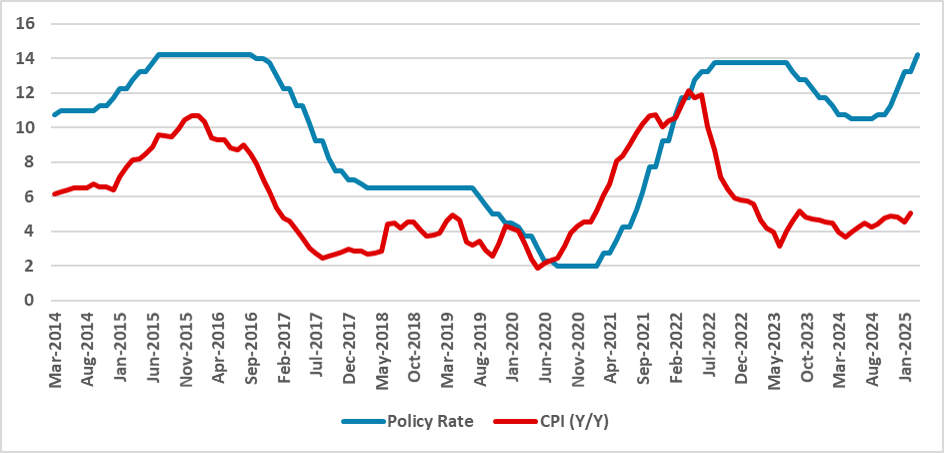

Figure 1: Brazil Policy Rate and Inflation (%)

Souce: IBGE and BCB

The Brazilian Central Bank (BCB) convened to decide on the policy rate. In a unanimous decision, the BCB opted to hike the policy rate by 100 bps to 14.25%, following its previous guidance and acting as expected by the markets. What actually mattered for this meeting was the next guidance that the BCB would give. Markets are now expecting that the BCB will hike the policy rate to 15%. It looks like the BCB will follow their prediction and announced they will continue hiking the policy rate in their next meeting, suggesting that it could be the last one, as decisions for the other meetings will be data-dependent. This suggests a final 75 bps hike in May, ending the hiking cycle at 15.0%.

We see the communiqué as generally hawkish. The fact that the Brazilian economy appears to be decelerating was only marginally cited, and more importance was given to the recent rise in inflation, inflation expectations, and the resilience of economic activity and labor markets. These factors demand an even more contractionary monetary policy according to the BCB.

On fiscal policy, the BCB maintained the paragraph stating that the current perception of fiscal policy is affecting the pricing of Brazilian assets, suggesting the current fiscal policy is damaging the inflationary outlook.

The BCB’s balance of risks indicates an asymmetry to the upside. According to them, risks related to unanchored expectations, inflationary pressures from services arising from a positive output gap, and possible impacts on external markets are outweighing downside risks such as a deceleration of domestic activity and a less inflationary scenario for emerging economies arising from trade and global financial conditions.

In general, the language adopted in the communiqué has been more hawkish, and it indicates that the current board will not be complacent with inflation. This suggests they will continue to be hawkish in the belief that they will convince markets they will not be complacent with inflation and will do everything they can to bring inflation to the 3.0% target. We believe that hiking to 15.0% in May will be enough, but if expectations continue to deteriorate, an additional hike to 15.75% cannot be discarded.